Question: THIS IS MY THIRD TIME POSTING THIS!! I NEED THIS ANSWERED ASAP!!! One-Size-Tire Corporation sells a single size of tires. The December 31 Trial balance

THIS IS MY THIRD TIME POSTING THIS!! I NEED THIS ANSWERED ASAP!!!

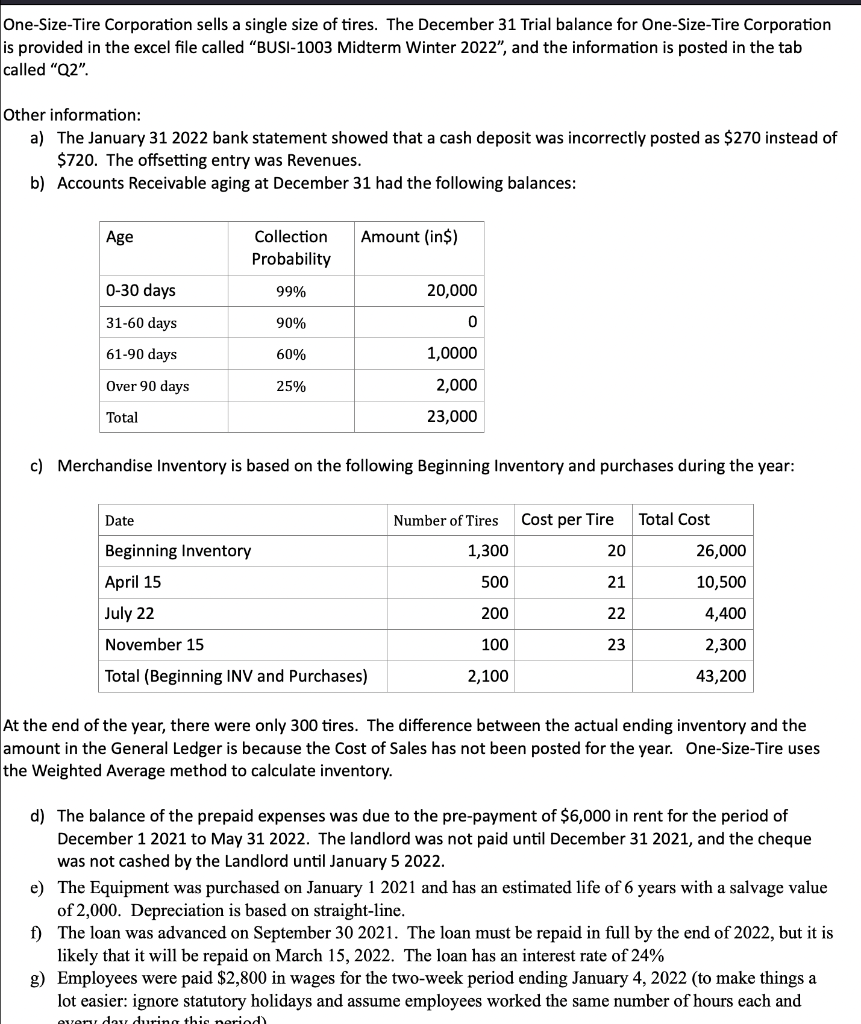

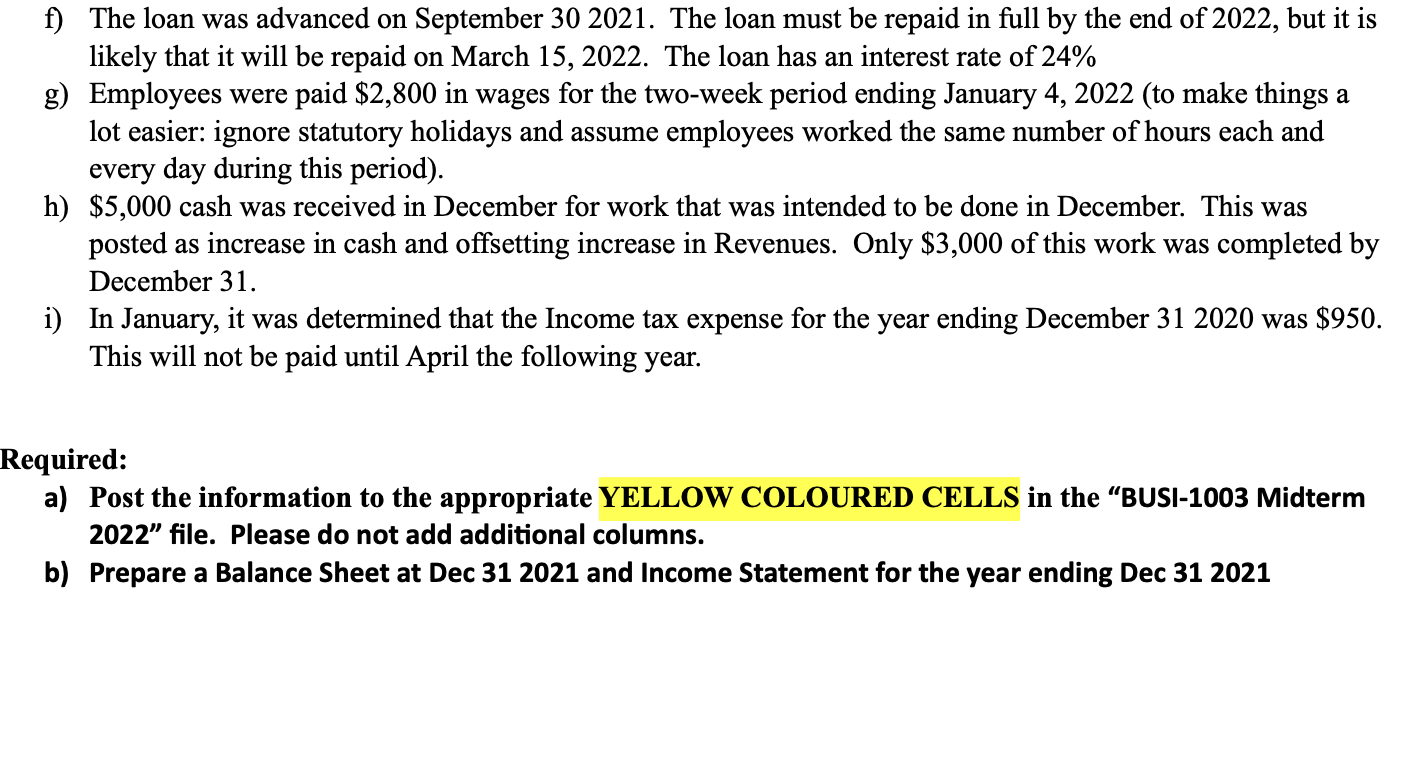

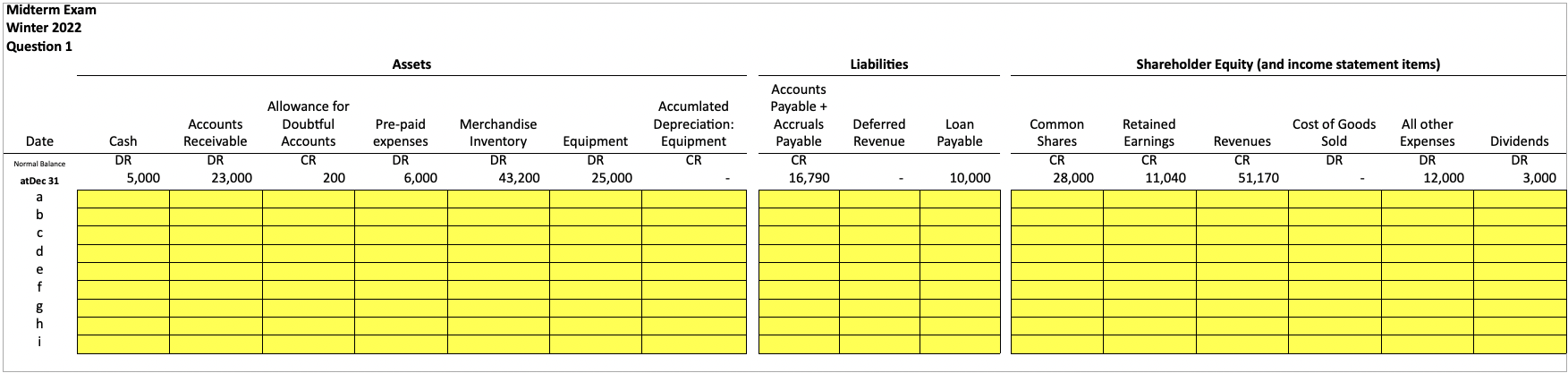

One-Size-Tire Corporation sells a single size of tires. The December 31 Trial balance for One-Size-Tire Corporation is provided in the excel file called "BUSI-1003 Midterm Winter 2022", and the information is posted in the tab called "Q2". Other information: a) The January 31 2022 bank statement showed that a cash deposit was incorrectly posted as $270 instead of $720. The offsetting entry was Revenues. b) Accounts Receivable aging at December 31 had the following balances: Age Amount (in$) Collection Probability 0-30 days 99% 20,000 31-60 days 90% 0 61-90 days 60% 1,0000 2,000 Over 90 days 25% Total 23,000 c) Merchandise Inventory is based on the following Beginning Inventory and purchases during the year: Date Number of Tires Cost per Tire Total Cost 1,300 20 26,000 500 21 10,500 Beginning Inventory April 15 July 22 November 15 Total (Beginning INV and Purchases) 200 22 4,400 100 23 2,300 43,200 2,100 At the end of the year, there were only 300 tires. The difference between the actual ending inventory and the amount in the General Ledger is because the cost of Sales has not been posted for the year. One-Size-Tire uses the Weighted Average method to calculate inventory. d) The balance of the prepaid expenses was due to the pre-payment of $6,000 in rent for the period of December 1 2021 to May 31 2022. The landlord was not paid until December 31 2021, and the cheque was not cashed by the Landlord until January 5 2022. e) The Equipment was purchased on January 1 2021 and has an estimated life of 6 years with a salvage value of 2,000. Depreciation is based on straight-line. f) The loan was advanced on September 30 2021. The loan must be repaid in full by the end of 2022, but it is likely that it will be repaid on March 15, 2022. The loan has an interest rate of 24% g) Employees were paid $2,800 in wages for the two-week period ending January 4, 2022 (to make things a lot easier: ignore statutory holidays and assume employees worked the same number of hours each and Ayer day during this neriod) f) The loan was advanced on September 30 2021. The loan must be repaid in full by the end of 2022, but it is likely that it will be repaid on March 15, 2022. The loan has an interest rate of 24% g) Employees were paid $2,800 in wages for the two-week period ending January 4, 2022 (to make things a lot easier: ignore statutory holidays and assume employees worked the same number of hours each and every day during this period). h) $5,000 cash was received in December for work that was intended to be done in December. This was posted as increase in cash and offsetting increase in Revenues. Only $3,000 of this work was completed by December 31. i) In January, it was determined that the Income tax expense for the year ending December 31 2020 was $950. This will not be paid until April the following year. Required: a) Post the information to the appropriate YELLOW COLOURED CELLS in the BUSI-1003 Midterm 2022" file. Please do not add additional columns. b) Prepare a Balance Sheet at Dec 31 2021 and Income Statement for the year ending Dec 31 2021 Midterm Exam Winter 2022 Question 1 Assets Liabilities Shareholder Equity (and income statement items) Date Allowance for Doubtful Accounts CR 200 Deferred Revenue Accumlated Depreciation: Equipment CR Accounts Receivable DR 23,000 Loan Payable Cash DR 5,000 Pre-paid expenses DR 6,000 Merchandise Inventory DR 43,200 Accounts Payable + Accruals Payable CR 16,790 Equipment DR 25,000 Common Shares CR 28,000 Retained Earnings CR 11,040 Normal Balance Cost of Goods Sold DR Revenues CR 51,170 All other Expenses DR 12,000 Dividends DR 3,000 atDec 31 10,000 a b d e f g h i One-Size-Tire Corporation sells a single size of tires. The December 31 Trial balance for One-Size-Tire Corporation is provided in the excel file called "BUSI-1003 Midterm Winter 2022", and the information is posted in the tab called "Q2". Other information: a) The January 31 2022 bank statement showed that a cash deposit was incorrectly posted as $270 instead of $720. The offsetting entry was Revenues. b) Accounts Receivable aging at December 31 had the following balances: Age Amount (in$) Collection Probability 0-30 days 99% 20,000 31-60 days 90% 0 61-90 days 60% 1,0000 2,000 Over 90 days 25% Total 23,000 c) Merchandise Inventory is based on the following Beginning Inventory and purchases during the year: Date Number of Tires Cost per Tire Total Cost 1,300 20 26,000 500 21 10,500 Beginning Inventory April 15 July 22 November 15 Total (Beginning INV and Purchases) 200 22 4,400 100 23 2,300 43,200 2,100 At the end of the year, there were only 300 tires. The difference between the actual ending inventory and the amount in the General Ledger is because the cost of Sales has not been posted for the year. One-Size-Tire uses the Weighted Average method to calculate inventory. d) The balance of the prepaid expenses was due to the pre-payment of $6,000 in rent for the period of December 1 2021 to May 31 2022. The landlord was not paid until December 31 2021, and the cheque was not cashed by the Landlord until January 5 2022. e) The Equipment was purchased on January 1 2021 and has an estimated life of 6 years with a salvage value of 2,000. Depreciation is based on straight-line. f) The loan was advanced on September 30 2021. The loan must be repaid in full by the end of 2022, but it is likely that it will be repaid on March 15, 2022. The loan has an interest rate of 24% g) Employees were paid $2,800 in wages for the two-week period ending January 4, 2022 (to make things a lot easier: ignore statutory holidays and assume employees worked the same number of hours each and Ayer day during this neriod) f) The loan was advanced on September 30 2021. The loan must be repaid in full by the end of 2022, but it is likely that it will be repaid on March 15, 2022. The loan has an interest rate of 24% g) Employees were paid $2,800 in wages for the two-week period ending January 4, 2022 (to make things a lot easier: ignore statutory holidays and assume employees worked the same number of hours each and every day during this period). h) $5,000 cash was received in December for work that was intended to be done in December. This was posted as increase in cash and offsetting increase in Revenues. Only $3,000 of this work was completed by December 31. i) In January, it was determined that the Income tax expense for the year ending December 31 2020 was $950. This will not be paid until April the following year. Required: a) Post the information to the appropriate YELLOW COLOURED CELLS in the BUSI-1003 Midterm 2022" file. Please do not add additional columns. b) Prepare a Balance Sheet at Dec 31 2021 and Income Statement for the year ending Dec 31 2021 Midterm Exam Winter 2022 Question 1 Assets Liabilities Shareholder Equity (and income statement items) Date Allowance for Doubtful Accounts CR 200 Deferred Revenue Accumlated Depreciation: Equipment CR Accounts Receivable DR 23,000 Loan Payable Cash DR 5,000 Pre-paid expenses DR 6,000 Merchandise Inventory DR 43,200 Accounts Payable + Accruals Payable CR 16,790 Equipment DR 25,000 Common Shares CR 28,000 Retained Earnings CR 11,040 Normal Balance Cost of Goods Sold DR Revenues CR 51,170 All other Expenses DR 12,000 Dividends DR 3,000 atDec 31 10,000 a b d e f g h

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts