Question: This is audit. Please help me solve this question. Noraidah & Partners is the auditor for Janester Jerry Plantation Sdn Bhd (JJP). JJP has a

This is audit. Please help me solve this question.

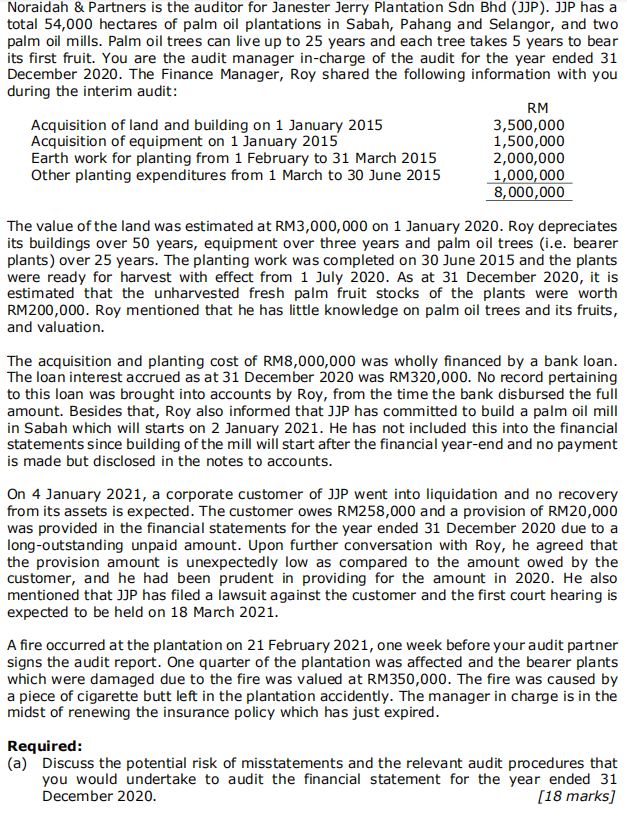

Noraidah & Partners is the auditor for Janester Jerry Plantation Sdn Bhd (JJP). JJP has a total 54,000 hectares of palm oil plantations in Sabah, Pahang and Selangor, and two palm oil mills. Palm oil trees can live up to 25 years and each tree takes 5 years to bear its first fruit. You are the audit manager in-charge of the audit for the year ended 31 December 2020. The Finance Manager, Roy shared the following information with you during the interim audit: RM Acquisition of land and building on 1 January 2015 3,500,000 Acquisition of equipment on 1 January 2015 1,500,000 Earth work for planting from 1 February to 31 March 2015 2,000,000 Other planting expenditures from 1 March to 30 June 2015 1,000,000 8,000,000 The value of the land was estimated at RM3,000,000 on 1 January 2020. Roy depreciates its buildings over 50 years, equipment over three years and palm oil trees (i.e. bearer plants) over 25 years. The planting work was completed on 30 June 2015 and the plants were ready for harvest with effect from 1 July 2020. As at 31 December 2020, it is estimated that the unharvested fresh palm fruit stocks of the plants were worth RM200,000. Roy mentioned that he has little knowledge on palm oil trees and its fruits, and valuation. The acquisition and planting cost of RM8,000,000 was wholly financed by a bank loan. The loan interest accrued as at 31 December 2020 was RM320,000. No record pertaining to this loan was brought into accounts by Roy, from the time the bank disbursed the full amount. Besides that, Roy also informed that JJP has committed to build a palm oil mill in Sabah which will starts on 2 January 2021. He has not included this into the financial statements since building of the mill will start after the financial year-end and no payment is made but disclosed in the notes to accounts. On 4 January 2021, a corporate customer of JJP went into liquidation and no recovery from its assets is expected. The customer owes RM258,000 and a provision of RM20,000 was provided in the financial statements for the year ended 31 December 2020 due to a long-outstanding unpaid amount. Upon further conversation with Roy, he agreed that the provision amount is unexpectedly low as compared to the amount owed by the customer, and he had been prudent in providing for the amount in 2020. He also mentioned that JJP has filed a lawsuit against the customer and the first court hearing is expected to be held on 18 March 2021. A fire occurred at the plantation on 21 February 2021, one week before your audit partner signs the audit report. One quarter of the plantation was affected and the bearer plants which were damaged due to the fire was valued at RM350,000. The fire was caused by a piece of cigarette butt left in the plantation accidently. The manager in charge is in the midst of renewing the insurance policy which has just expired. Required: (a) Discuss the potential risk of misstatements and the relevant audit procedures that you would undertake to audit the financial statement for the year ended 31 December 2020. (18 marks]Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock