Question: This is an Economic Analysis Question. Answer both Parts, can be in-depth or just answer but make sure answers are correct! Will Give Thumbs Up!

This is an Economic Analysis Question. Answer both Parts, can be in-depth or just answer but make sure answers are correct! Will Give Thumbs Up! Thanks

a) The depreciation write-off allowance (DWO) at the end of year 1 is:

b) The present worth (PW) of all the after-tax cash flows (ATCFs) is:

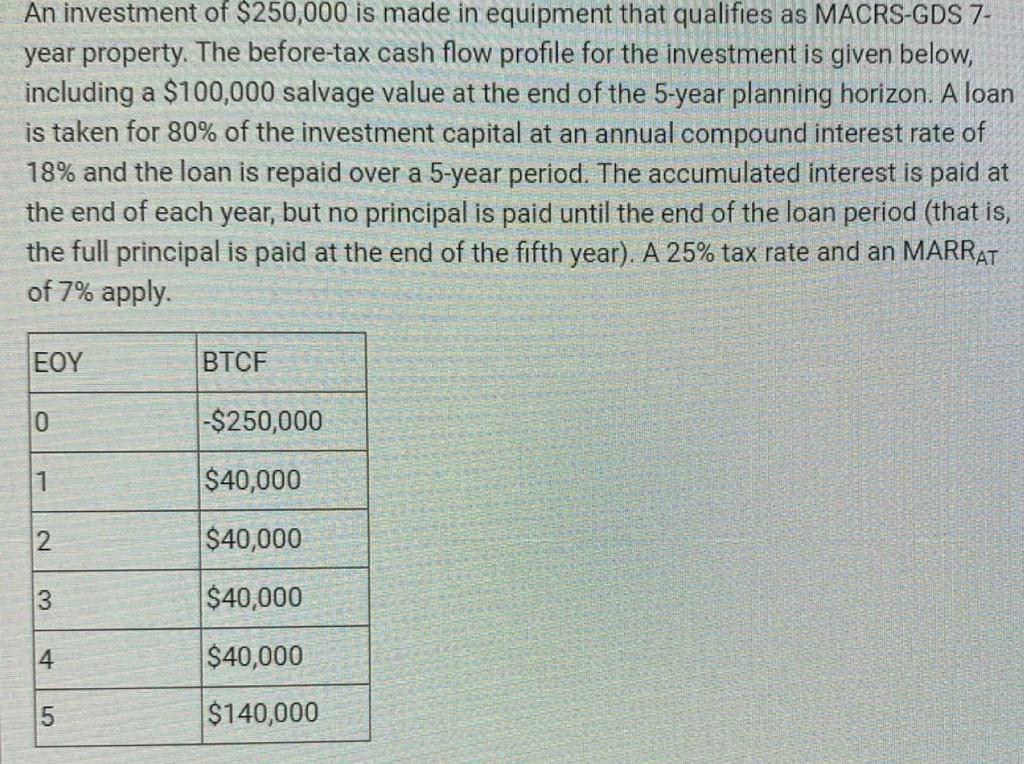

An investment of $250,000 is made in equipment that qualifies as MACRS-GDS 7- year property. The before-tax cash flow profile for the investment is given below, including a $100,000 salvage value at the end of the 5-year planning horizon. A loan is taken for 80% of the investment capital at an annual compound interest rate of 18% and the loan is repaid over a 5-year period. The accumulated interest is paid at the end of each year, but no principal is paid until the end of the loan period (that is, the full principal is paid at the end of the fifth year). A 25% tax rate and an MARRAT of 7% apply. EOY BTCF 0 -$250,000 1 $40,000 2 $40,000 3 $40,000 4 $40,000 on 5 $140,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts