Question: this is my 3rd time posting this. please help. GW means good will S if for simple co P is for puzzle co sorry its

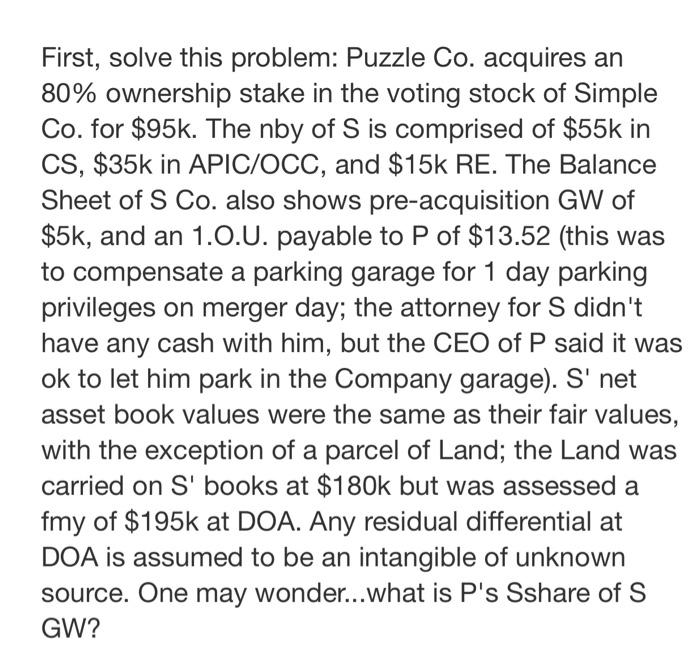

First, solve this problem: Puzzle Co. acquires an 80% ownership stake in the voting stock of Simple Co. for $95k. The nby of S is comprised of $55k in CS,$35k in APIC/OCC, and $15k RE. The Balance Sheet of SCo. also shows pre-acquisition GW of $5k, and an 1.O.U. payable to P of $13.52 (this was to compensate a parking garage for 1 day parking privileges on merger day; the attorney for S didn't have any cash with him, but the CEO of P said it was ok to let him park in the Company garage). S' net asset book values were the same as their fair values, with the exception of a parcel of Land; the Land was carried on S books at $180k but was assessed a fmy of $195k at DOA. Any residual differential at DOA is assumed to be an intangible of unknown source. One may wonder...what is P s Sshare of S GW? First, solve this problem: Puzzle Co. acquires an 80% ownership stake in the voting stock of Simple Co. for $95k. The nby of S is comprised of $55k in CS,$35k in APIC/OCC, and $15k RE. The Balance Sheet of SCo. also shows pre-acquisition GW of $5k, and an 1.O.U. payable to P of $13.52 (this was to compensate a parking garage for 1 day parking privileges on merger day; the attorney for S didn't have any cash with him, but the CEO of P said it was ok to let him park in the Company garage). S' net asset book values were the same as their fair values, with the exception of a parcel of Land; the Land was carried on S books at $180k but was assessed a fmy of $195k at DOA. Any residual differential at DOA is assumed to be an intangible of unknown source. One may wonder...what is P s Sshare of S GW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts