Question: This is completely confusing to me. Please help me fill these out. Required information [The following information applies to the questions displayed below.) Reba Dixon

This is completely confusing to me. Please help me fill these out.

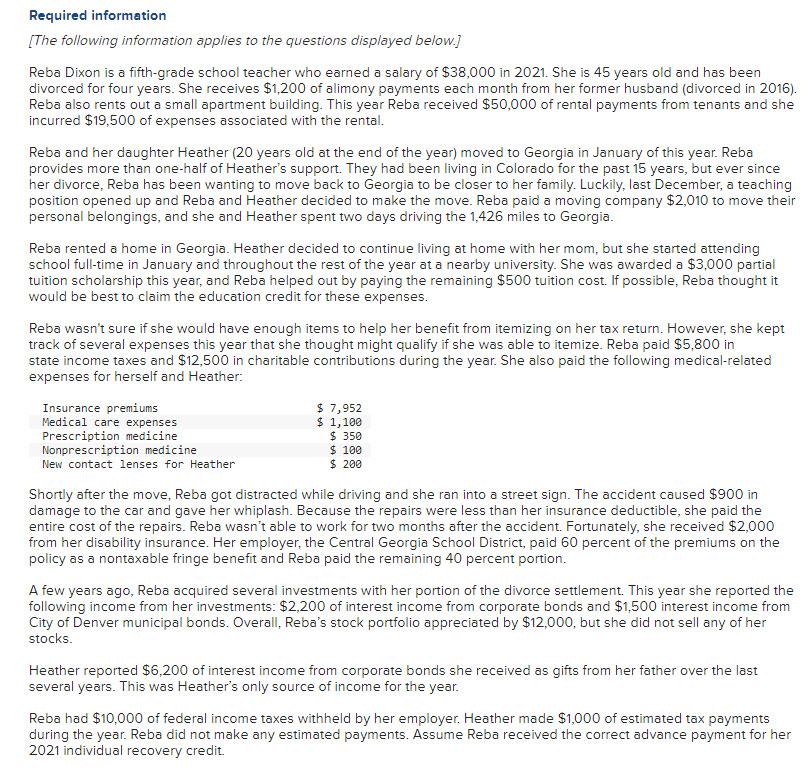

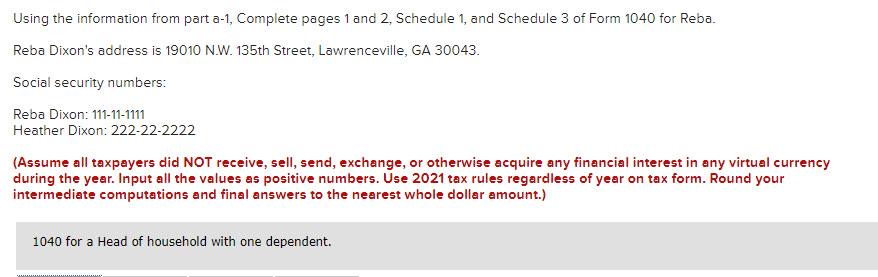

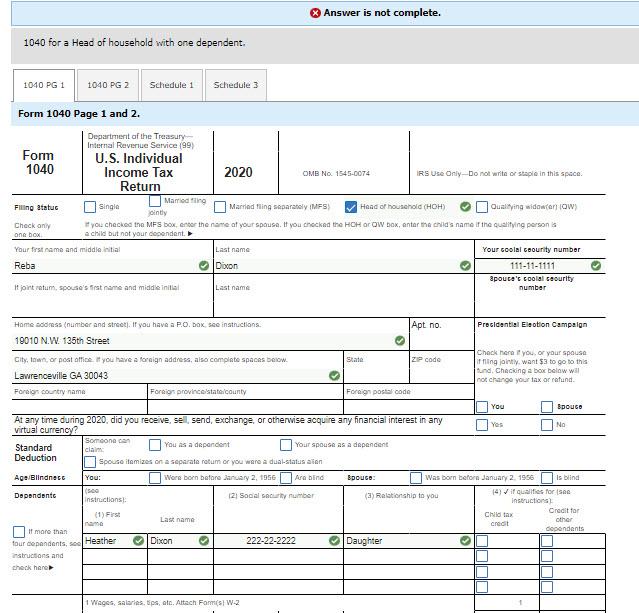

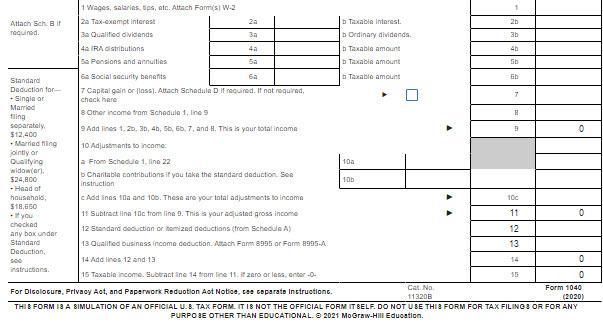

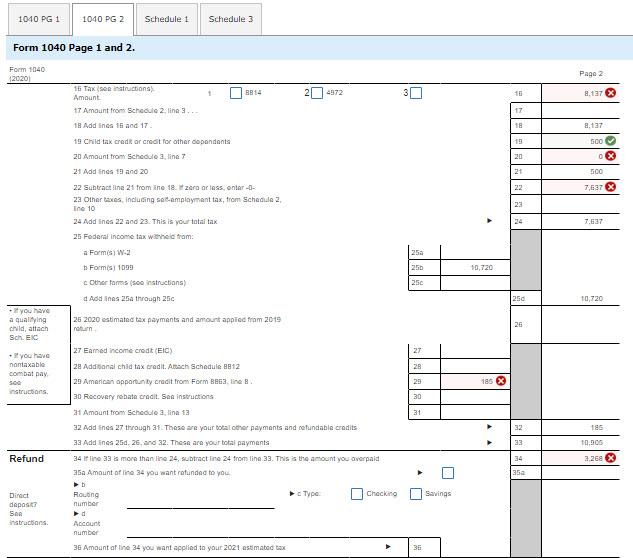

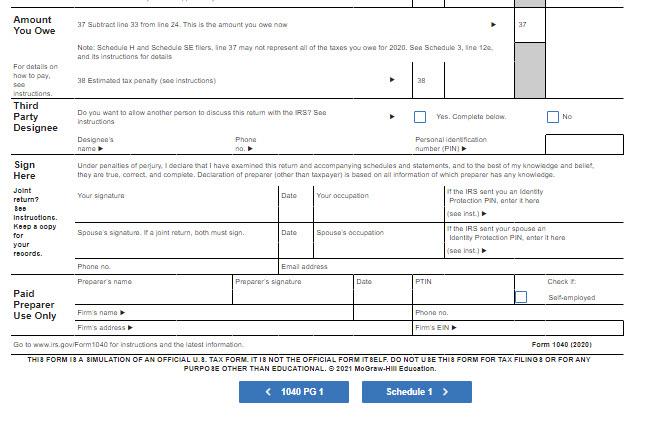

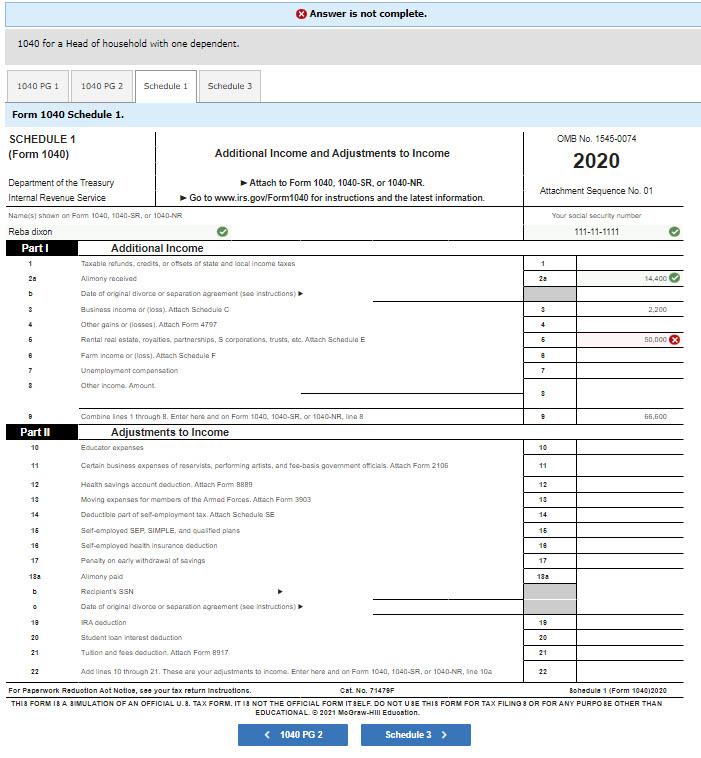

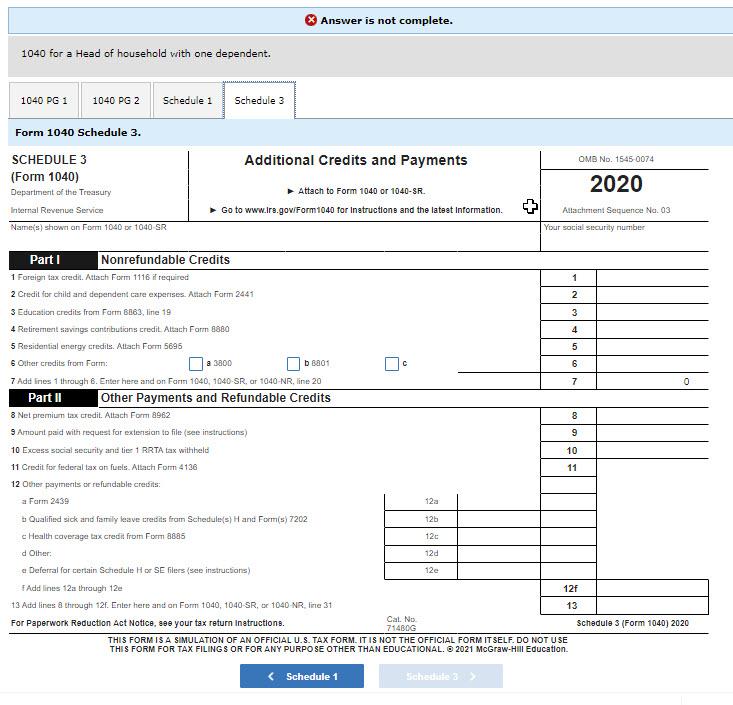

Required information [The following information applies to the questions displayed below.) Reba Dixon is a fifth-grade school teacher who earned a salary of $38,000 in 2021. She is 45 years old and has been divorced for four years. She receives $1,200 of alimony payments each month from her former husband (divorced in 2016). Reba also rents out a small apartment building. This year Reba received $50,000 of rental payments from tenants and she incurred $19,500 of expenses associated with the rental. Reba and her daughter Heather (20 years old at the end of the year) moved to Georgia in January of this year. Reba provides more than one-half of Heather's support. They had been living in Colorado for the past 15 years, but ever since her divorce, Reba has been wanting to move back to Georgia to be closer to her family. Luckily, last December, a teaching position opened up and Reba and Heather decided to make the move. Reba paid a moving company $2,010 to move their personal belongings, and she and Heather spent two days driving the 1,426 miles to Georgia. Reba rented a home in Georgia. Heather decided to continue living at home with her mom, but she started attending school full-time in January and throughout the rest of the year at a nearby university. She was awarded a $3,000 partial tuition scholarship this year, and Reba helped out by paying the remaining $500 tuition cost. If possible, Reba thought it would be best to claim the education credit for these expenses. Reba wasn't sure if she would have enough items to help her benefit from itemizing on her tax return. However, she kept track of several expenses this year that she thought might qualify if she was able to itemize. Reba paid $5,800 in state income taxes and $12,500 in charitable contributions during the year. She also paid the following medical-related expenses for herself and Heather: Insurance premiums $ 7,952 Medical care expenses $ 1,100 Prescription medicine $ 350 Nonprescription medicine $ 100 New contact lenses for Heather $ 200 Shortly after the move, Reba got distracted while driving and she ran into a street sign. The accident caused $900 in damage to the car and gave her whiplash. Because the repairs were less than her insurance deductible, she paid the entire cost of the repairs. Reba wasn't able to work for two months after the accident. Fortunately, she received $2,000 from her disability insurance. Her employer, the Central Georgia School District, paid 60 percent of the premiums on the policy as a nontaxable fringe benefit and Reba paid the remaining 40 percent portion. A few years ago, Reba acquired several investments with her portion of the divorce settlement. This year she reported the following income from her investments: $2,200 of interest income from corporate bonds and $1,500 interest income from City of Denver municipal bonds. Overall, Reba's stock portfolio appreciated by $12,000, but she did not sell any of her stocks. Heather reported $6,200 of interest income from corporate bonds she received as gifts from her father over the last several years. This was Heather's only source of income for the year. Reba had $10,000 of federal income taxes withheld by her employer. Heather made $1,000 of estimated tax payments during the year. Reba did not make any estimated payments. Assume Reba received the correct advance payment for her 2021 individual recovery credit. Using the information from part a-1, Complete pages 1 and 2 Schedule 1, and Schedule 3 of Form 1040 for Reba. Reba Dixon's address is 19010 NW. 135th Street, Lawrenceville, GA 30043. Social security numbers: Reba Dixon: 111-11-1111 Heather Dixon: 222-22-2222 (Assume all taxpayers did NOT receive, sell, send, exchange, or otherwise acquire any financial interest in any virtual currency during the year. Input all the values as positive numbers. Use 2021 tax rules regardless of year on tax form. Round your intermediate computations and final answers to the nearest whole dollar amount.) 1040 for a Head of household with one dependent. Answer is not complete. 1040 for a Head of household with one dependent, 1040 PG 1 1040 PG 2 Schedule 1 Schedule 3 Form 1040 Page 1 and 2. Department of the Treasury Internal Revenue Service (99) Form U.S. Individual 1040 Income Tax 2020 OMB No 1545-0074 IRS Use Only Do not write of staple in this space Return Marrioting Filling Status Single Married fling separately IMES) Head of household (HOH) Qualifying widowieniowy intly Check only you checked the MFS box, enter the name at your spouse. If you checked the HOH OGOW box, antarme child's name if the qualifying person is one box a child but not your docendent. Your first name and middle initial Last name Your coolal courity number Reba Dixon 111-11-1111 Spouts's coolal caourity It joint retum, spouse's first name and middle initial Last name number Home address number and street. If you have a P.O.box, see instructions Apt no Presidential Election Campaign 19010 N.W. 135th Street Check here you or your spouse City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code it ing jointly want $3 to go to this Lawrenceville GA 30043 Rund. Checking a box below wal not change your lax or refund Foreign country nama Forsion province stata county Foreign postal code You Bpouco At any time during 2020, did you receive, sell send, exchange or otherwise acquire any financial interest in any Yes No virtual currency? Someone Standard You as a dependent Your spouse AS A dependent claim Deduction spouze itemizes on a separate ratum or you ware a dual-statussion Age Blindness You: Wore born before January 2, 1956 Ara bind Bpouco: Was born before January 2. 1956 is blind (Se Dependente 121 Social Security number 14) Vif qualities for SC Instructions: (2) Relationship to you instructions Credit for (1) First Chid tax Last name other cheat If more than dependents four dependents, Heather Dixon 222-22-2222 Daughter instructions and check here 1 Wages, salaries Eps, etc. Altach Fams W-2 ] 1 Wages, salaries, ups, etc. Attach Fam's W-2 2a Tax-exempt interest 23 Attach Sch. Bit Taxable interest nequired 3a Qualified vidends 3a b Ordinary dividends. 3b 4. IRA distributions 4a Taxable amount 45 Be Pensions and annuities 5a Taxable amount Sb 6. Social security benefits 6a Standard th Taxable amount Deduction for 7 Capital gain or loss). Altach Schedule D if required. If not required, 7 + Single or check here Married tring 8 Other income from Schedule 1, line 9 separately 5 9 Add lines 1.20.30, 45, 56, 6b. 7, and H. This is your total income $12.400 0 Married ning 10 Adjustments to income jointly or Delting From Schedule 1. line 22 10a widowani 524.800 Charitable contributions it you take the standard deduction Son - Head of instruction household - Add Enes 10a and 100. These are your total adjustments to income 100 518,650 .you 11 Subtractina 10c from line 9. This is your nousted gross income 11 0 checked any box under 12 Standard duction or tomized deductions from Schedule A) 12 Standard 13 Qualified business income deduction. Adach Farm 8995 or Form 1995-A 13 Deduction, so 14 Addlines 12 and 13 14 0 instructions 15 Taxable income. Subtractine 14 om line 11. zero or less enter... 0 Cat. Na Form 1040 For Dicolocure. Privacy Act, and Paperwork Reduction Act Notice, caparate Instruction 11320B (2020) THE FORM 12 A SIMULATION OF AN OFFICIAL U.B. TAX FORM IT IS NOT THE OFFICIAL FORM IT BELF. DO NOT USE THIS FORM FOR TAX FILING: OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL 2021 Mo Graw-Hm Education. | 1040 PG 1 1040 PG 2 Schedule 1 Schedule 3 Form 1040 Page 1 and 2. Form 1040 120201 Page 2 4972 15 8.137 17 18 8.137 19 500 0 % 21 500 22 7,637 X 16 Tax on Instructions Amount 1 B014 17 Amount from Schedule 2. line 3... 18 Add lines and 17 19 Child tax credt or credit for other dependents 20 Amount from Schedule 3. line 7 21 Addnes 19 and 20 22 Subtract line 21 from ine 18. zero or less, ontar-O- 22 Other taxes, including set-employment tax, from Schedule 2 Ene 10 24 Addnes 22 and 23. This is your total tax 25 Federal income tax whole from: a Forms W2 Forms 1000 coher forms (800 instructions) d Ada Ines 25 through 21 23 7.637 25a 250 10,720 250 250 10,720 you have a qualifying child, attach Sch. EC 26 2020 estimate tax payments and amount appled from 2019 notar 26 27 28 you have nontaxable combat Day 500 Instructors 29 185 30 27 Emad come credt (EIC) 28 Additional chid tax credit. Attach Schedule 8812 29 American opportunity credit from Form BEES line 8 30 Recovery robate credit. See instructions 31 Amount from Schedule 3. lina 13 32 Addnes 27 through 21. These are your balther payments and refundable credits 33 Addines 260, 26, and 32. These are your total payments 34 line 33 more than line 24, subtract line 24 from line 33. This the amount you over paid 25a Amount of in 34 you want rounded to you 31 32 185 33 10,000 Refund 34 3.268 X Routing number Type Checking Savings Direct deposits San Instructors Account number 36 Amount of line 34 you want applied to your 2021 estimated tax 35 Amount You Owe 37 Subtract line 33 from ine 24. This is the amount you owe non Note: Schedule Hand Schedule SE ilers, line 27 may not represent all of the taxes you w for 2020. Son Schedule 3. ine 12 and its instructions for details For details on how to pay 30 Estimated tak penalty (see instructions 28 Instructions Third Party Designee Do you want to low another person to discuss this num with the RS? See Instruccions Yes. Complete below No Sign Here Designs Phone Personalientification name 10. number (PIN) Under penalties of penjury. I declare that I have examined this totum and accompanying schedules and statements, and to the best of my knowledge and beliet they are true, comect and comite Declaration of prepare other than taxpayens based on all information of which preparer has any knowledge Your signatura Dato if the RS sent you an identity Your occupation Protection PIN, enter the Joint return? Bop Instructionc. for your rooorde Spouse's signature in return, both must sign. Dato Spouso s tuto it the issant your spouse an Identity Protection PIN enter it here (se Inst Phonan Emal add Preparar a namo Praparer's signature Dato PTIN Check Stamplayed Paid Preparer Use Only Fins name Phone no. Firm's address Fimm's EN Go to www.rs.govi Form1040 for instructions and the latest Information Form 1040 12020) THIS FORM IS A SIMULATION OF AN OFFICIAL U. 2. TAX FORM. IT IS NOT THE OFFICIAL FORM IT BELF. DO NOT U BE THIS FORM FOR TAX FILING OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 Mo Graw-Hill Education. Answer is not complete. 1040 for a Head of household with one dependent. 1040 PG 1 Schedule 1 Schedule 3 1040 PG 2 Form 1040 Schedule 1. SCHEDULE 1 (Form 1040) OMB No. 1545-0074 Additional Income and Adjustments to Income 2020 Attachment Sequence No. 01 Your social security number 111-11-1111 1 2a 14,400 Department of the Treasury Attach to Form 1040 1040-SR, or 1040-NR. Internal Revenue Service Go to www.irs.govlForm 1040 for instructions and the latest information Namas shown on Fam 1040, 040-SR, ar 1040-NR Reba dixon Partl Additional Income 1 Taxabinnafunds, crosits, arosats af state and local income taxes 20 Allmany received b Date of original divorce or separation agreement (see instructions) 8 Business income or loss). Attach Schedule 4 Other gains or losses. Attach Form 4707 5 Rental real estate, royalties, partnerships, corporations, trusts, etc. Anach Schedule E 6 Farm income or loss). Arach Schedule F 7 Unemployment compensation 8 Other income Amount 3 2.200 4 5 50,000 X 7 3 9 66,600 Part II Combine Ines through H. Enter here and an Form 1040 1040-SR. 1040-NR, linea Adjustments to Income Educator expenses Certain business expenses of reservists, perfamming artists, and co-bass govement officials. Attach Form 2105 10 10 11 11 12 12 13 18 14 14 16 15 10 18 17 17 Health Savings account docction Attach Farm 889 Moving expenses for members of the Armed Forces. Altach Farm 3003 Deductible part of ser-employment tax. Attach Schedule SE Saif-employed SEF SIMPLE, and ested plans Soit employed heath insurance deduction Penalty on early withdrawal of savings Alimony paid Recipient's SSN Date of original divorce or separation agreement (sce instructions) FRA deduction Student Loaninharest deduction Tution and to deduction Attach Form 2917 183 18a b o 19 19 20 20 21 21 22 Adelines 10 through 21. These are your adjustments to come. Enter here and an Fam 1040, 1020-SR, or 1040-NR, Ine 109 22 For Paperwork Reduction Act Notico, cee your tax return instructions. Cat No. 71478F Bohedule 1 (Form 10402020 THIS FORM IBA SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILING 3 OR FOR ANY PURPO BE OTHER THAN EDUCATIONAL 2021 MoGraw-Hill Eduontion Answer is not complete. 1040 for a Head of household with one dependent. 1040 PG 1 1040 PG 2 Schedule 1 Schedule 3 Form 1040 Schedule 3. SCHEDULE 3 (Form 1040) Department of the Treasury OMB No. 1545 0074 Additional Credits and Payments Attach to Form 1040 or 1040-SR. Go to www.lrs.gov/Form 1040 for Instructions and the latest Information. 2020 Internal Revenue Service Attachment Sequence No. 03 Name(s) shown on Form 1040 1040 SR Your social security number 4 Partl Nonrefundable Credits 1 Foreign tax credit. Attach Form 1116 it required 1 2 Credit for child and dependent care experises. Attach Form 2441 2 3 Education credits from Farm 6363, line 19 3 4 Retirement savings contributions credit Attach Form 3880 5 Residential energy credits. Attach Form 5695 5 6 Other credits from Farm: a 3800 b 8801 6 7 Add lines 1 through 6. Enter here and on Fann 1040 1040-SR, ar 1040-NR. line 20 7 0 Part II Other Payments and Refundable Credits 8 Net premium tax credit. Altach Form 8962 8 9 Amount paid with request for extension to file (see instructions) 9 10 Excess social security and tie 1 RRTA lax withheld 10 11 Credit for federal tax on fuels. Altach Form 4136 11 12 Other payments or refundable credits: a Farm 2439 Qualified sick and family leave credits from Schedule(s) H and Formis) 7202 12b c Health coverage tax credit from Form8885 120 d Other: 120 Deferral for certain Schedule Hor SE filers (see instructions) 12e FAdd lines 12a thraugh 12 121 13 Add lines a through 121. Enter here and on Form 1040, 1040 SR. Br 1040 NR. line 31 13 Cal. Nes For Paperwork Reduction Act Notice, see your tax return Instructions. 714BOG Schedule 3 (Form 1040) 2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education 12a Answer is not complete. 1040 for a Head of household with one dependent. 1040 PG 1 Schedule 1 Schedule 3 1040 PG 2 Form 1040 Schedule 1. SCHEDULE 1 (Form 1040) OMB No. 1545-0074 Additional Income and Adjustments to Income 2020 Attachment Sequence No. 01 Your social security number 111-11-1111 1 2a 14,400 Department of the Treasury Attach to Form 1040 1040-SR, or 1040-NR. Internal Revenue Service Go to www.irs.govlForm 1040 for instructions and the latest information Namas shown on Fam 1040, 040-SR, ar 1040-NR Reba dixon Partl Additional Income 1 Taxabinnafunds, crosits, arosats af state and local income taxes 20 Allmany received b Date of original divorce or separation agreement (see instructions) 8 Business income or loss). Attach Schedule 4 Other gains or losses. Attach Form 4707 5 Rental real estate, royalties, partnerships, corporations, trusts, etc. Anach Schedule E 6 Farm income or loss). Arach Schedule F 7 Unemployment compensation 8 Other income Amount 3 2.200 4 5 50,000 X 7 3 9 66,600 Part II Combine Ines through H. Enter here and an Form 1040 1040-SR. 1040-NR, linea Adjustments to Income Educator expenses Certain business expenses of reservists, perfamming artists, and co-bass govement officials. Attach Form 2105 10 10 11 11 12 12 13 18 14 14 16 15 10 18 17 17 Health Savings account docction Attach Farm 889 Moving expenses for members of the Armed Forces. Altach Farm 3003 Deductible part of ser-employment tax. Attach Schedule SE Saif-employed SEF SIMPLE, and ested plans Soit employed heath insurance deduction Penalty on early withdrawal of savings Alimony paid Recipient's SSN Date of original divorce or separation agreement (sce instructions) FRA deduction Student Loaninharest deduction Tution and to deduction Attach Form 2917 183 18a b o 19 19 20 20 21 21 22 Adelines 10 through 21. These are your adjustments to come. Enter here and an Fam 1040, 1020-SR, or 1040-NR, Ine 109 22 For Paperwork Reduction Act Notico, cee your tax return instructions. Cat No. 71478F Bohedule 1 (Form 10402020 THIS FORM IBA SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILING 3 OR FOR ANY PURPO BE OTHER THAN EDUCATIONAL 2021 MoGraw-Hill Eduontion Answer is not complete. 1040 for a Head of household with one dependent. 1040 PG 1 1040 PG 2 Schedule 1 Schedule 3 Form 1040 Schedule 3. SCHEDULE 3 (Form 1040) Department of the Treasury OMB No. 1545 0074 Additional Credits and Payments Attach to Form 1040 or 1040-SR. Go to www.lrs.gov/Form 1040 for Instructions and the latest Information. 2020 Internal Revenue Service Attachment Sequence No. 03 Name(s) shown on Form 1040 1040 SR Your social security number 4 Partl Nonrefundable Credits 1 Foreign tax credit. Attach Form 1116 it required 1 2 Credit for child and dependent care experises. Attach Form 2441 2 3 Education credits from Farm 6363, line 19 3 4 Retirement savings contributions credit Attach Form 3880 5 Residential energy credits. Attach Form 5695 5 6 Other credits from Farm: a 3800 b 8801 6 7 Add lines 1 through 6. Enter here and on Fann 1040 1040-SR, ar 1040-NR. line 20 7 0 Part II Other Payments and Refundable Credits 8 Net premium tax credit. Altach Form 8962 8 9 Amount paid with request for extension to file (see instructions) 9 10 Excess social security and tie 1 RRTA lax withheld 10 11 Credit for federal tax on fuels. Altach Form 4136 11 12 Other payments or refundable credits: a Farm 2439 Qualified sick and family leave credits from Schedule(s) H and Formis) 7202 12b c Health coverage tax credit from Form8885 120 d Other: 120 Deferral for certain Schedule Hor SE filers (see instructions) 12e FAdd lines 12a thraugh 12 121 13 Add lines a through 121. Enter here and on Form 1040, 1040 SR. Br 1040 NR. line 31 13 Cal. Nes For Paperwork Reduction Act Notice, see your tax return Instructions. 714BOG Schedule 3 (Form 1040) 2020 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education 12a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts