Question: This is from my Monetary Policy course. Please try to keep the answers as brief as possible, especially part (a). Q.2: By considering the interest

This is from my Monetary Policy course. Please try to keep the answers as brief as possible, especially part (a).

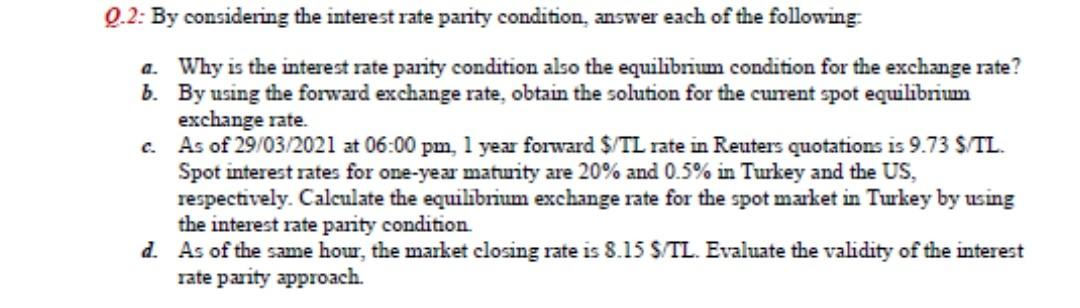

Q.2: By considering the interest rate parity condition, answer each of the following: a. Why is the interest rate parity condition also the equilibrium condition for the exchange rate? b. By using the forward exchange rate, obtain the solution for the current spot equilibrium exchange rate. c. As of 29/03/2021 at 06:00 pm, 1 year forward $/TL rate in Reuters quotations is 9.73 S/TL. Spot interest rates for one-year maturity are 20% and 0.5% in Turkey and the US, respectively. Calculate the equilibrium exchange rate for the spot market in Turkey by using the interest rate parity condition d. As of the same hour, the market closing rate is 8.15 S/TL. Evaluate the validity of the interest rate parity approach

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts