Question: This is Intermediate Accounting 2 9th edition by authors: Spiceland, Nelson, and Thomas. Ch.19 P-15. When calculating preferred dividends, I don't see why 77,000 is

This is Intermediate Accounting 2 9th edition by authors: Spiceland, Nelson, and Thomas. Ch.19 P-15. When calculating preferred dividends, I don't see why 77,000 is added and then subtracted. This seems silly! Can you please explain why?

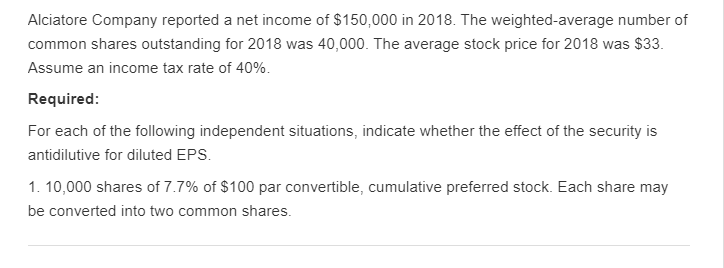

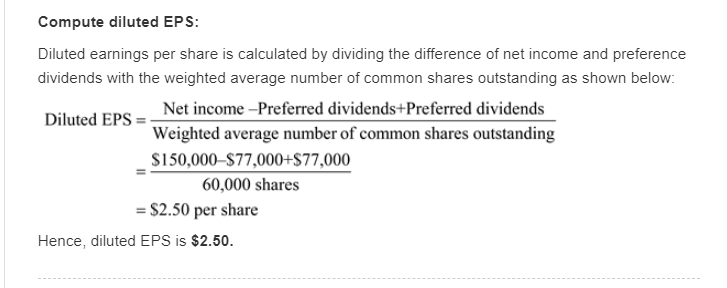

Alciatore Company reported a net income of $150,000 in 2018. The weighted average number of common shares outstanding for 2018 was 40,000. The average stock price for 2018 was $33. Assume an income tax rate of 40%. Required: For each of the following independent situations, indicate whether the effect of the security is antidilutive for diluted EPS. 1. 10,000 shares of 7.7% of $100 par convertible, cumulative preferred stock. Each share may be converted into two common shares. Compute diluted EPS: Diluted earnings per share is calculated by dividing the difference of net income and preference dividends with the weighted average number of common shares outstanding as shown below: Diluted EPS = Net income-Preferred dividends+Preferred dividends Weighted average number of common shares outstanding $150,000-$77,000+$77,000 60,000 shares = $2.50 per share Hence, diluted EPS is $2.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts