Question: This is how I started out this problem not really sure if I'm headed in the right direction ACC 3300-Fall 2017-Chapter 2 Funwork Always show

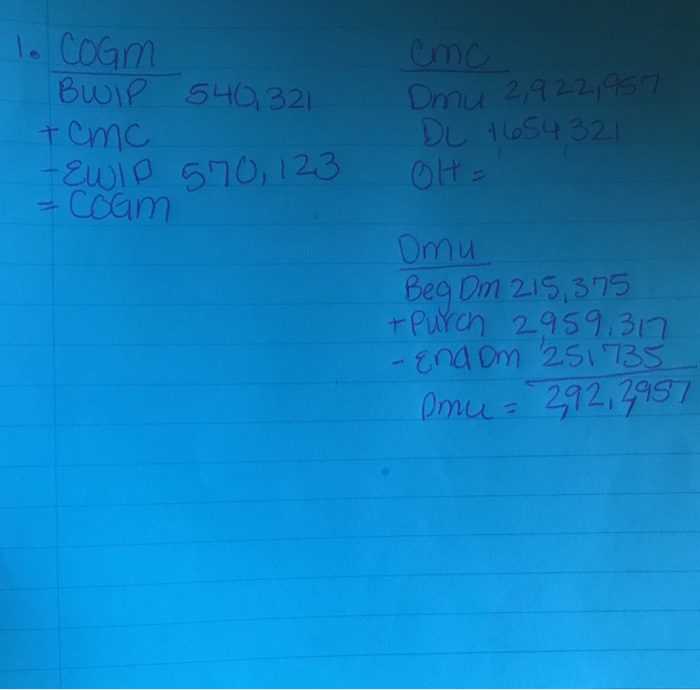

This is how I started out this problem not really sure if I'm headed in the right direction

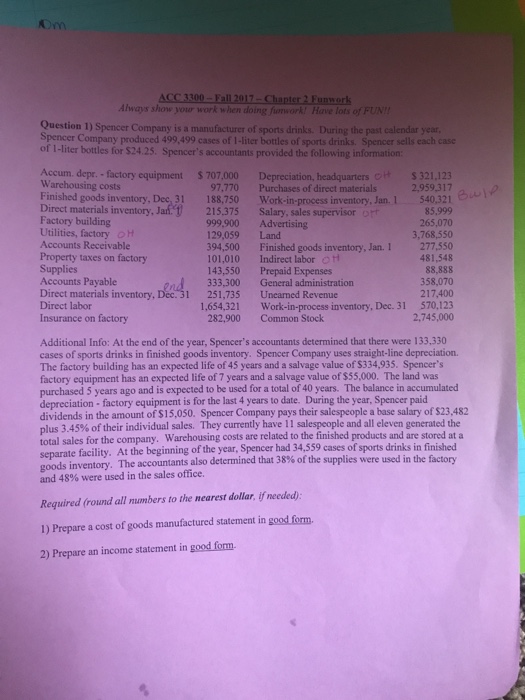

This is how I started out this problem not really sure if I'm headed in the right direction ACC 3300-Fall 2017-Chapter 2 Funwork Always show your work when doing fwnwork! Have lots of FUN Question 1) Spencer Company is a manufacturer of sports drinks. During the past calendar year Spencer Company produced 499,499 cases of 1-liter bottles of sports drinks. Spencer sells each case of i-liter bottles for $24.25. Spencer's accountants provided the following information Accum. depr.-factory equipment $ 707,000 Warehousing costs Finished goods inventory, Dec,31 188,750 Direct materials inventory, Jaf 215375 Factory building Utilities, factory OH Accounts Receivable Property taxes on factory Supplies Accounts Payable Direct materials inventory, Dec. 31 251,735 Direct labor Insurance on factory Depreciation, headquarters C Purchases of direct materials Work-in-process inventory, Jan. 1 Salary, sales supervisor or 321,123 2,959,317 540,321 85,999 265,070 3,768,550 394,500 Finished goods inventory, Jan. 1 277,550 481,548 88,888 358,070 217,400 1,654,321 Work-in-process inventory, Dec. 31 570,123 2,745,000 97,770 999,900 Advertising 129,059 Land 101,010 Indirect labor O H 143,550Prepaid Expenses 333,300 General administration Uneamed Revenue 282,900 Common Stock Additional Info: At the end of the year, Spencer's accountants determined that there were 133,330 cases of sports drinks in finished goods inventory. Spencer Company uses straight-line depreciation. The factory building has an expected life of 45 years and a salvage value of $334,935. Spencer's factory equipment has an expected life of 7 years and a salvage value of $55,000. The land was purchased 5 years ago and is expected to be used for a total of 40 years. The balance in accumulated depreciation-factory equipment is for the last 4 years to date. During the year, Spencer paid dividends in the amount of $15,050. Spencer Company pays their salespeople a base salary of $23,482 lus 3.45% of their individual sales. They currently have l l salespeople and all eleven generated the total sales for the company. Warehousing costs are related to the finished products and are stored at a separate facility. At the beginning of the year, Spencer had 34,559 cases of sports drinks in finished goods inventory. and 48% were used in the sales office. The accountants also determined that 38% of the supplies were used in the factory Required (round all mumbers to the nearest dollar, if needed 1) Prepare a cost of goods manufactured statement in good form. 2) Prepare an income statement in good form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts