Question: This is an Essay Style Question. Students MUST answer the question with detailed working-out, calculations, explanations of the relevant legal principles, and reference to relevant

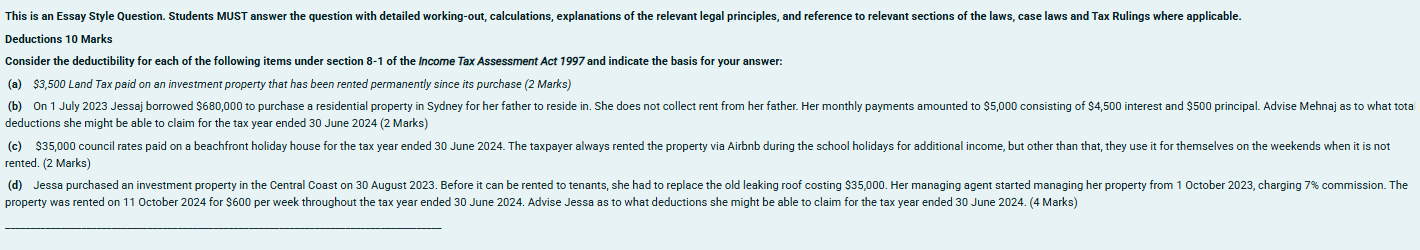

This is an Essay Style Question. Students MUST answer the question with detailed working-out, calculations, explanations of the relevant legal principles, and reference to relevant sections of the laws, case laws and Tax Rulings where applicable. Deductions 10 Marks 'Consider the deductibility for each of the following items under section 8-1 of the Income Tax Assessment Act 1997 and indicate the basis for your answer: (a) 53,500 Land Tax paid on an investment property that has been rented permanently since its purchase (2 Marks) (b) On 1 July 2023 Jessaj borrowed $680,000 to purchase a residential property in Sydney for her father to reside in. She does not collect rent from her father. Her monthly payments amounted to $5,000 consisting of $4,500 interest and $500 principal. Advise Mehnaj as to what total deductions she might be able to claim for the tax year ended 30 June 2024 (2 Marks) (c) $35,000 council rates paid on a beachfront holiday house for the tax year ended 30 June 2024. The taxpayer always rented the property via Airbnb during the school holidays for additional income, but other than that, they use it for themselves on the weekends when it is not rented. (2 Marks) (d) Jessa purchased an investment property in the Central Coast on 30 August 2023. Before it can be rented to tenants, she had to replace the old leaking roof costing $35,000. Her managing agent started managing her property from 1 October 2023, charging 7% commission. The property was rented on 11 October 2024 for $600 per week throughout the tax year ended 30 June 2024. Advise Jessa as to what deductions she might be able to claim for the tax year ended 30 June 2024. (4 Marks)

This is an Essay Style Question. Students MUST answer the question with detailed working-out, calculations, explanations of the relevant legal principles, and reference to relevant sections of the laws, case laws and Tax Rulings where applicable. Deductions 10 Marks 'Consider the deductibility for each of the following items under section 8-1 of the Income Tax Assessment Act 1997 and indicate the basis for your answer: (a) 53,500 Land Tax paid on an investment property that has been rented permanently since its purchase (2 Marks) (b) On 1 July 2023 Jessaj borrowed $680,000 to purchase a residential property in Sydney for her father to reside in. She does not collect rent from her father. Her monthly payments amounted to $5,000 consisting of $4,500 interest and $500 principal. Advise Mehnaj as to what total deductions she might be able to claim for the tax year ended 30 June 2024 (2 Marks) (c) $35,000 council rates paid on a beachfront holiday house for the tax year ended 30 June 2024. The taxpayer always rented the property via Airbnb during the school holidays for additional income, but other than that, they use it for themselves on the weekends when it is not rented. (2 Marks) (d) Jessa purchased an investment property in the Central Coast on 30 August 2023. Before it can be rented to tenants, she had to replace the old leaking roof costing $35,000. Her managing agent started managing her property from 1 October 2023, charging 7% commission. The property was rented on 11 October 2024 for $600 per week throughout the tax year ended 30 June 2024. Advise Jessa as to what deductions she might be able to claim for the tax year ended 30 June 2024. (4 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts