Question: This is individual work, and you must reference your textbook in each of your answers. The textbook is the only source need to be referenced.

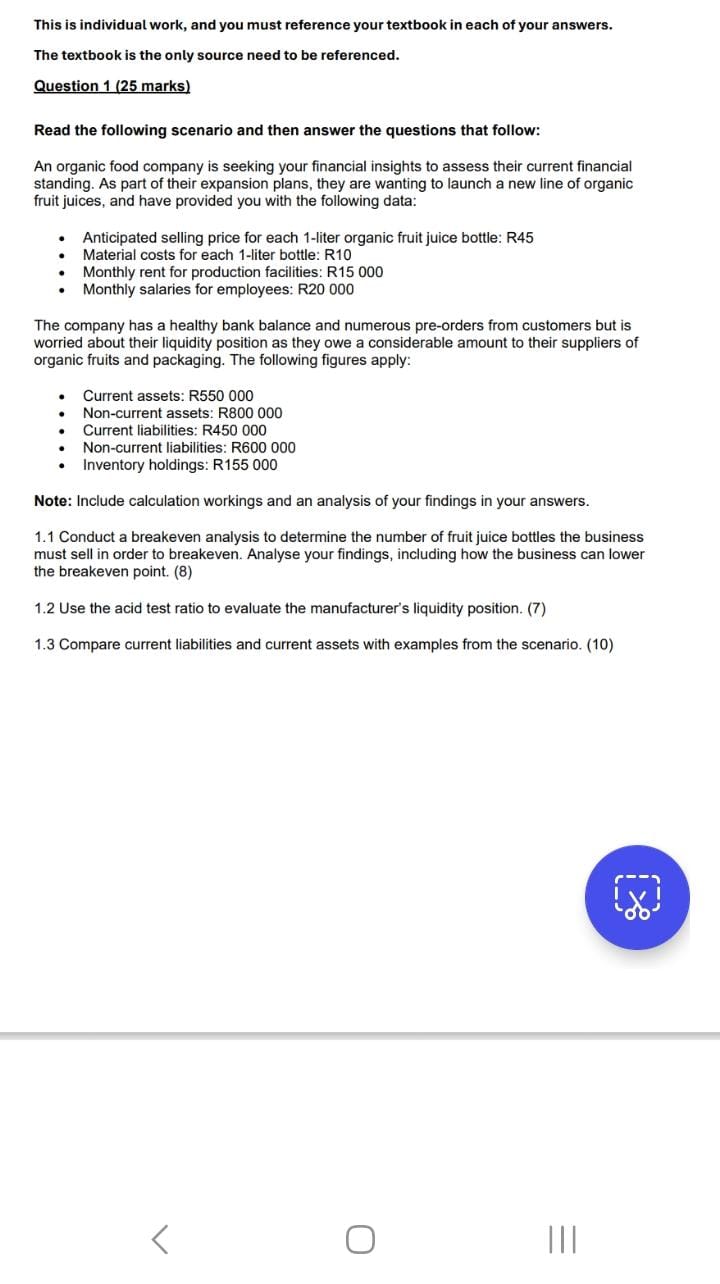

This is individual work, and you must reference your textbook in each of your answers.

The textbook is the only source need to be referenced.

Question marks

Read the following scenario and then answer the questions that follow:

An organic food company is seeking your financial insights to assess their current financial standing. As part of their expansion plans, they are wanting to launch a new line of organic fruit juices, and have provided you with the following data:

Anticipated selling price for each liter organic fruit juice bottle: R

Material costs for each liter bottle: R

Monthly rent for production facilities: R

Monthly salaries for employees: R

The company has a healthy bank balance and numerous preorders from customers but is worried about their liquidity position as they owe a considerable amount to their suppliers of organic fruits and packaging. The following figures apply:

Current assets: R

Noncurrent assets: R

Current liabilities: R

Noncurrent liabilities: R

Inventory holdings: R

Note: Include calculation workings and an analysis of your findings in your answers.

Conduct a breakeven analysis to determine the number of fruit juice bottles the business must sell in order to breakeven. Analyse your findings, including how the business can lower the breakeven point.

Use the acid test ratio to evaluate the manufacturer's liquidity position.

Compare current liabilities and current assets with examples from the scenario.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock