Question: This is my third time posting the same question and have yet receive a correct response...please do not reply unless you are absolutely certain that

This is my third time posting the same question and have yet receive a correct response...please do not reply unless you are absolutely certain that you're correct. Don't mean to come across too harsh, but this problem has become a thorn in my side...please & thank you in advance!

1.) Please include all formulas;

2.) Please round final answers to 3 decimal places;

3.) The answers for Company A in both parts are correct;

4.) Need correct answers for Company B.

________________________________________________________________________________________________________________________________

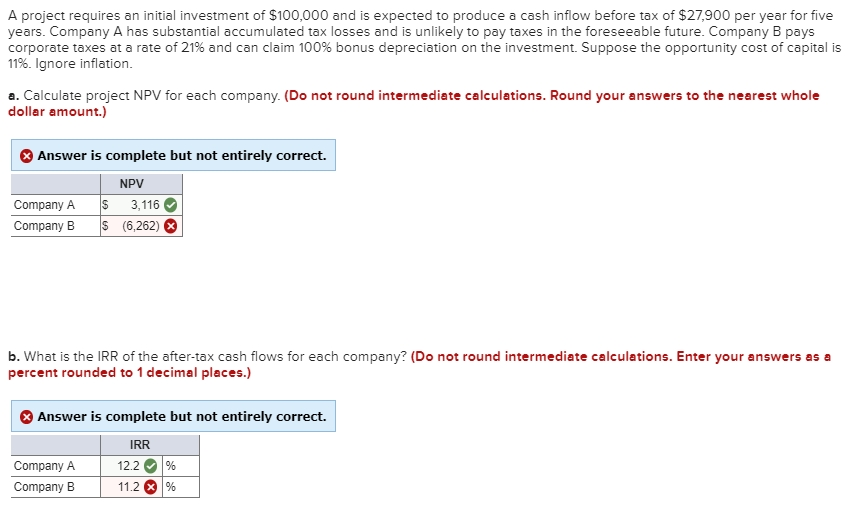

A project requires an initial investment of $100,000 and is expected to produce a cash inflow before tax of $27,900 per year for five years. Company A has substantial accumulated tax losses and is unlikely to pay taxes in the foreseeable future. Company B pays corporate taxes at a rate of 21% and can claim 100 % bonus depreciation on the investment. Suppose the opportunity cost of capital is 11%. Ignore inflation. a. Calculate project NPV for each company. (Do not round intermediate calculations. Round your answers to the nearest whole dollar amount.) Answer is complete but not entirely correct. NPV Company A 3,116 $ (6,262) Company B b. What is the IRR of the after-tax cash flows for each company? (Do not round intermediate calculations. Enter your answers as a percent rounded to 1 decimal places.) Answer is complete but not entirely correct. IRR Company A 12.2 11.2 % Company B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts