Question: This is for finance class, the question is below and the two template are actully one template, but continues. I have written problem 29 and

This is for finance class, the question is below and the two template are actully one template, but continues. I have written problem 29 and 30.

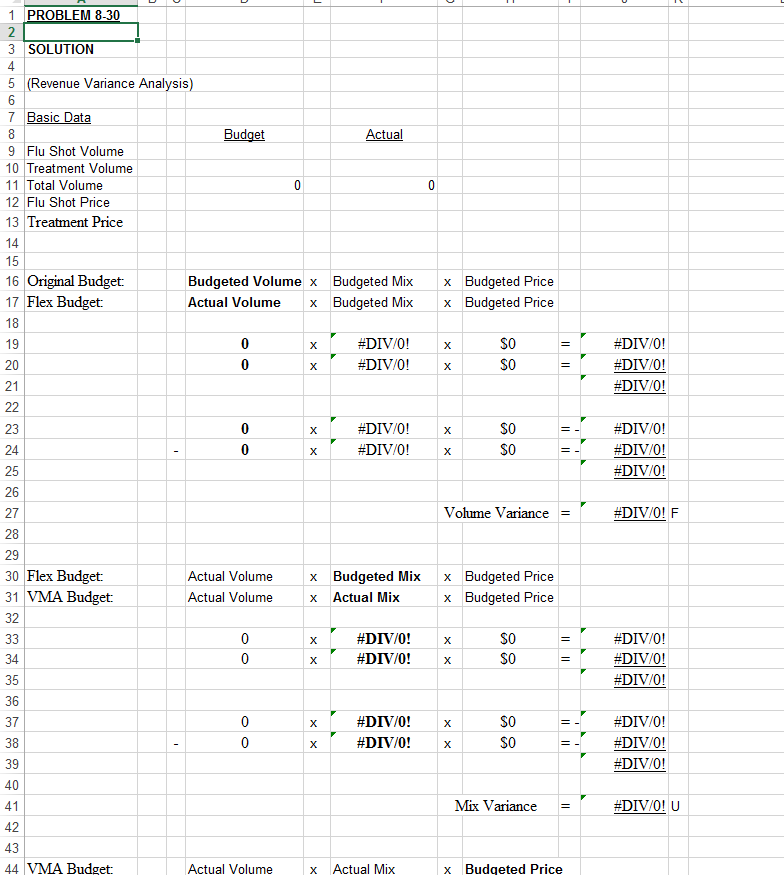

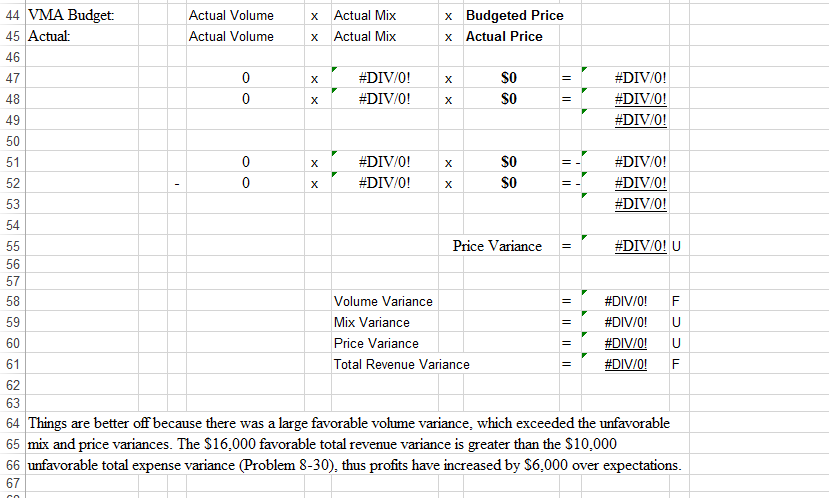

Question:(problem 8-30) Using the information from Problem 8- 29, assume that the nursing administrator expected 400 patients for flu shots and 1,600 for flu treatment. The medical group typically charges $ 50 for a flu shot and $ 80 for treating a flu patient. Actually, the group had 1,200 patients who received flu shots and 1,400 who had the flu and received treatment. On average, it was able to collect $ 55 per flu shot and $ 70 per flu patient. Compute the volume, mix, and price revenue variances. How did things turn out for the group considering just revenues? How did they turn out from a profit perspective?

(problem 8-29) Assume that you are the nursing administrator for a medical group that expects a severe outbreak of flu this winter. You hire additional staff to treat patients and administer shots. Your special project budget was for 1,000 hours of part-time nurses services at $ 40 per hour, for a total cost of $ 40,000. It was expected that these nurses would treat 2,000 patients. After the flu season was over, it turned out that the total spent on part-time nurses was $ 50,000. The nurses worked 1,200 hours and 2,600 patients were treated. Calculate the variances. Was the overall result favorable or unfavorable?

1 PROBLEM 8-30 3 SOLUTION 5 (Revenue Variance Analysis) 7 Basic Data Actual 9 Flu Shot Volume 10 Treatment Volume 11 Total Volume 12 Flu Shot Price 13 Treatment Price 15 16 Original Budget: 17 Flex Budget 18 19 20 21 Budgeted Volumex Budgeted Mixx eted Mixx Budgeted Price Budgeted Price Actual Volumex Budgeted Mixx eted Mixx #DIV/0! #DIV/0! SO SO #DIV/0 ! #DIV/0 ! #DIV/0 ! SO SO 23 24 25 26 27 28 29 30 Flex Budget 31 VMA Budget 32 #DIV/0! #DIV/0! #DIV/0 ! #DIVO! #DIV/0! . -- Volume Variance #DIV/01 F Actual Volume Actual Volume x Budgeted Mix x Actual Mix x Budgeted Price x Budgeted Price #DIV/0! #DIV/0! SO SO #DIV/0 ! #DIV/0! #DIVO! 34 35 36 37 38 39 40 41 42 43 44 VMA Budget #DIV/0! #DIV/0! SO SO , #DIV/0! #DIVO! #DIVO! . -- Mix Variance #DIV/0! U Actual Volume x Actual Mix x Budgeted Price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts