Question: This is for Canada, Ontario Please select the correct category for the following: Income earned from provision of services by an individual who is self-employed

This is for Canada, Ontario

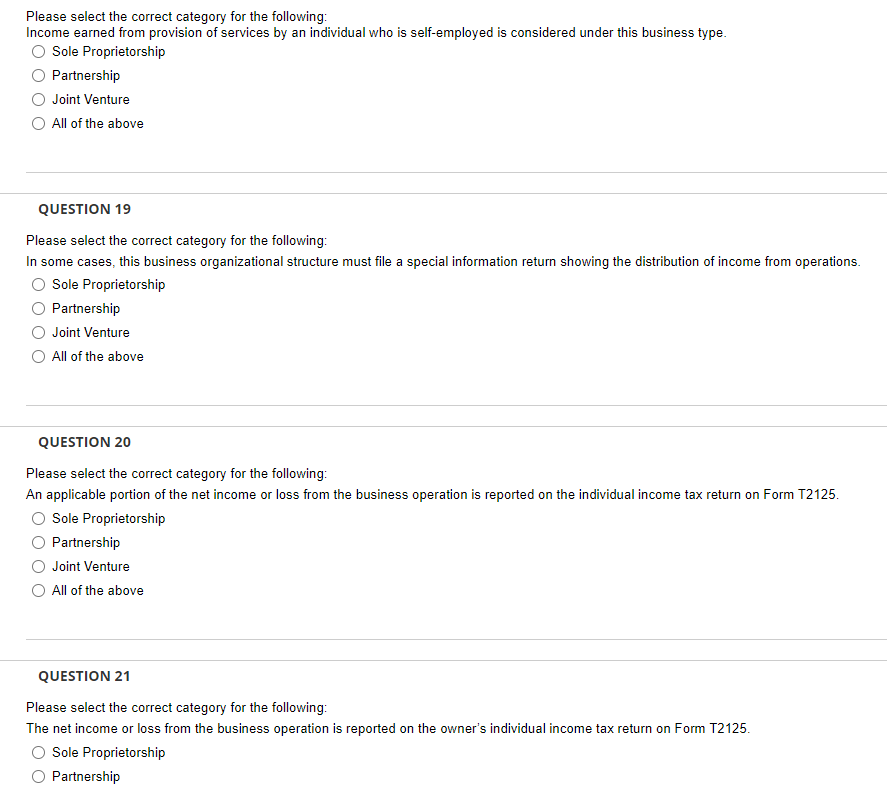

Please select the correct category for the following: Income earned from provision of services by an individual who is self-employed is considered under this business type. Sole Proprietorship Partnership Joint Venture All of the above QUESTION 19 Please select the correct category for the following: In some cases, this business organizational structure must file a special information return showing the distribution of income from operations. Sole Proprietorship Partnership Joint Venture All of the above QUESTION 20 Please select the correct category for the following: An applicable portion of the net income or loss from the business operation is reported on the individual income tax return on Form T2125. Sole Proprietorship Partnership Joint Venture All of the above QUESTION 21 Please select the correct category for the following: The net income or loss from the business operation is reported on the owner's individual income tax return on Form T2125. Sole Proprietorship Partnership

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts