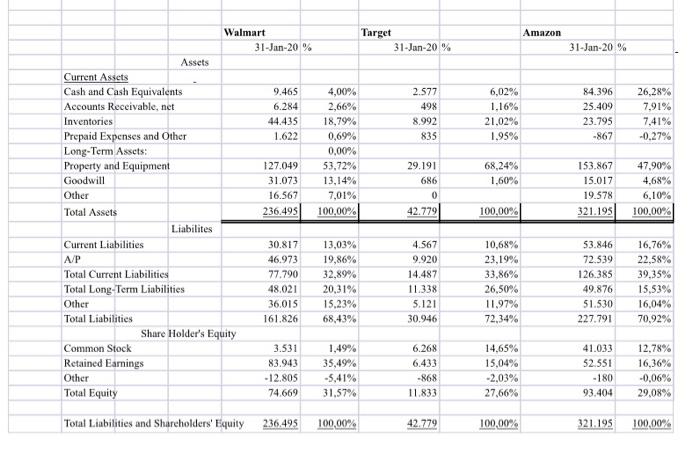

Question: this is common sized balanced sheet! Comment on the differences and similarities between this three companies! Walmart Amazon Target 31-Jan-20% 31-Jan-20% 31-Jan-20% Assets 9.465 4,00%

Walmart Amazon Target 31-Jan-20% 31-Jan-20% 31-Jan-20% Assets 9.465 4,00% 2.577 84.396 26,28% 6,02% 1.16% 6.284 498 25.409 44.435 8.992 21.02% 23.795 Current Assets Cash and Cash Equivalents Accounts Receivable, net Inventories Prepaid Expenses and Other Long-Term Assets: Property and Equipment Goodwill 7,91% 7.41% -0.27% 1.622 835 1.95% -867 2,66% 18,79% 0,69% 0,00% 53.72% 13,14% 127.049 29.191 153.867 68,24% 1,60% 31.073 686 15.017 47,90% 4,68% 6,10% Other 16.567 7,01% 0 19.578 Total Assets 236.495 100,00% 42.779 100.00% 321.195 100,00% Liabilites Current Liabilities 30.817 4.567 53.846 16,76% A/P 46.973 9.920 72.539 22,58% Total Current Liabilities 77.790 14.487 126.385 39,35% 13,03% 19,86% 32,89% 20,31% 15.23% 68,43% 10,68% 23,19% 33.86% 26,50% 11.97% 72,34% 48.021 11.338 15,53% Total Long-Term Liabilities Other 36.015 5.121 49.876 51.530 227.791 16,04% 70,92% Total Liabilities 161.826 30.946 Share Holder's Equity Common Stock 3.531 6.268 14,65% 41.033 12.78% 83.943 6.433 15,04% Retained Earnings Other Total Equity 1.49% 35,49% -5,41% 31.57% -12.805 -868 -2,03% 52.551 -180 93.404 16,36% -0,06% 29,08% 74.669 11.833 27,66% Total Liabilities and Shareholders' Equity 236.495 100,00% 42.779 100,00% 321.195 100,00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts