Question: This is finanacial accouting. I really need the answer asap. Thank you so much! 1) Walden Extreme Corp. reported the following amounts in the shareholders'

This is finanacial accouting. I really need the answer asap. Thank you so much!

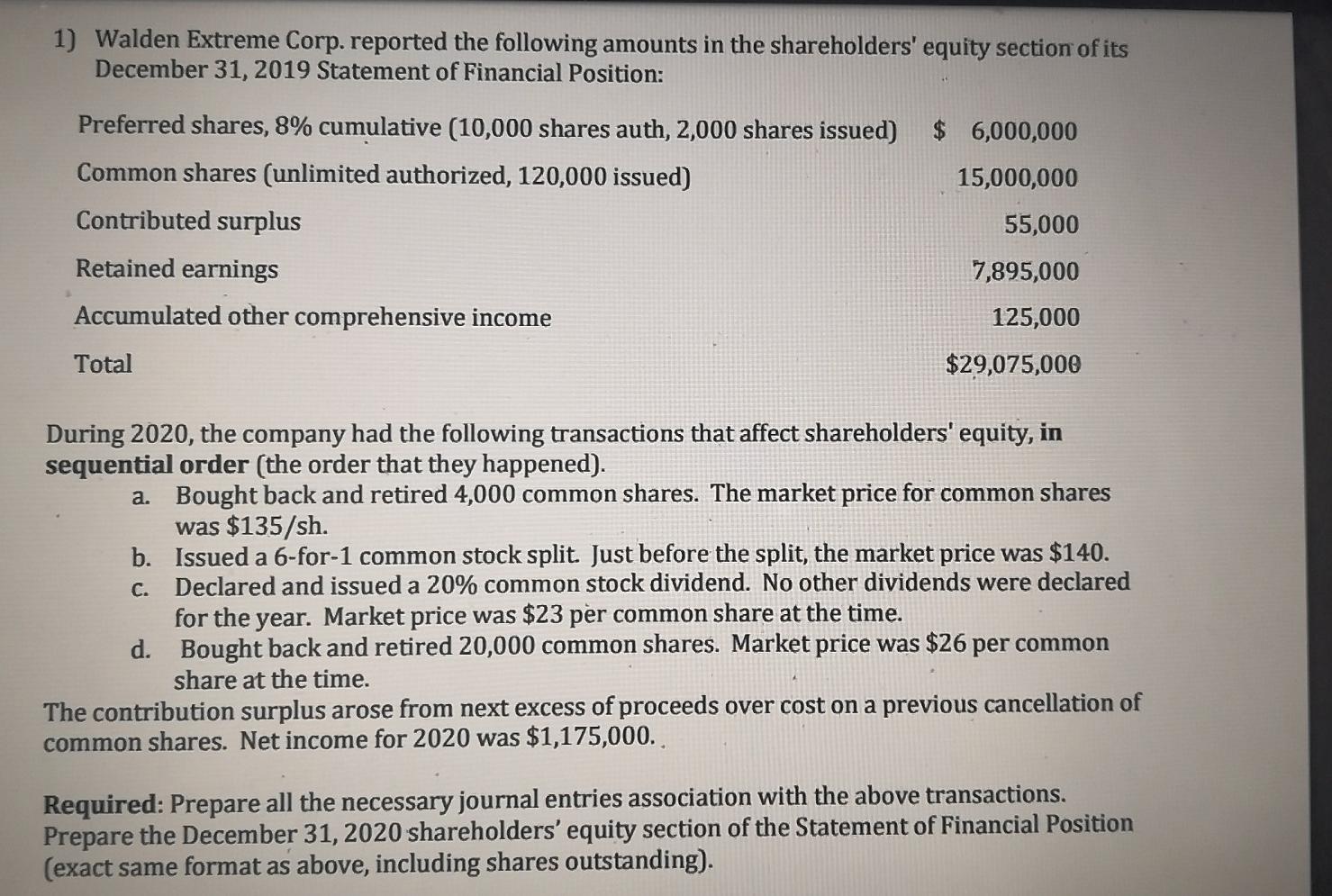

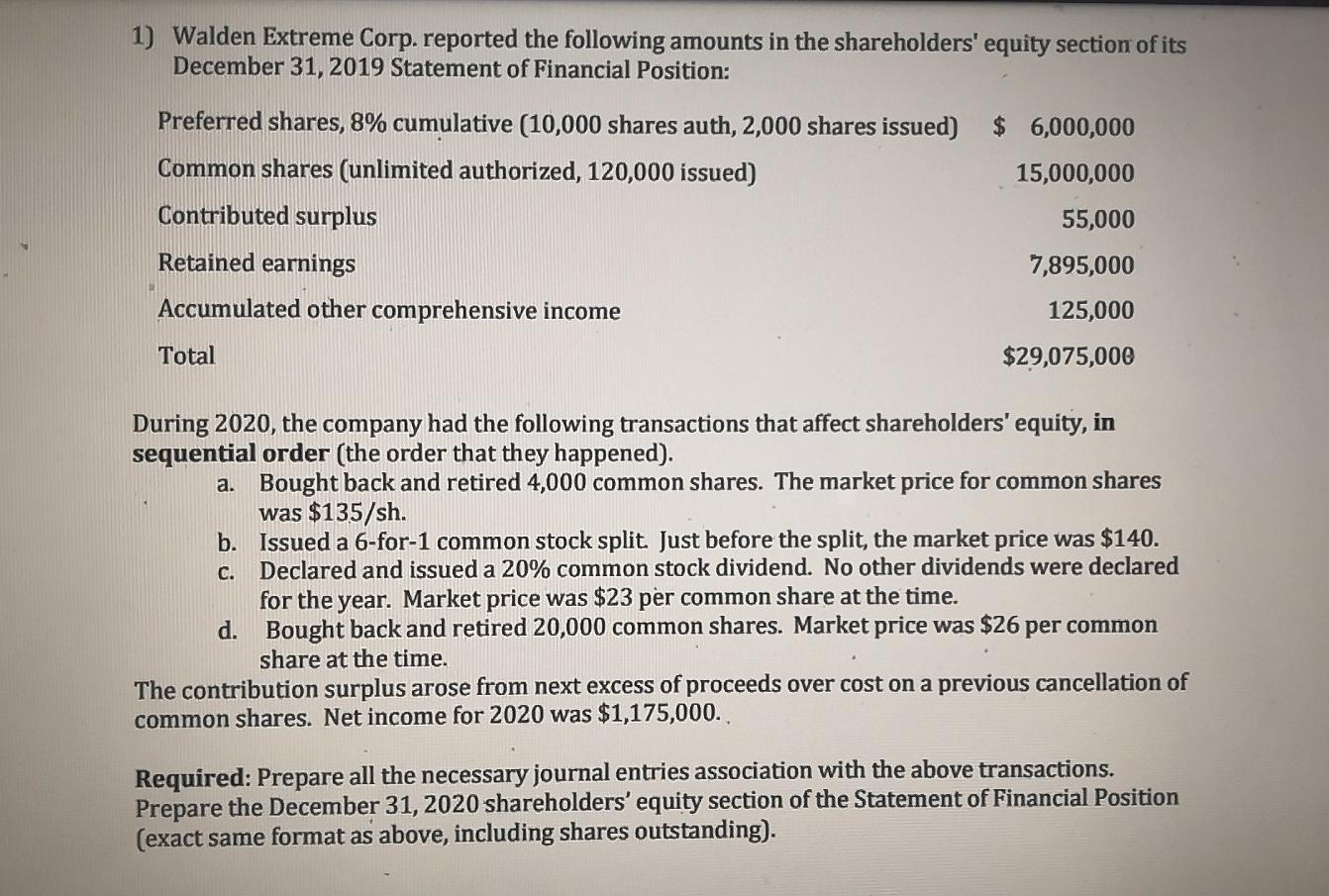

1) Walden Extreme Corp. reported the following amounts in the shareholders' equity section of its December 31, 2019 Statement of Financial Position: Preferred shares, 8% cumulative (10,000 shares auth, 2,000 shares issued) $ 6,000,000 Common shares (unlimited authorized, 120,000 issued) 15,000,000 Contributed surplus 55,000 Retained earnings 7,895,000 Accumulated other comprehensive income 125,000 Total $29,075,000 During 2020, the company had the following transactions that affect shareholders' equity, in sequential order (the order that they happened). a. Bought back and retired 4,000 common shares. The market price for common shares was $135/sh. b. Issued a 6-for-1 common stock split. Just before the split, the market price was $140. Declared and issued a 20% common stock dividend. No other dividends were declared for the year. Market price was $23 per common share at the time. d. Bought back and retired 20,000 common shares. Market price was $26 per common share at the time. The contribution surplus arose from next excess of proceeds over cost on a previous cancellation of common shares. Net income for 2020 was $1,175,000.. C. Required: Prepare all the necessary journal entries association with the above transactions. Prepare the December 31, 2020 shareholders' equity section of the Statement of Financial Position (exact same format as above, including shares outstanding). 1) Walden Extreme Corp. reported the following amounts in the shareholders' equity section of its December 31, 2019 Statement of Financial Position: Preferred shares, 8% cumulative (10,000 shares auth, 2,000 shares issued) Common shares (unlimited authorized, 120,000 issued) Contributed surplus Retained earnings Accumulated other comprehensive income $ 6,000,000 15,000,000 55,000 7,895,000 125,000 $29,075,000 Total During 2020, the company had the following transactions that affect shareholders' equity, in sequential order (the order that they happened). a. Bought back and retired 4,000 common shares. The market price for common shares was $135/sh. b. Issued a 6-for-1 common stock split. Just before the split, the market price was $140. C. Declared and issued a 20% common stock dividend. No other dividends were declared for the year. Market price was $23 per common share at the time. d. Bought back and retired 20,000 common shares. Market price was $26 per common share at the time. The contribution surplus arose from next excess of proceeds over cost on a previous cancellation of common shares. Net income for 2020 was $1,175,000. Required: Prepare all the necessary journal entries association with the above transactions. Prepare the December 31, 2020 shareholders' equity section of the Statement of Financial Position (exact same format as above, including shares outstanding)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts