Question: This is in class assignment please can you answer these questions. this is finance-2 course. 1. How do you value a common stock (equation)? I

This is in class assignment please can you answer these questions. this is finance-2 course.

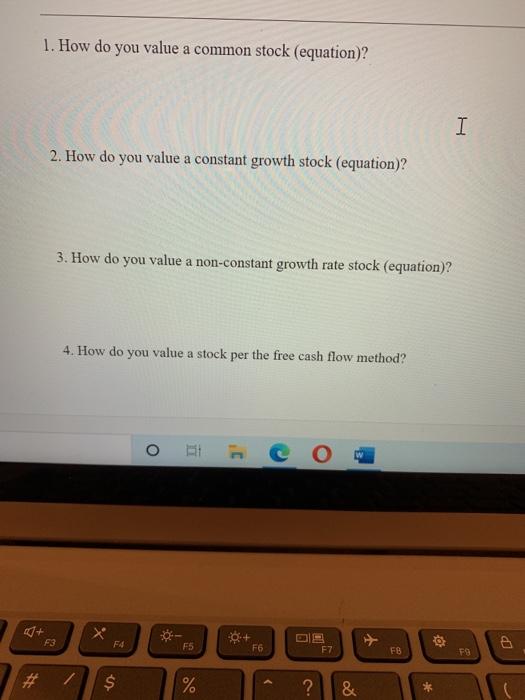

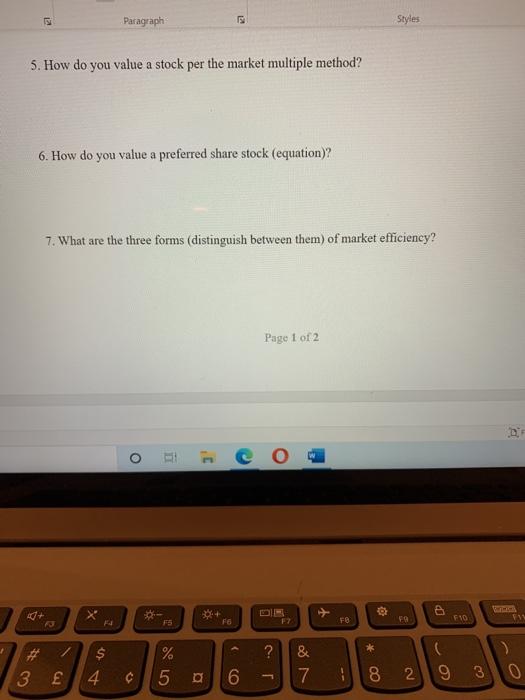

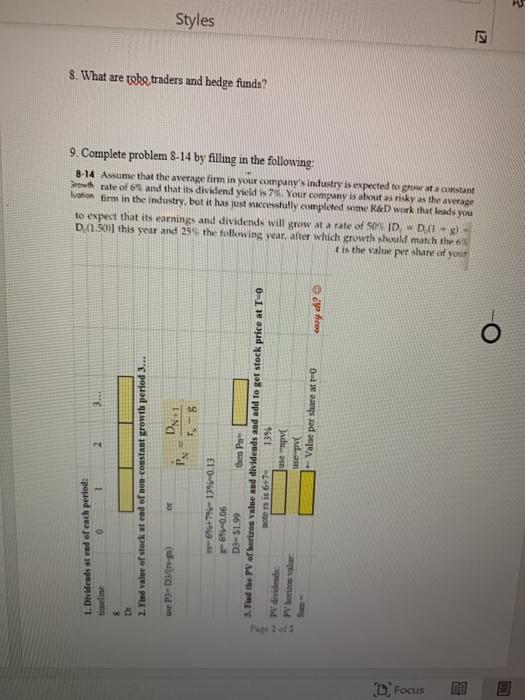

1. How do you value a common stock (equation)? I 2. How do you value a constant growth stock (equation)? 3. How do you value a non-constant growth rate stock (equation)? 4. How do you value a stock per the free cash flow method? O X F3 + F4 F5 F6 & F7 FB 79 # / $ % ? & Paragraph Styles 5. How do you value a stock per the market multiple method? 6. How do you value a preferred share stock (equation)? 7. What are the three forms (distinguish between them) of market efficiency? Page 1 of 2 X -0% F6 17 FB 9 F10 > * ? # > 3 14 % 5 & 7 4 6 18 2 9 3 0 3 Styles 5 8. What are robe traders and hedge funds? 9. Complete problem 8-14 by filling in the following: 8-14 Assume that the average firm in your company's industry is expected to grow at a constant Browth rate of 6% and that is dividend yield is 7. Your company is about risky as the average vation firm in the industry, but it has just successfully completed some R&D work that leads you to expect that its earnings and dividends will grow at a rate of ID, D. (1) D (1.501 this year and 25 the following year after which growth should match the t is the value per lure of your canych? 3... 8 DN 1 2 1395 -- Valse per share atto then Pn- 3. The the PV of hories value and dividends and add to get stock price at To up notes is 67 -0.06 D3 $1.99 Pondende Jaduan PA - 2. Find value of stock stead of non-constant growth period 3... D jo ETO+69- 1. Dividends at end of each period: timeline 0 PJ-Din- D Focus EU

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts