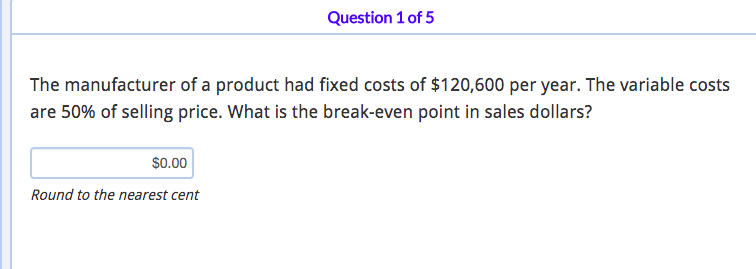

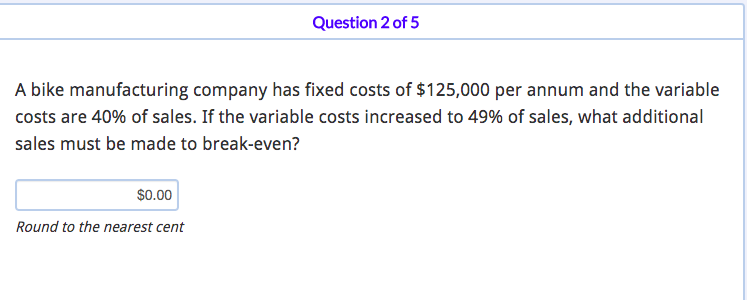

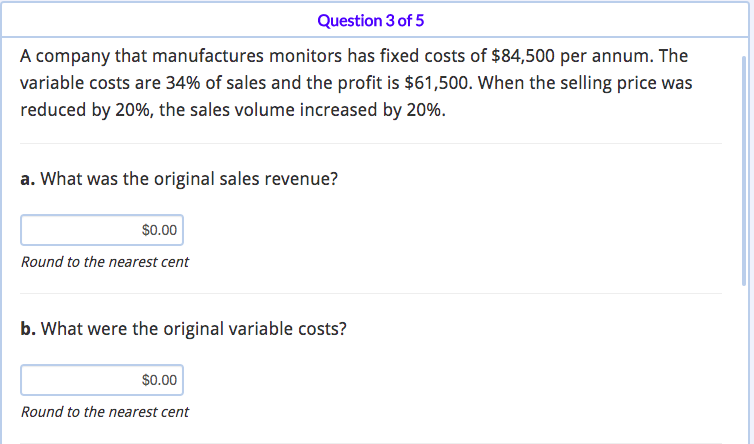

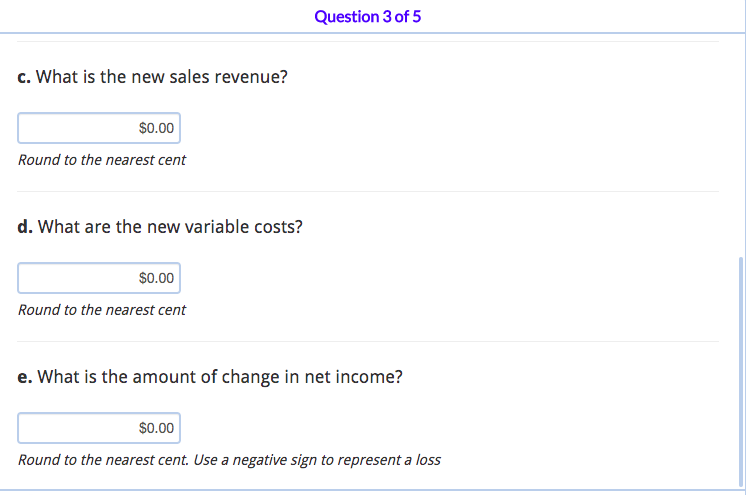

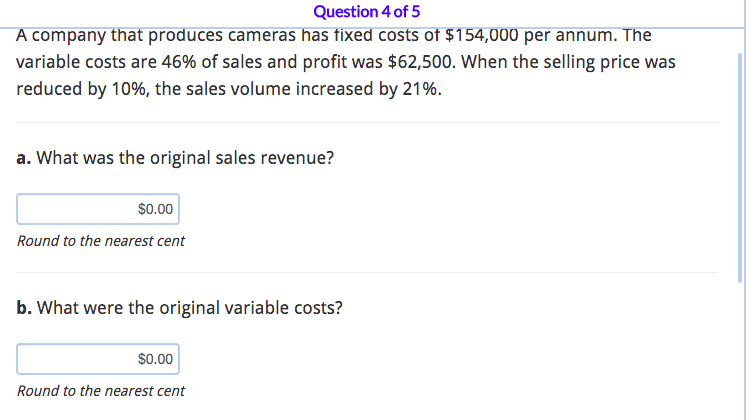

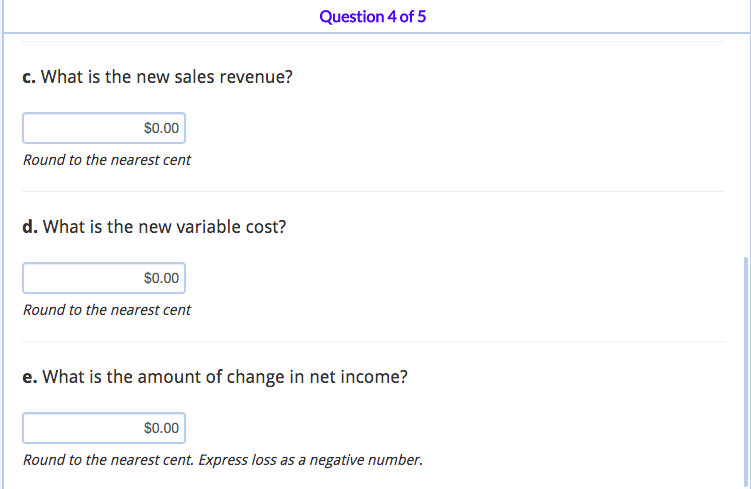

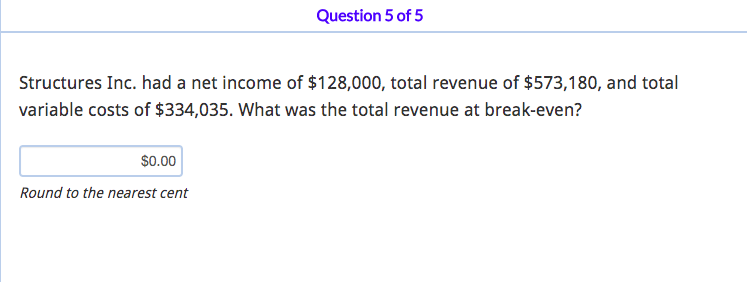

Question: this is based on CVP analysis (percent basis) - please help thank u Question 1 of 5 The manufacturer of a product had fixed costs

this is based on CVP analysis (percent basis) - please help thank u

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock