Question: This is like Example 3-2: P = present worth, A = annuity, F = Final worth. A cash flow stream consists of an annuity of

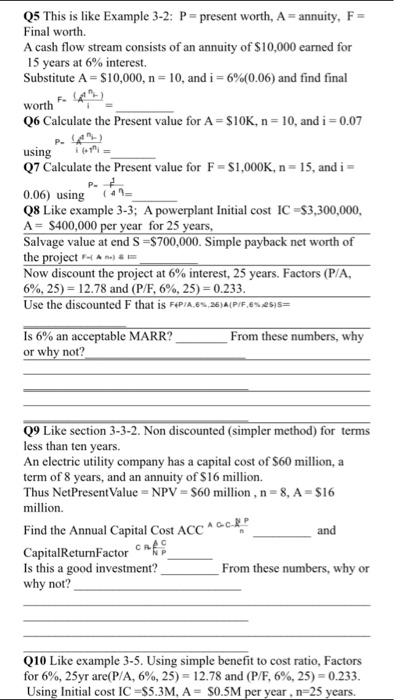

This is like Example 3-2: P = present worth, A = annuity, F = Final worth. A cash flow stream consists of an annuity of $10,000 earned for 15 years at 6% interest. Substitute A = $10,000, n = 10, and i = 6%(0.06) and find final worth Calculate the Present value for A = $10K, n = 10, and i = 0.07 using Calculate the Present value for F = $1,000K, n = 15, and i = 0.06) using Like example 3-3; A powerplant Initial cost IC = $3, 300,000, A = $400,000 per year for 25 years, Salvage value at end S = $700,000. Simple payback net worth of the project Now discount the project at 6% interest, 25 years. Factors (P/A, 6% 25) = 12.78 and (P/F, 6%, 25) = 0.233. Use the discounted F that is Is 6% an acceptable MARR? From these numbers, why or why not? Like section 3-3-2. Non discounted (simpler method) for terms less than ten years. An electric utility company has a capital cost of $60 million, a term of 8 years, and an annuity of $16 million. Thus NetPresentValue = NPV = $60 million, n = 8, A = $16 million. Find the Annual Capital Cost ACC and Capital ReturnFactor Is this a good investment? From these numbers, why or why not? Like example 3-5. Using simple benefit to cost ratio, Factors for 6%, 25yr are(P/A, 6%, 25) = 12.78 and (P/F, 6%, 25) = 0.233. Using Initial cost IC = $5.3M, A = $0.5M per year, n = 25 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts