Question: this is for my global dimensions class. Question: Determine the profitability of the international business by using foreign exchange calculations for the first and second

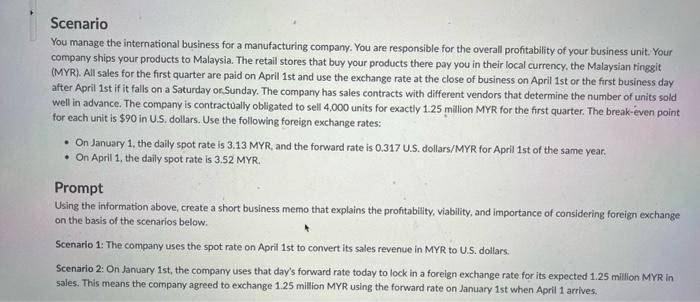

scenario You manage the international business for a manufacturing company. You are responsible for the overall profitability of your business unit. Your company ships your products to Malaysia. The retail stores that buy your products there pay you in their local currency, the Malaysian ringgit (MYR). All sales for the first quarter are paid on April 1st and use the exchange rate at the close of business on April 1st or the first business day after April 1st if it falls on a Saturday or. Sunday. The company has sales contracts with different vendors that determine the number of units sold well in advance. The company is contractually obligated to sell 4,000 units for exactly 1.25 million MYR for the first quarter. The break-even point for each unit is $90 in U.S. dollars. Use the following foreign exchange rates: - On January 1, the dally spot rate is 3.13 MYR, and the forward rate is 0.317 U.S. dollars/MYR for April 15t of the same year. - On April 1, the daily spot rate is 3.52MYR. Prompt Using the information above, create a short business memo that explains the profitability, viability, and importance of considering foreign exchange on the basis of the scenarios below. Scenario 1: The company uses the spot rate on April 1st to convert its sales revenue in MYR to U.S. dollars. Scenario 2: On January 1st, the company uses that day's forward rate today to lock in a foreign exchange rate for its expected 1.25 million MYR in sales. This means the company agreed to exchange 1.25 million MYR using the forward rate on January 1 st when April 1 arrives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts