Question: This is my second time posting this question. If you are unsure how to solve it, please do not answer. Please do this problem in

This is my second time posting this question. If you are unsure how to solve it, please do not answer. Please do this problem in Microsoft Excel.

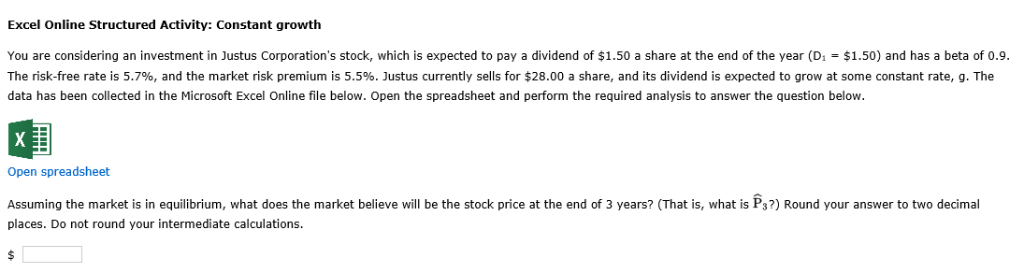

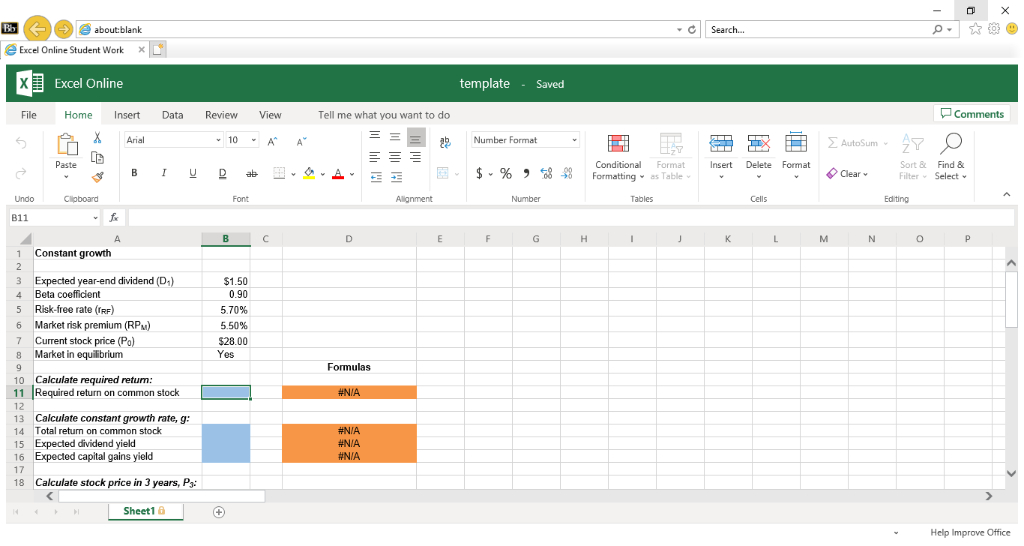

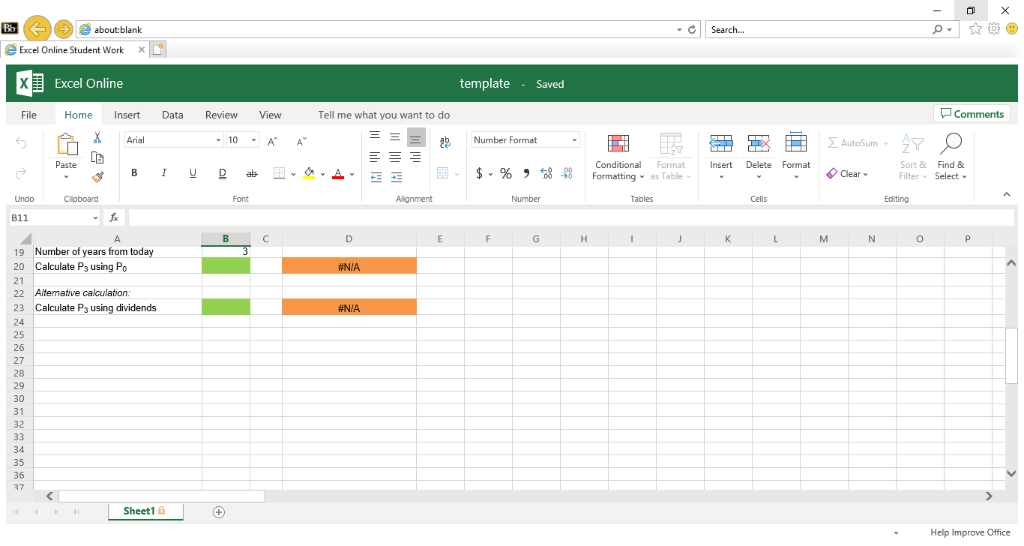

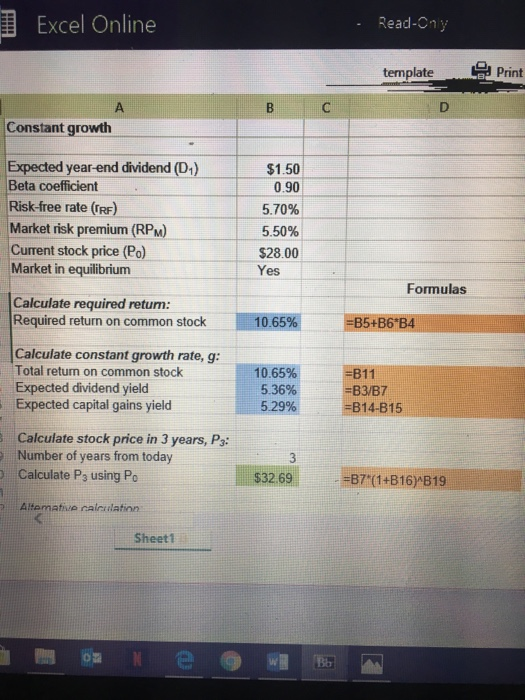

Excel Online Structured Activity: Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a share at the end of the year (D1 $1.50) and has a beta of 0.9. The risk-free rate is 5.7%, and the market risk premium is 5.5%. Justus currently sells for s28 00 a share and its di en is expected to grow at some constant rate. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is Ps?) Round your answer to two decimal places. Do not round your intermediate calculations. about:blank CI Search Excel Online Student WorkX Excel Online template Saved File Home Insert Data Review View Tell me what you want to do Comments 10A A Number Format Paste Conditional Format Formatting. as Table. Insert Delete Format $-% , .6848 Sort Find & FilterSelect Clear Cells B11 1 Constant growth 3 Expected year-end dividend D,) 4 Beta coefficient 5 Risk-free rate (RF 6 Market risk premium (RPM) 7 Current stock price 8 Market in equilibrium 0.90 570% 5.50% $28.00 Yes Formulas 10 Calculate required retum: 11 Required return on common stock 13 Calculate constant growth rate, g: 14 Total return on common stock 15 Expected dividend yield 16 Expected capital gains yield #N/A 18 Calculate stock price in 3 years, Ps Sheet1 Help Improve Office about:blank CI Search Excel Online Student WorkX Excel Online template Saved File Home Insert Data Review View Tell me what you want to do Comments 10A A Number Format Paste Conditional Format Formatting. as Table. Insert Delete Format $-% , .6848 Sort Find & FilterSelect Clear Cells B11 9 Number of years from today 20 Calculate Ps using Po 24 27 28 31 35 27 Sheet1 Help Improve Office Excel Online . Read-Cny ternplate Print Constant growth Expected year-end dividend (D1) $1.50 0.90 570% 5.50% $28.00 Yes Beta coefficient Risk-free rate (RF) Market risk premium (RPM) Current stock price (Po) Market in equilibrium Formulas Calculate required return: Required return on common stock 10.65% B5+B6 B4 Calculate constant growth rate, g: Total retum on common stock Expected dividend yield Expected capital gains yield 10.65% 5.36% 5.29% B11 -B3/B7 #814815 Calculate stock price in 3 years, Ps: Number of years from today Calculate P3 using Po ) $32.69 1-1 . #B7.(1+816)4B19 Alternati/ rala ilation Sheet1 Excel Online Structured Activity: Constant growth You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a share at the end of the year (D1 $1.50) and has a beta of 0.9. The risk-free rate is 5.7%, and the market risk premium is 5.5%. Justus currently sells for s28 00 a share and its di en is expected to grow at some constant rate. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is Ps?) Round your answer to two decimal places. Do not round your intermediate calculations. about:blank CI Search Excel Online Student WorkX Excel Online template Saved File Home Insert Data Review View Tell me what you want to do Comments 10A A Number Format Paste Conditional Format Formatting. as Table. Insert Delete Format $-% , .6848 Sort Find & FilterSelect Clear Cells B11 1 Constant growth 3 Expected year-end dividend D,) 4 Beta coefficient 5 Risk-free rate (RF 6 Market risk premium (RPM) 7 Current stock price 8 Market in equilibrium 0.90 570% 5.50% $28.00 Yes Formulas 10 Calculate required retum: 11 Required return on common stock 13 Calculate constant growth rate, g: 14 Total return on common stock 15 Expected dividend yield 16 Expected capital gains yield #N/A 18 Calculate stock price in 3 years, Ps Sheet1 Help Improve Office about:blank CI Search Excel Online Student WorkX Excel Online template Saved File Home Insert Data Review View Tell me what you want to do Comments 10A A Number Format Paste Conditional Format Formatting. as Table. Insert Delete Format $-% , .6848 Sort Find & FilterSelect Clear Cells B11 9 Number of years from today 20 Calculate Ps using Po 24 27 28 31 35 27 Sheet1 Help Improve Office Excel Online . Read-Cny ternplate Print Constant growth Expected year-end dividend (D1) $1.50 0.90 570% 5.50% $28.00 Yes Beta coefficient Risk-free rate (RF) Market risk premium (RPM) Current stock price (Po) Market in equilibrium Formulas Calculate required return: Required return on common stock 10.65% B5+B6 B4 Calculate constant growth rate, g: Total retum on common stock Expected dividend yield Expected capital gains yield 10.65% 5.36% 5.29% B11 -B3/B7 #814815 Calculate stock price in 3 years, Ps: Number of years from today Calculate P3 using Po ) $32.69 1-1 . #B7.(1+816)4B19 Alternati/ rala ilation Sheet1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts