Question: This is Engineering Economics. Please explain using MIRR, modified internal rate of return procedure. This needs to be done my hand. The explaination in the

This is Engineering Economics.

Please explain using MIRR, modified internal rate of return procedure. This needs to be done my hand. The explaination in the book used Excel, and that is not acceptable.

I do not understand the equations to use, so I would appreciate it if you could explain the logic and equations.

Thanks so much!

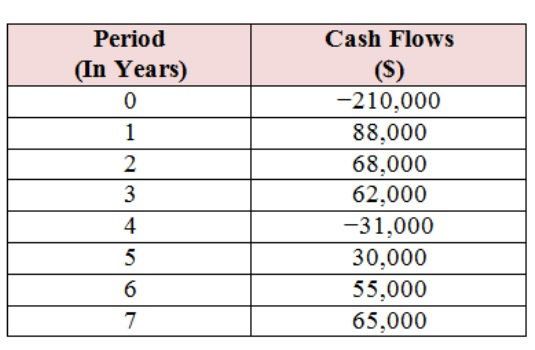

What is the rate of return associated with this project?

Period (In Years) 0 Cash Flows 210,000 88,000 68,000 62,000 31,000 30,000 55,000 65.000 2 4 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts