Question: This is my initial answer However, today the professor gave me this information: Regarding Problem Set 7-8, analytical question 5, I didn't list a year.

This is my initial answer

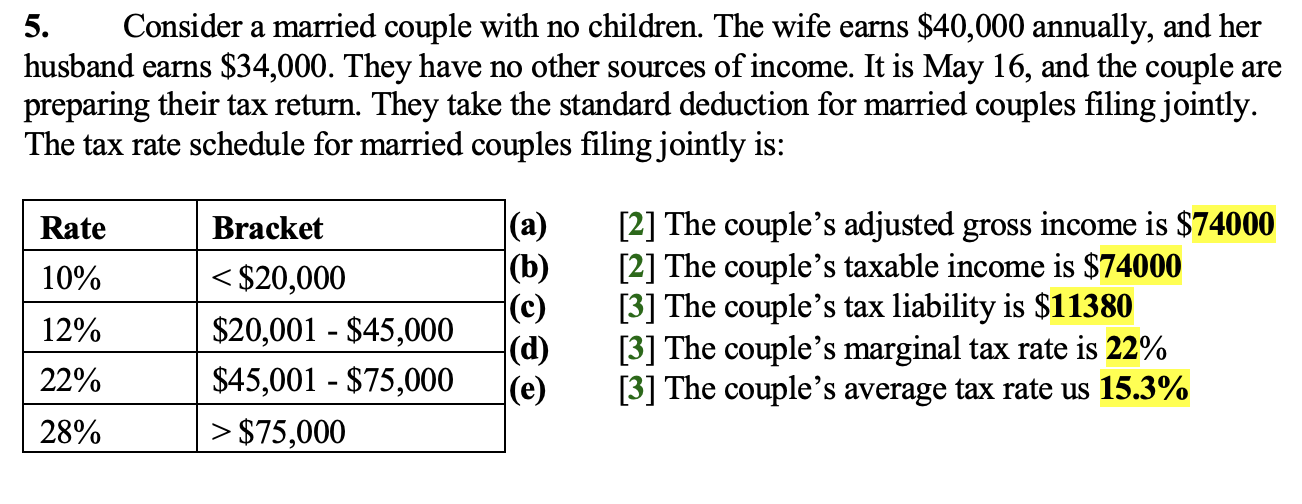

However, today the professor gave me this information: "Regarding Problem Set 7-8, analytical question 5, I didn't list a year. When I wrote the problem, I had 2018 in my head, which is the first year the standard deduction doubles (to $24,000) from the Tax Cuts and Jobs Act. If you use 2018 = $24,000, you'll get a much neater calculation. But if you use 2020 = $24,800, that's fine too."

I wanted to make sure my answer is accurate. Can you please verify

5. Consider a married couple with no children. The wife earns $40,000 annually, and her husband earns $34,000. They have no other sources of income. It is May 16, and the couple are preparing their tax return. They take the standard deduction for married couples filing jointly. The tax rate schedule for married couples filing jointly is: Rate Bracket 10% (a) (b) (c) (d) (e) $75,000 [2] The couple's adjusted gross income is $74000 [2] The couple's taxable income is $74000 [3] The couple's tax liability is $11380 [3] The couple's marginal tax rate is 22% [3] The couple's average tax rate us 15.3% 12% 22% 28%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts