Question: This is depreciation method need in chart form X Post Attendee X Microsoft Off x Presentation1 X g now microsoft 161740/cfi/703!/4/4@0.00:41.3 Double-declining balance method An

This is depreciation method need in chart form

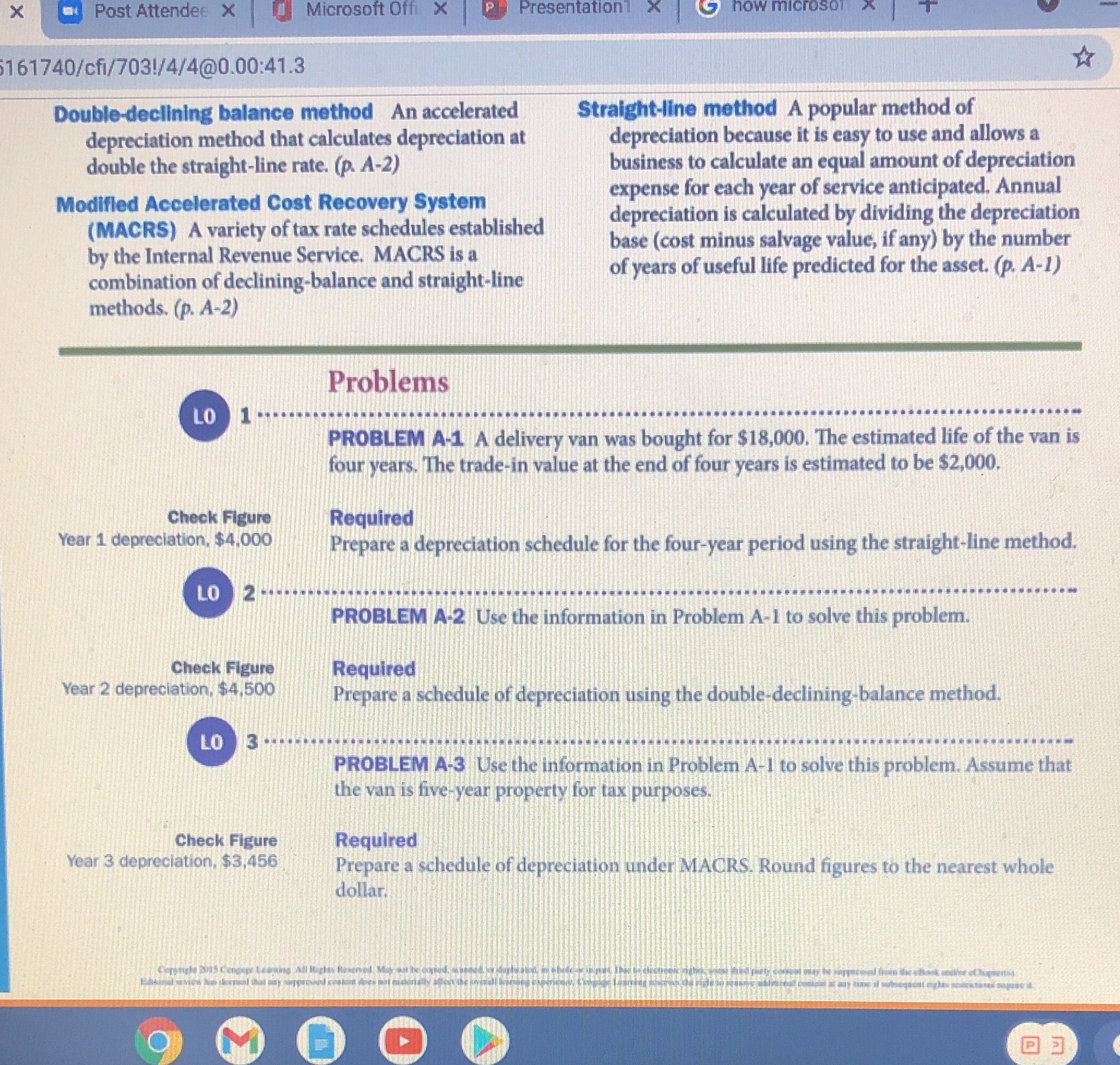

X Post Attendee X Microsoft Off x Presentation1 X g now microsoft 161740/cfi/703!/4/4@0.00:41.3 Double-declining balance method An accelerated Straight-line method A popular method of depreciation method that calculates depreciation at depreciation because it is easy to use and allows a double the straight-line rate. (p. A-2) business to calculate an equal amount of depreciation Modified Accelerated Cost Recovery System expense for each year of service anticipated, Annual (MACRS) A variety of tax rate schedules established depreciation is calculated by dividing the depreciation by the Internal Revenue Service. MACRS is a base (cost minus salvage value, if any) by the number combination of declining-balance and straight-line of years of useful life predicted for the asset. (p. A-1) methods. (p. A-2) Problems LO PROBLEM A-1 A delivery van was bought for $18,000. The estimated life of the van is four years, The trade-in value at the end of four years is estimated to be $2,000, Check Figure Required Year 1 depreciation, $4,000 Prepare a depreciation schedule for the four-year period using the straight-line method. LO PROBLEM A-2 Use the information in Problem A-1 to solve this problem. Check Figure Required Year 2 depreciation, $4,500 Prepare a schedule of depreciation using the double-declining-balance method. PROBLEM A-3 Use the information in Problem A-1 to solve this problem. Assume that the van is five-year property for tax purposes. Check Figure Required Year 3 depreciation, $3,456 Prepare a schedule of depreciation under MAGRS. Round figures to the nearest whole dollar. M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts