Question: This is my second time posting this question and the first time was incorrect Gluon Incorporated is considering the purchase of a new high pressure

This is my second time posting this question and the first time was incorrect

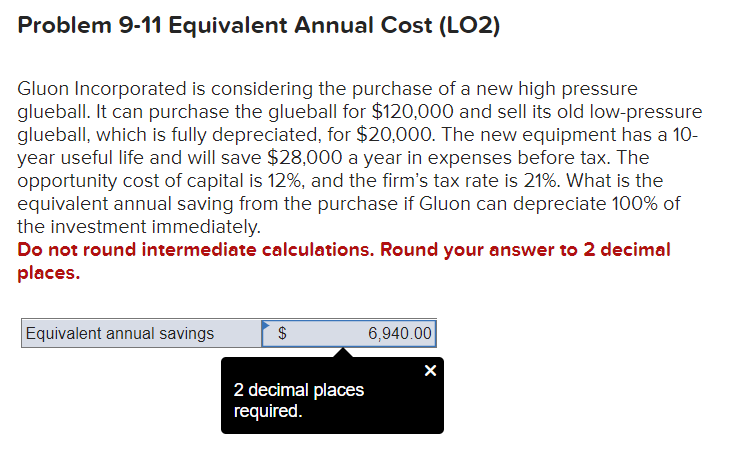

Gluon Incorporated is considering the purchase of a new high pressure glueball. It can purchase the glueball for $120,000 and sell its old low-pressure glueball, which is fully depreciated, for $20,000. The new equipment has a 10 year useful life and will save $28,000 a year in expenses before tax. The opportunity cost of capital is 12%, and the firm's tax rate is 21%. What is the equivalent annual saving from the purchase if Gluon can depreciate 100% of the investment immediately. Do not round intermediate calculations. Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts