Question: This is Comprehensive Problem 3 for Accounting 25e, I need the answers for this. If you have the answers for the whole problem, including statements

This is Comprehensive Problem 3 for Accounting 25e, I need the answers for this. If you have the answers for the whole problem, including statements please post as well.

Here is the problem:

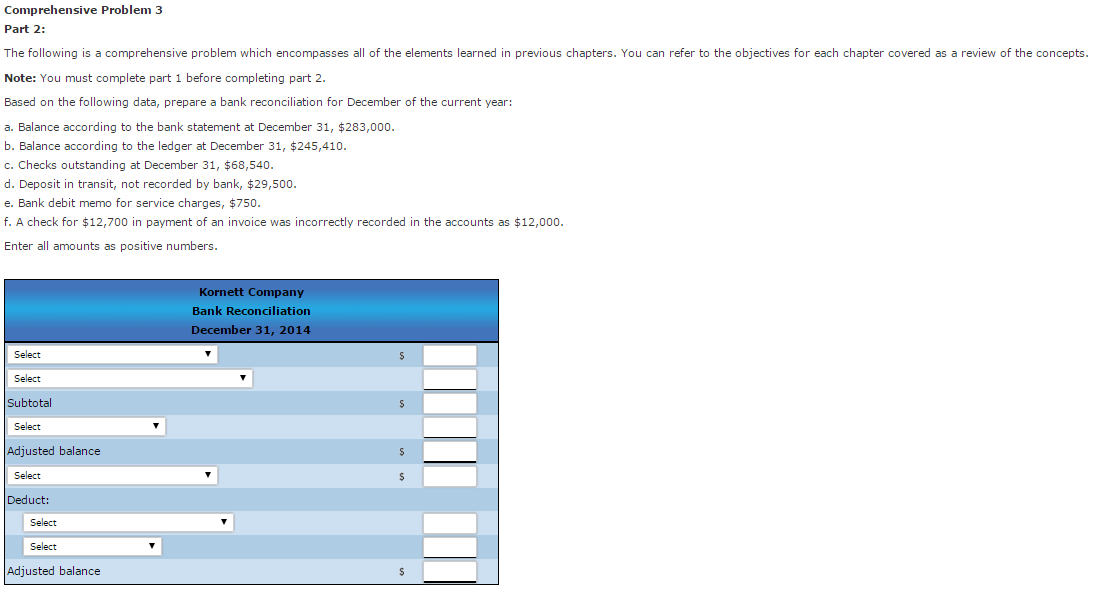

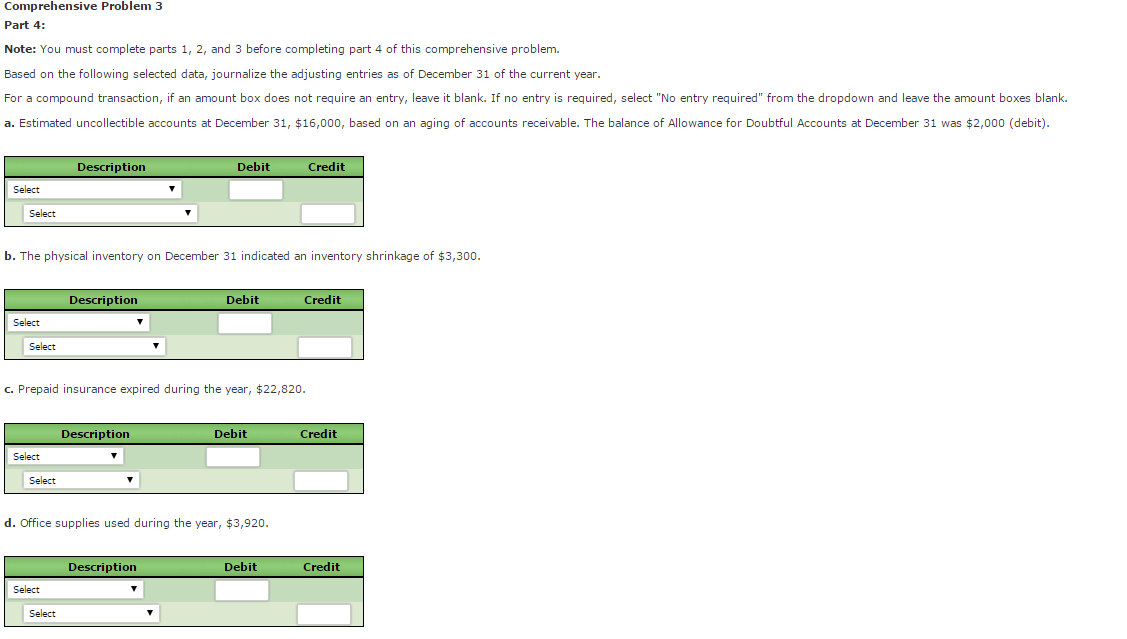

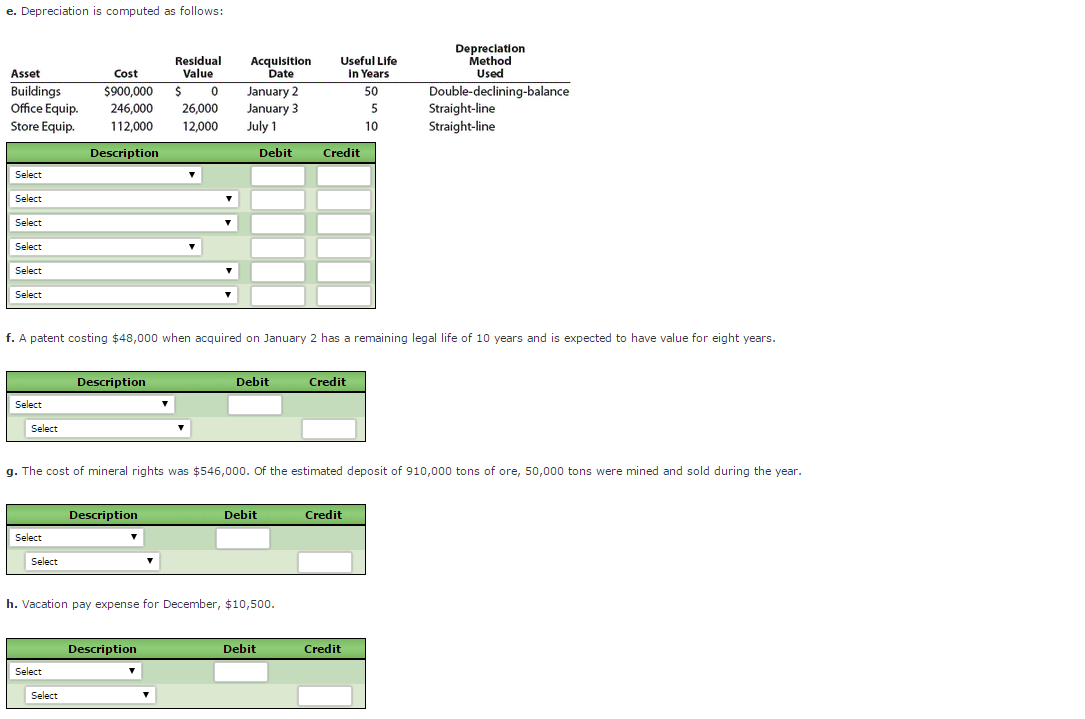

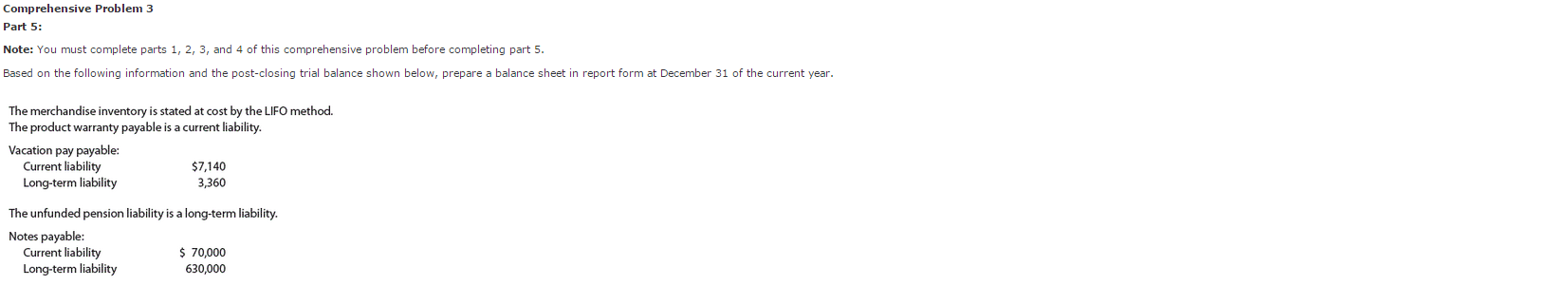

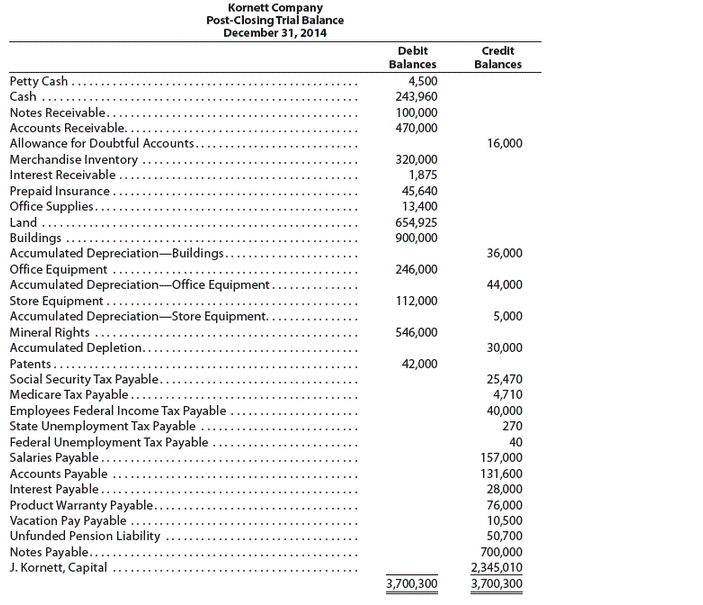

The following is a comprehensive problem which encompasses all of the elements learned in previous chapters. You can refer to the objectives for each chapter covered as a review of the concepts. You must complete part 1 before completing part 2. Based on the following data, prepare a bank reconciliation for December of the current year: Balance according to the bank statement at December 31, $283,000. Balance according to the ledger at December 31, $245,410. Checks outstanding at December 31, $68,540. Deposit in transit, not recorded by bank, $29,500. Bank debit memo for service charges, $750. A check for $12,700 in payment of an invoice was incorrectly recorded in the accounts as $12,000. Enter all amounts as positive numbers. You must complete parts 1, 2, and 3 before completing part 4 of this comprehensive problem. Based on the following selected data, journalize the adjusting entries as of December 31 of the current year. For a compound transaction, if an amount box does not require an entry, leave it blank. If no entry is required, select "No entry required" from the dropdown and leave the amount boxes blank, a. Estimated uncollectible accounts at December 31, $16,000, based on an aging of accounts receivable. The balance of Allowance for Doubtful Accounts at December 31 was $2,000 (debit). Depreciation is computed as follows: A patent costing $48,000 when acquired on January 2 has a remaining legal life of 10 years and is expected to have value for eight years. The cost of mineral rights was $546,000. Of the estimated deposit of 910,000 tons of ore, 50,000 tons were mined and sold during the year. Vacation pay expense for December, $10,500 You must complete parts 1, 2, 3, and 4 of this comprehensive problem before completing part 5. Based on the following information and the post-closing trial balance shown below, prepare a balance sheet in report form at December 31 of the current year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts