Question: this is for a finanical mathematics class! this particular problem is over immunization! 007 (part 1 of 3) 10.0 points A court has ordered Security

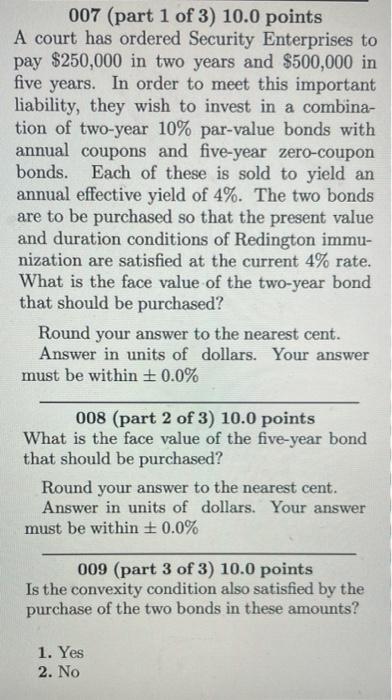

007 (part 1 of 3) 10.0 points A court has ordered Security Enterprises to pay $250,000 in two years and $500,000 in five years. In order to meet this important liability, they wish to invest in a combina- tion of two-year 10% par-value bonds with annual coupons and five-year zero-coupon bonds. Each of these is sold to yield an annual effective yield of 4%. The two bonds are to be purchased so that the present value and duration conditions of Redington immu- nization are satisfied at the current 4% rate. What is the face value of the two-year bond that should be purchased? Round your answer to the nearest cent. Answer in units of dollars. Your answer must be within 0.0% 008 (part 2 of 3) 10.0 points What is the face value of the five-year bond that should be purchased? Round your answer to the nearest cent. Answer in units of dollars. Your answer must be within + 0.0% 009 (part 3 of 3) 10.0 points Is the convexity condition also satisfied by the purchase of the two bonds in these amounts? 1. Yes 2. No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts