Question: This is an Annuity challenge problem so i believe this amortization schedule is working backwards, if someone could give a somewhat detailed explanation on formulas

This is an Annuity challenge problem so i believe this amortization schedule is working backwards, if someone could give a somewhat detailed explanation on formulas and reference/absolute numbers to solve this along with the annual tax column that would be great thank you!

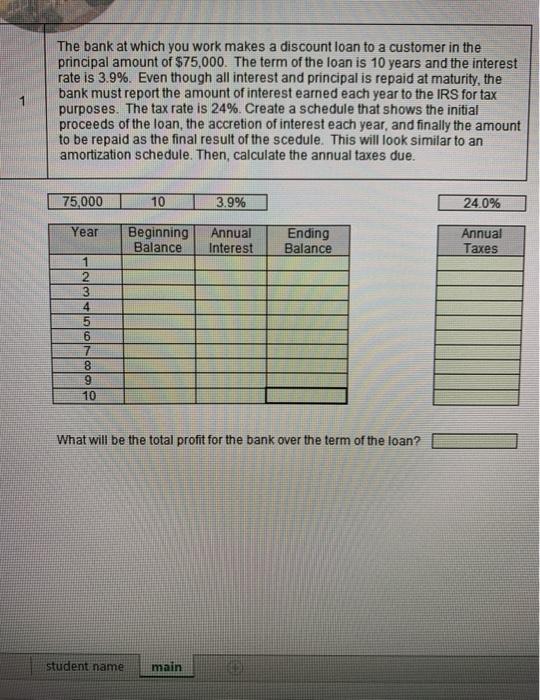

This is an Annuity challenge problem so i believe this amortization schedule is working backwards, if someone could give a somewhat detailed explanation on formulas and reference/absolute numbers to solve this along with the annual tax column that would be great thank you! The bank at which you work makes a discount loan to a customer in the principal amount of $75,000. The term of the loan is 10 years and the interest rate is 3.9%. Even though all interest and principal is repaid at maturity, the bank must report the amount of interest earned each year to the IRS for tax purposes. The tax rate is 24%. Create a schedule that shows the initial proceeds of the loan, the accretion of interest each year, and finally the amount to be repaid as the final result of the scedule. This will look similar to an amortization schedule. Then, calculate the annual taxes due. 75,000 10 3.9% 24.0% Year Beginning Balance Annual Interest Ending Balance Annual Taxes 1 2 ON AW 5 6 7 8 9 10 What will be the total profit for the bank over the term of the loan? student name main

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts