Question: This is Auditing Assignment. Please provide detailed explanation for each request from a to f. Part a) relates the last 5 pictures. Thank you so

This is Auditing Assignment. Please provide detailed explanation for each request from a to f. Part a) relates the last 5 pictures. Thank you so so much for your help!

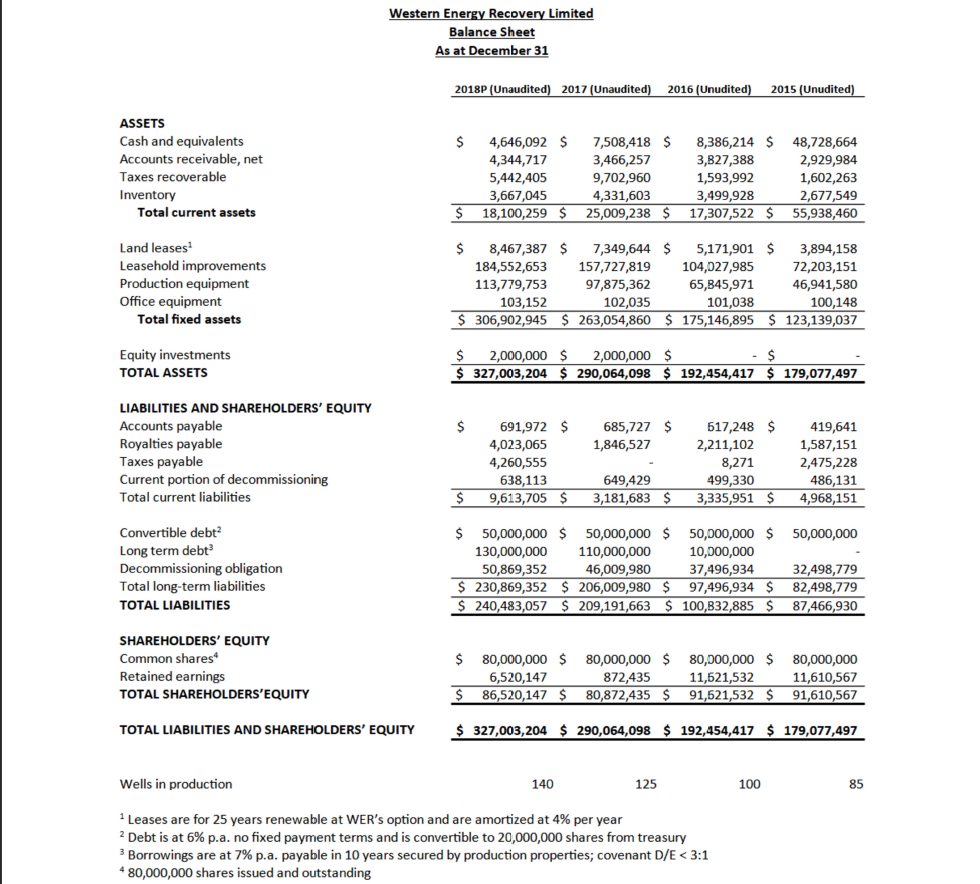

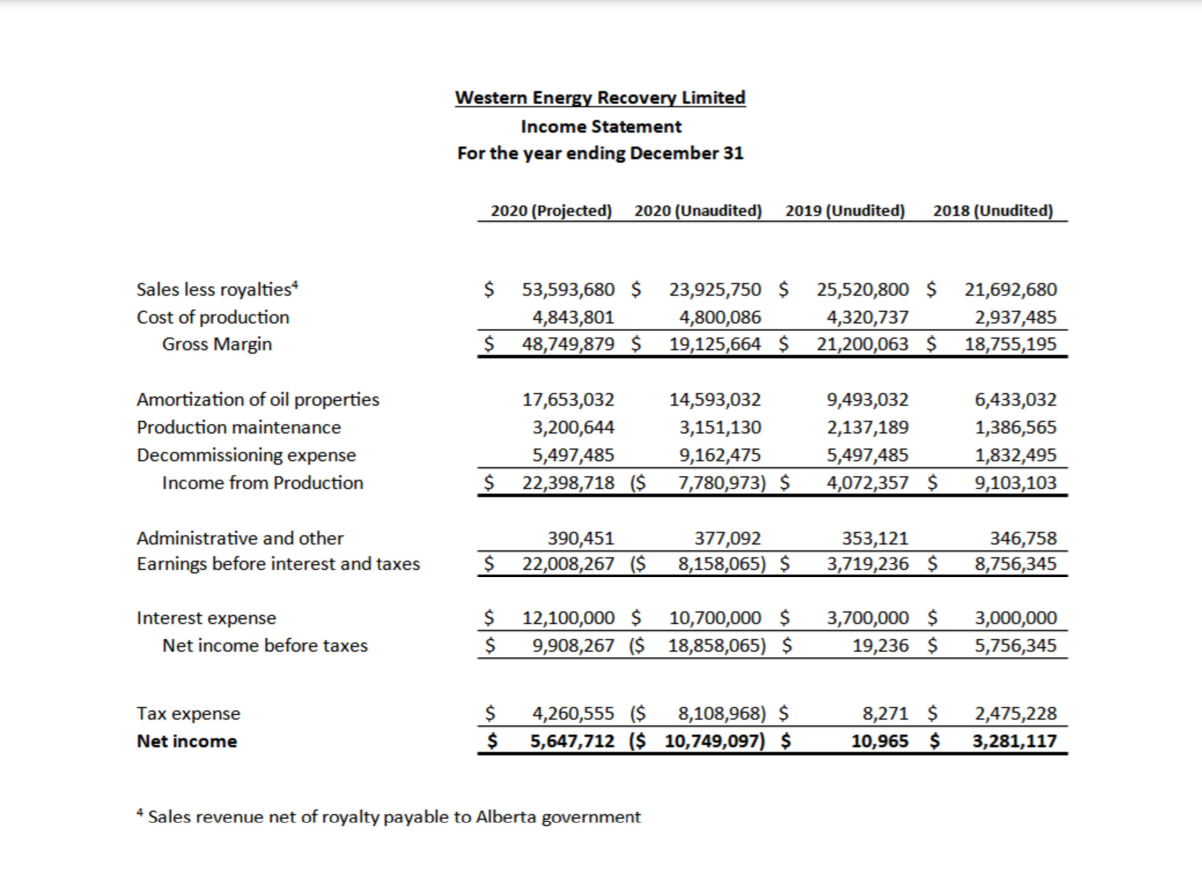

Western Energy Recovery Limited

Case Notes

You are an audit manager in the Calgary offices of Rowlands, Marcellin, and Khan, LLP. Since you specialize in the oil sector, you have heard of Western Energy Recovery Ltd (WER), but, as it is a private company, you have not had any solid information about WER. Today, you are meeting with Elaine To, CFO, and Darrell Haines, CEO. Darrell Haines is tall and broad shouldered, made taller by his western-style boots. The offices of WER are simply, yet tastefully, furnished in wood panelling and pictures of the trains so important in the history of the Canadian west. "Nice to meet you," says Darrell, "Maybe we can start with a little about me so you know where I'm coming from." "When I was seventeen, I was a top hockey player in major junior with Swift Current. A bad fall into the boards ended my NHL dream. In truth, though, a lot of guys who I thought were much better players never made it either, so, really, my dream was just an illusion." "The timing turned out to be perfect. I went home to Olds, concentrated on school, got my diploma, then a chemical engineering degree out of Lethbridge where I got on the honour roll for the first time in my life. I had a couple of jobs in the oil patch while paying for school, and joined full time after graduation. But I got lured by the dot-com boom in the nineties, did my MBA at UofT and went into the venture capital business." "The v-cap business in Toronto is all about software, web services, and pharmaceuticals. Anything else is radioactive. Trust me. I tried, but there was no interest in the extractive or manufacturing parts of the economy. Everything was fast in and fast out." "The 2008 real estate collapse made the firm go nova. A few of us decided to go out on our own but I insisted on looking at a wider selection of targets. I convinced one of the senior players to buy into some small players in the oil and gas sector. In 2011 we were riding high on record oil prices. Shale oil was still coming onstream and we were players there too so we thought we were protected. I did a lot of travelling throughout Alberta getting to know all the players." "In 2014, prices tanked. The lead partner wanted out and we worked out a deal where I took ownership, and he had debt convertible to a 20% equity stake. He hasn't converted yet." "In 2018, we bought a small producer, Fields Oil Company. We bought the assets and liabilities and left the company shell for the old owner. After the merger, as is common, we let most everyone go except those we needed to keep the bills paid. Elaine was accounting manager there. I quickly came to rely on her and in 2019 made her our company's first CFO." "So what do we do? We buy old oil fields and old producers. You know about the orphan well problem in Alberta? We target those. In a lot of cases, the wells do not produce enough to carry a high corporate overhead, but still produce. The hole is drilled, the pump is in place, the pipe is connected to the system, so all of the capital expenditure is done. All that is left is maintenance." "And do not underestimate maintenance. Most of these older wells leak gas like a sieve. When we take them over, we immediately upgrade everything. Rather than let the gas leak or get burned off, we recover it. People don't realize that there is no such thing as an oil well. They are always oil and gas wells. You cannot have one without the other." "Everything gets inspected at least once per year. We connect a system to each well to compress any gas into an onsite tank. Since most oil derricks already have electricity, it costs very little to add a compressor. Then, we monitor the tank. Right now, we job out the collection of gas from the tank if there is no connection to gas lines, but we are looking at having our own fleet of tankers to do the collection and also inspect and service the well head at every visit." "And that brings us to the costs of decommissioning. Often, we buy these sites virtually for free. Capping the well - essentially pouring concrete down the bore hole - and removing the equipment is about $100,000 depending on how remote the site is. Cleaning up the ground is the big one. At a minimum, it is $150,000, and it can go into the millions. Every producer pays into an Orphan Well Fund, because some companies just abandon the wells and declare bankruptcy rather than do what our mom's taught us and clean up after ourselves." " The equipment is usually fully depreciated when we buy the wells. So all we are doing is buying the production license, less cost to clean up, and we have a revenue generating asset. Elaine will walk you through the accounting." "Thank you, Darrell," says Elaine. "When we buy an oil well, we set up the production asset at fair market value, and the offsetting liability for the decommissioning costs. We retire the debt by paying into a trust fund based on the expected date of last production, discounted at 6%." "The initial refurbish extends the life of the asset. We capitalize that as a leasehold improvement, depreciated at five percent double-declining. After that, maintenance is expensed. We track each well using standardized oil and gas prices to estimate the date of last profitable production." "In 2020, we bought a dormant listing on the TSX, TAL Software. Our lawyers are going through the process of merging the two companies, after which we will rename the listing to WER. We will then raise more money for more wells through a secondary offering. It also allows the debt-holder to liquidate their investment. We expect them to convert the debt and hold the shares when we go public and that would be a huge increase in equity." "We have never had an audit before and, obviously, before we file a prospectus for the secondary offering, we need one. Except for the convertible debt, Darrell owns everything. After we go public senior employees will be paid in share options as well as salary. That should allow us to attract and retain talent. Darrell can't be out in the oil fields and run the company all by himself."

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts