Question: this is my third time posting the same question. please show work like how the example shows work. write it down using pencil and paper.

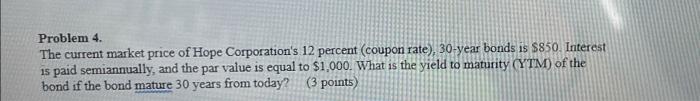

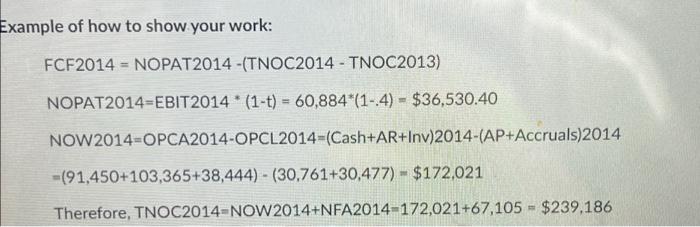

Problem 4. The current market price of Hope Corporation's 12 percent (coupon rate), 30-year bonds is $850. Interest is paid semiannually, and the par value is equal to $1,000. What is the yield to maturity CYTM) of the bond if the bond mature 30 years from today? (3 points) Example of how to show your work: FCF2014 = NOPAT2014 -(TNOC2014 - TNOC2013) NOPAT2014=EBIT2014 (1-t) = 60,884*(1-4) - $36,530.40 NOW 2014-OPCA2014-OPCL2014=(Cash+AR+Inv)2014-(AP+Accruals)2014 +(91,450+103,365+38,444) - (30.761+30,477) - $172,021 Therefore, TNOC2014=NOW 2014+NFA2014-172,021+67,105 - $239,186

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts