Question: this is full question what more do u need Part A: Calculating Allocation Rates and Job Cost ( 5 marks) World Engines ttd. Manufactures custom

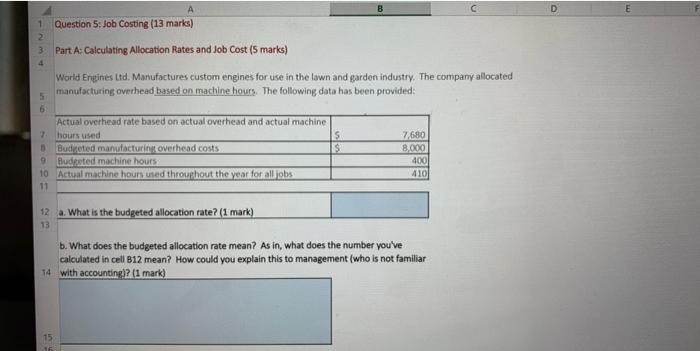

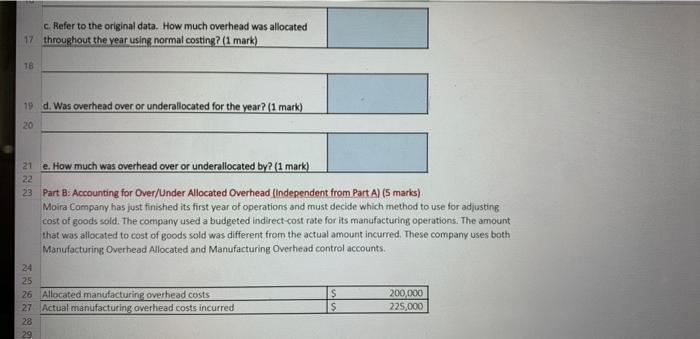

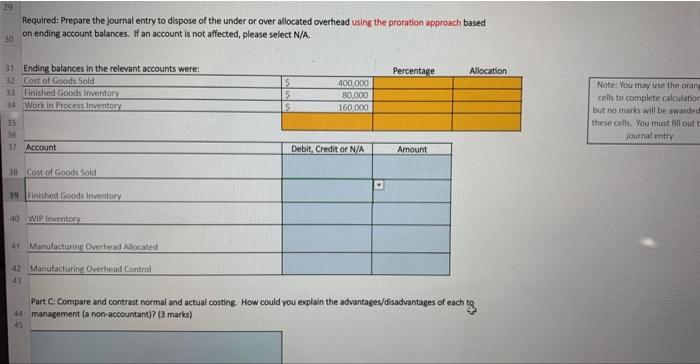

Part A: Calculating Allocation Rates and Job Cost ( 5 marks) World Engines ttd. Manufactures custom engines for use in the lawn and garden industry. The company allocated manufacturing overhead based on machine hours. The following data has been provided: b. What does the budgeted allocation rate mean? As in, what does the number you've calculated in cell B12 mean? How could you explain this to management (Who is not familiar with accountine)? (1 mark) Part B: Accounting for Over/Under Allocated Overhead (independent from Rart A) (5 marks) Moira Company has just finished its first year of operations and must decide which method to use for adjusting cost of goods sold. The company used a budgeted indirect-cost rate for its manufacturing operations. The amount that was allocated to cost of goods sold was different from the actual amount incurred. These company uses both Manufacturing Overhead Allocated and Manufacturing Overhead control accounts. Required: Prepare the journal entry to dispose of the under or over allocated overhead using the proration approach based on ending account balances. If an account is not affected, please select N/A. Note: You may use the orany cells to complete calculatior but no etark will be wwarded these cells. Vou must fillout t joidtal ertary Part C: Compare and contrast normal and actual costing. How could you explain the advantages/disadyantages of each to management (a non-accountant)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts