Question: This is mostly a conceptual question about the investment strategy all investors should prefer to use according to the CAPM. Suppose the market portfolio has

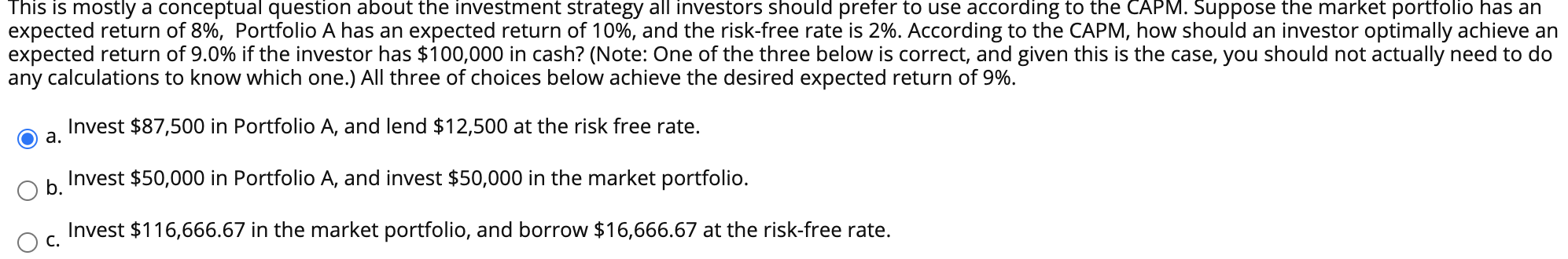

This is mostly a conceptual question about the investment strategy all investors should prefer to use according to the CAPM. Suppose the market portfolio has an expected return of 8%, Portfolio A has an expected return of 10%, and the risk-free rate is 2%. According to the CAPM, how should an investor optimally achieve an expected return of 9.0% if the investor has $100,000 in cash? (Note: One of the three below is correct, and given this is the case, you should not actually need to do any calculations to know which one.) All three of choices below achieve the desired expected return of 9%. Invest $87,500 in Portfolio A, and lend $12,500 at the risk free rate. a. b. Invest $50,000 in Portfolio A, and invest $50,000 in the market portfolio. Invest $116,666.67 in the market portfolio, and borrow $16,666.67 at the risk-free rate. C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts