Question: this is for class FIN 3403 Ch 08: Assignment - Risk and Rates of Return Back to Assignment Attempts Average/3 8. Portfolio risk and return

this is for class FIN 3403

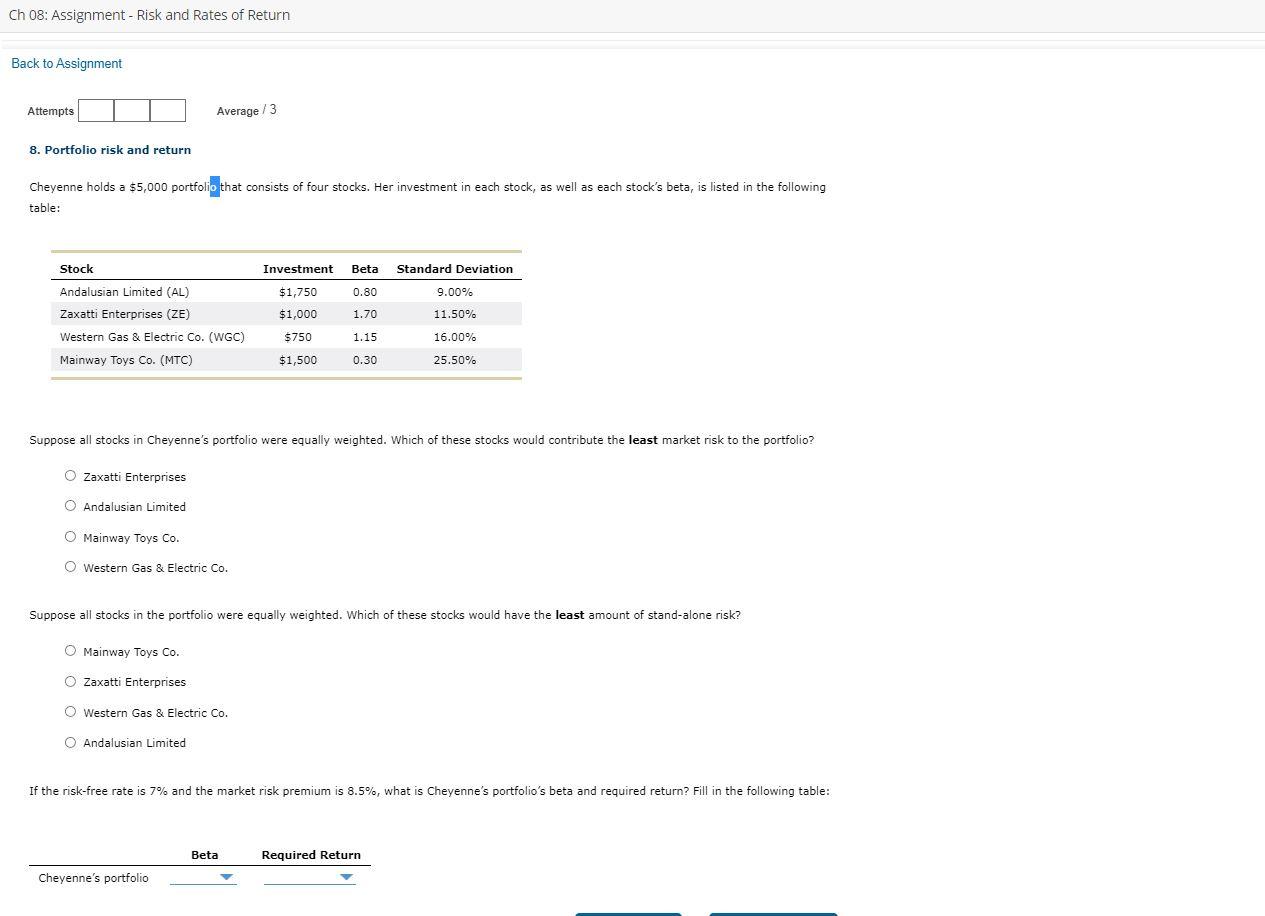

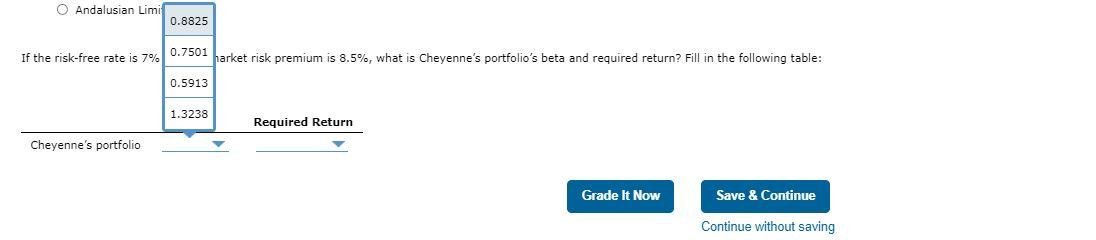

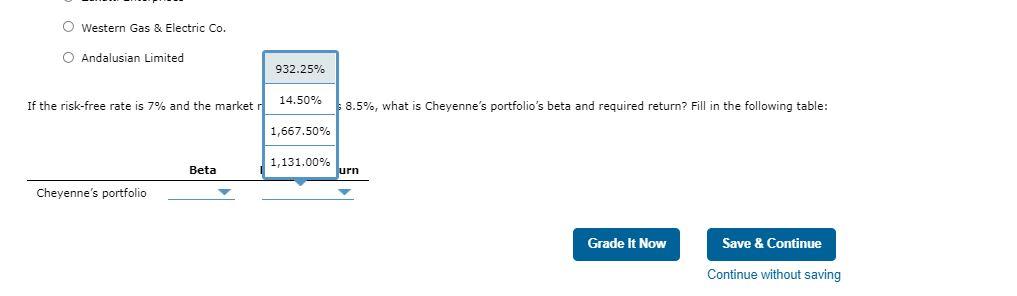

Ch 08: Assignment - Risk and Rates of Return Back to Assignment Attempts Average/3 8. Portfolio risk and return Cheyenne holds a $5,000 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Investment Beta 0.80 Stock Andalusian Limited (AL) Zaxatti Enterprises (ZE) Western Gas & Electric Co. (WGC) Mainway Toys Co. (MTC) $1,750 $1,000 $ $750 Standard Deviation 9.00% 11.50% 1.70 1.15 16.00% $1,500 0.30 25.50% Suppose all stocks in Cheyenne's portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Zaxatti Enterprises O Andalusian Limited O Mainway Toys Co. Western Gas & Electric Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? O Mainway Toys Co. Zaxatti Enterprises O Western Gas & Electric Co. 0 Andalusian Limited If the risk-free rate is 7% and the market risk premium is 8.5%, what is Cheyenne's portfolio's beta and required return? Fill in the following table: Beta Required Return Cheyenne's portfolio Andalusian Limi 0.8825 If the risk-free rate is 7% 0.7501 parket risk premium is 3.5%, what is Cheyenne's portfolio's beta and required return? Fill in the following table: 0.5913 1.3238 Required Return Cheyenne's portfolio Grade It Now Save & Continue Continue without saving Western Gas & Electric Co. 0 Andalusian Limited 932.25% If the risk-free rate is 7% and the market 14.50% 8.5%, what is Cheyenne's portfolio's beta and required return? Fill in the following table: 1,667.50% Beta 1,131.00% urn Cheyenne's portfolio Grade It Now Save & Continue Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts