Question: This is huge multipart question, with the same set of information. Please help. Thanks. Part 1: Part 2: Part 4: Part 5: Part 6: Required

This is huge multipart question, with the same set of information. Please help. Thanks.

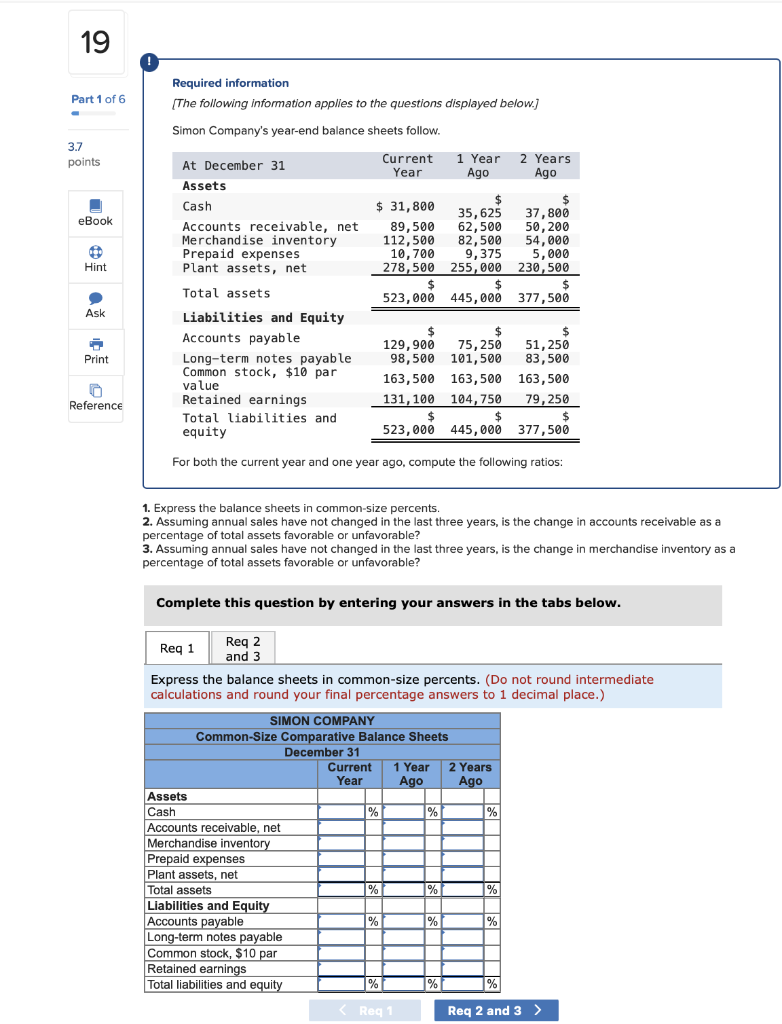

Part 1:

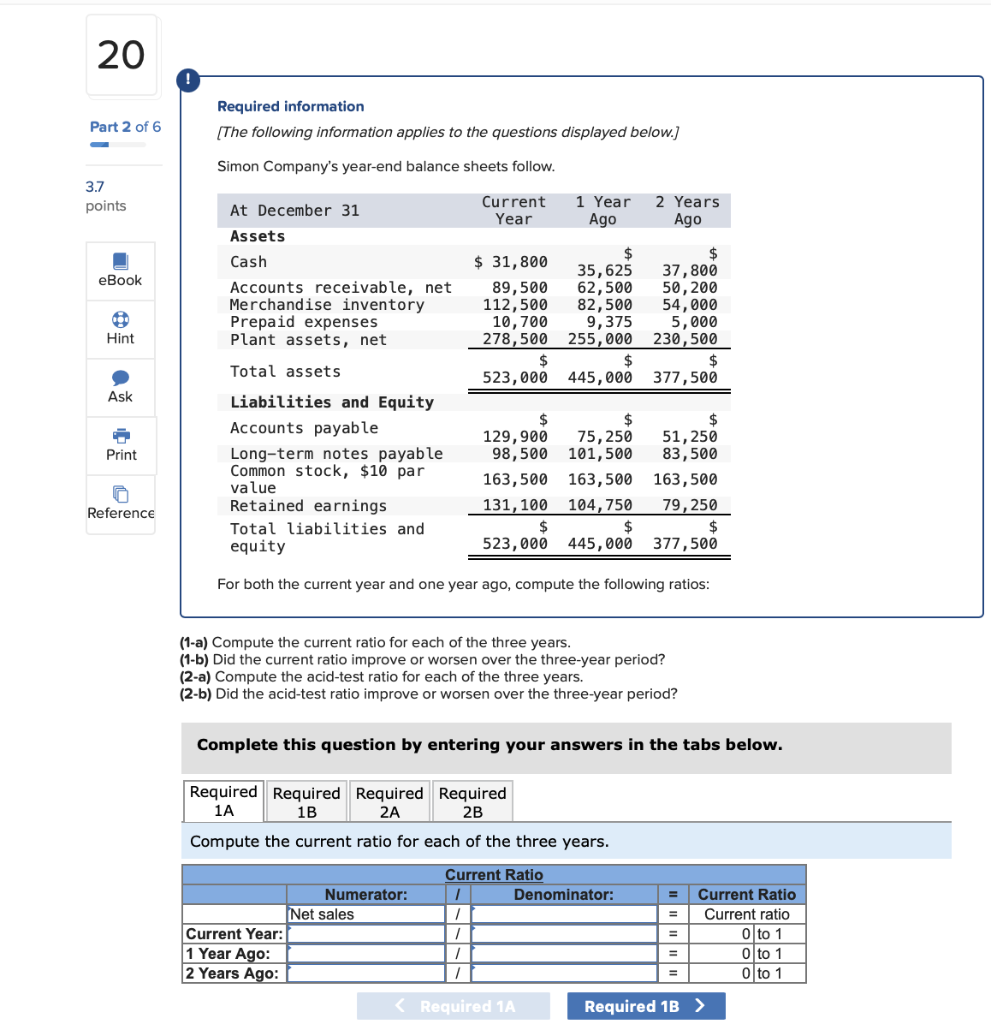

Part 2:

Part 4:![Required information [The following information applies to the questions displayed below.] Simon](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6716610e9fee9_8856716610dcbff9.jpg)

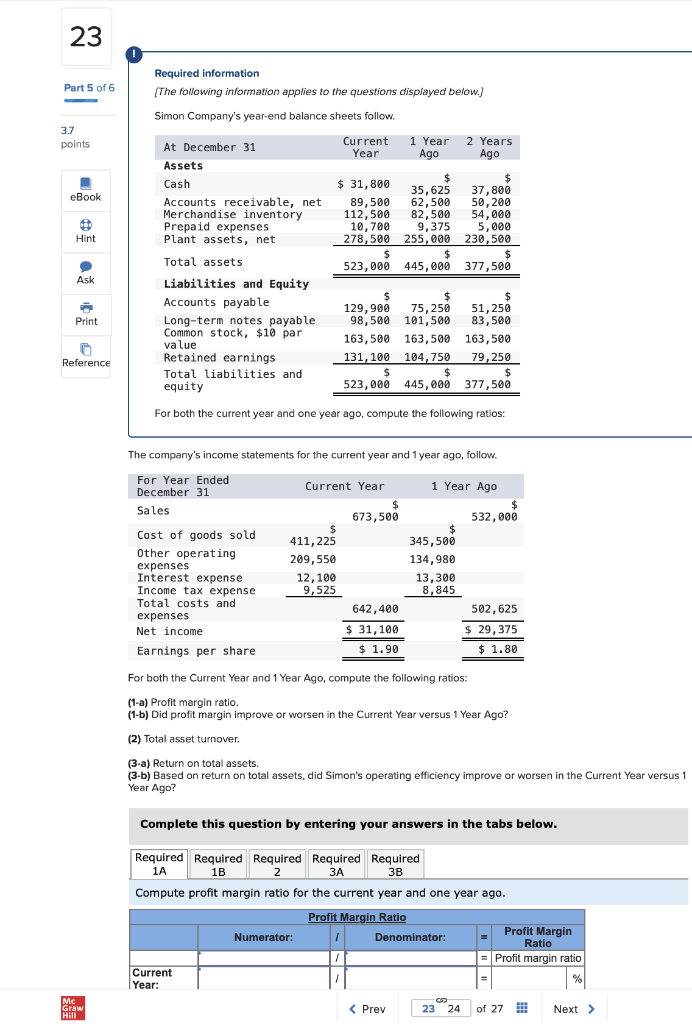

Part 5:

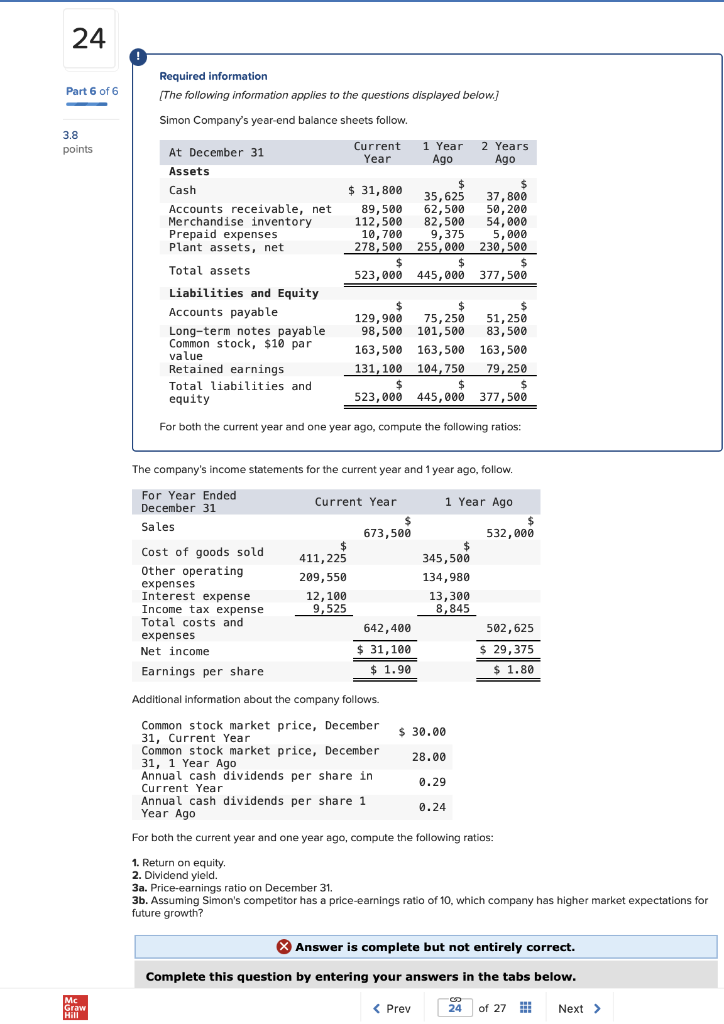

Part 6:

Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Complete this question by entering your answers in the tabs below. Express the balance sheets in common-size percents. (Do not round intermediate calculations and round your final percentage answers to 1 decimal place.) Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: (1-a) Compute the current ratio for each of the three years. (1-b) Did the current ratio improve or worsen over the three-year period? (2-a) Compute the acid-test ratio for each of the three years. (2-b) Did the acid-test ratio improve or worsen over the three-year period? Complete this question by entering your answers in the tabs below. Compute the current ratio for each of the three years. Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: The company's income statements for the current year and one year ago, follow. (1) Debt and equity ratios. (2-a) Compute debt-to-equity ratio for the current year and one year ago. (2-b) Based on debt-to-equity ratio, does the company have more or less debt in the current year versus one year ago? (3-a) Times interest earned. (3-b) Based on times interest earned, is the company more or less risky for creditors in the Current Year versus 1 Year Ago? Complete this question by entering your answers in the tabs below. Compute debt and equity ratio for the current year and one year ago. Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: The company's income statements for the current year and 1 year ago, follow. For both the Current Year and 1 Year Ago, compute the following ratios: (1-a) Profit margin ratio. (1-b) Did profit margin improve or worsen in the Current Year versus 1 Year Ago? (2) Total asset turnover. (3-a) Return on total assets. (3-b) Based on return on total assets, did Simon's operating efficiency improve or worsen in the Current Year versus Year Ago? Complete this question by entering your answers in the tabs below. Compute profit margin ratio for the current year and one year ago. Required information [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. For both the current year and one year ago, compute the following ratios: The company's income statements for the current year and 1 year ago, follow. Additional information about the company follows. For both the current year and one year ago, compute the following ratios: 1. Return on equity. 2. Dividend yleld. 3a. Price-earnings ratio on December 31. 3b. Assuming Simon's competitor has a price-earnings ratio of 10, which company has higher market expectations for future growth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts