Question: This is my second time asking this question. The previous expert was as clueless as I am. Please show work so I can understand what

This is my second time asking this question. The previous "expert" was as clueless as I am. Please show work so I can understand what I'm doing wrong.

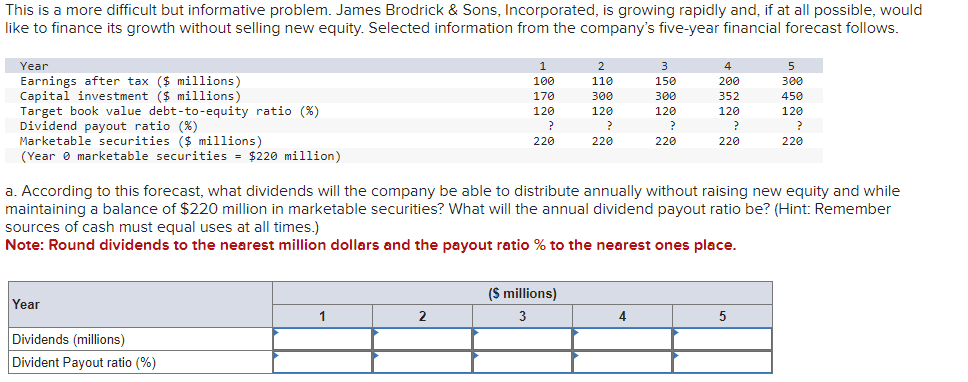

This is a more difficult but informative problem. James Brodrick \& Sons, Incorporated, is growing rapidly and, if at all possible, would like to finance its growth without selling new equity. Selected information from the company's five-year financial forecast follows. a. According to this forecast, what dividends will the company be able to distribute annually without raising new equity and while maintaining a balance of $220 million in marketable securities? What will the annual dividend payout ratio be? (Hint: Remember sources of cash must equal uses at all times.) Note: Round dividends to the nearest million dollars and the payout ratio % to the nearest ones place

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts