Question: This is an example of what the completed project should look like: This is another question with similar numbers, so I need help with the

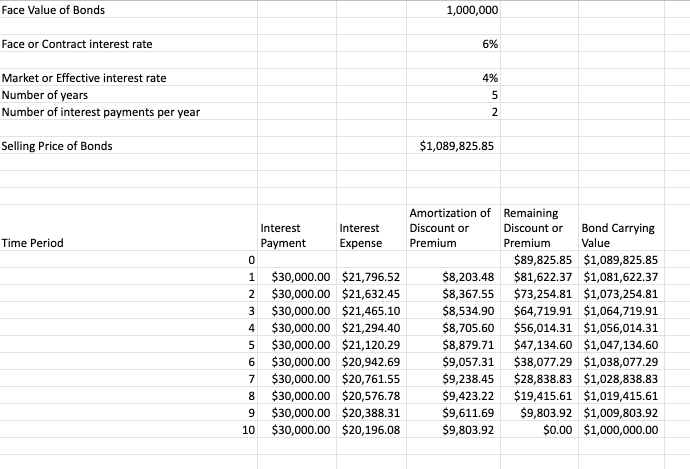

This is an example of what the completed project should look like:

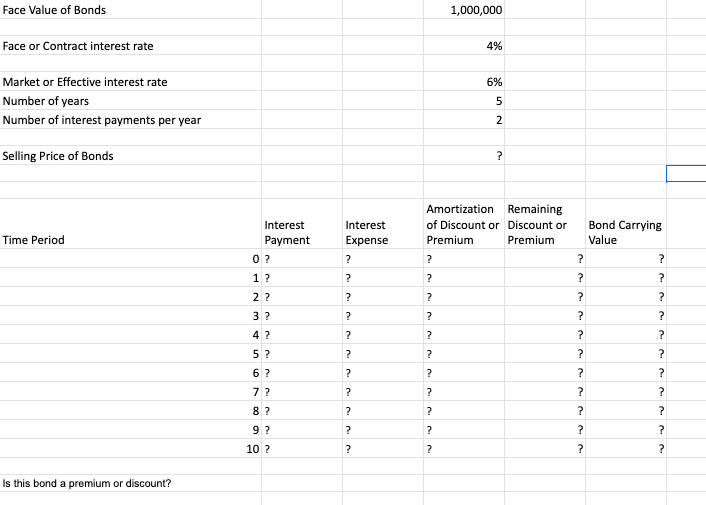

This is another question with similar numbers, so I need help with the answers as well as the formulas used on Excell/sheets to get the answers.

Face Value of Bonds Face or Contract interest rate Market or Effective interest rate Number of years Number of interest payments per year Selling Price of Bonds Time Period Interest Interest Payment Expense 0 1 $30,000.00 $21,796.52 2 $30,000.00 $21,632.45 3 $30,000.00 $21,465.10 4 $30,000.00 $21,294.40 5 $30,000.00 $21,120.29 6 $30,000.00 $20,942.69 7 $30,000.00 $20,761.55 8 $30,000.00 $20,576.78 $30,000.00 $20,388.31 $30,000.00 $20,196.08 1,000,000 6% 4% 5 2 $1,089,825.85 Amortization of Remaining Discount or Premium Discount or Premium Bond Carrying Value $89,825.85 $1,089,825.85 $8,203.48 $81,622.37 $1,081,622.37 $8,367.55 $73,254.81 $1,073,254.81 $8,534.90 $64,719.91 $1,064,719.91 $8,705.60 $56,014.31 $1,056,014.31 $8,879.71 $47,134.60 $1,047,134.60 $9,057.31 $38,077.29 $1,038,077.29 $9,238.45 $28,838.83 $1,028,838.83 $9,423.22 $19,415.61 $1,019,415.61 $9,611.69 $9,803.92 $1,009,803.92 $9,803.92 $0.00 $1,000,000.00 Face Value of Bonds Face or Contract interest rate Market or Effective interest rate Number of years Number of interest payments per year Selling Price of Bonds Time Period Is this bond a premium or discount? Interest Payment 0? 1? 2 ? 3? 4? 5? 6? 7? 8? 9? 10 ? Interest Expense ? ? ? ? ? ? ? ? ? ? ? 1,000,000 4% 6% 5 2 ? Amortization Remaining of Discount or Discount or Premium Premium ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? ? Bond Carrying Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts