Question: THIS IS MY THIRD TIME POSTING THIS. THE RED ANSWERS ARE INCORRECT CAN SOMEONE PLEASE HELP ME FIX THEM? Alomar Co., a consolidated enterprise, conducted

THIS IS MY THIRD TIME POSTING THIS. THE RED ANSWERS ARE INCORRECT CAN SOMEONE PLEASE HELP ME FIX THEM?

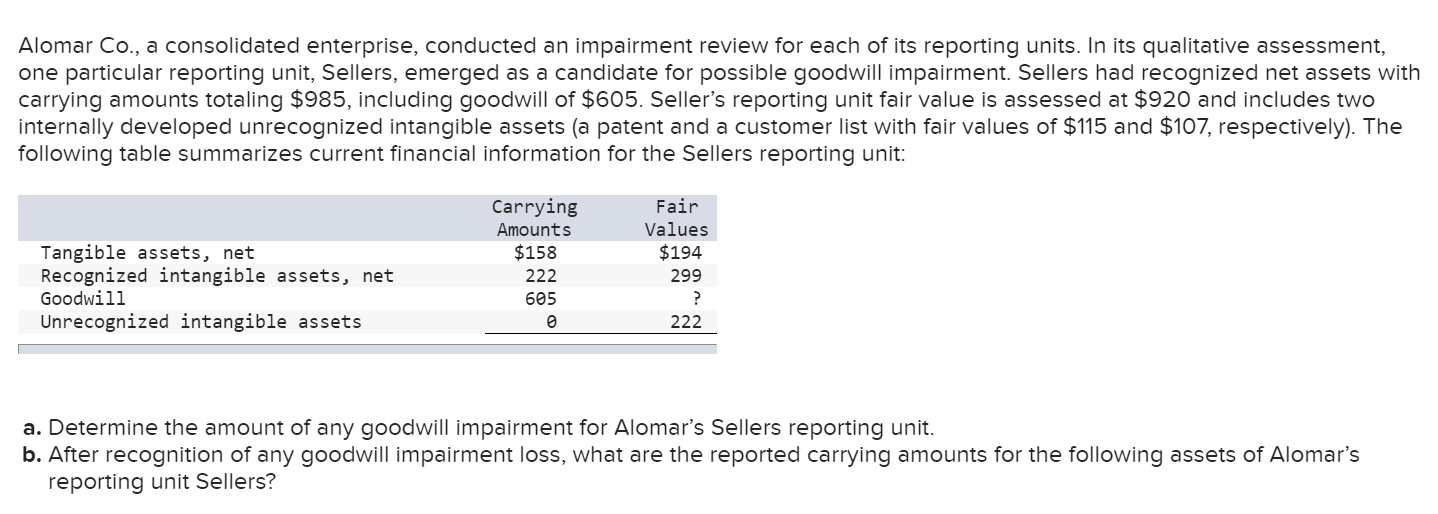

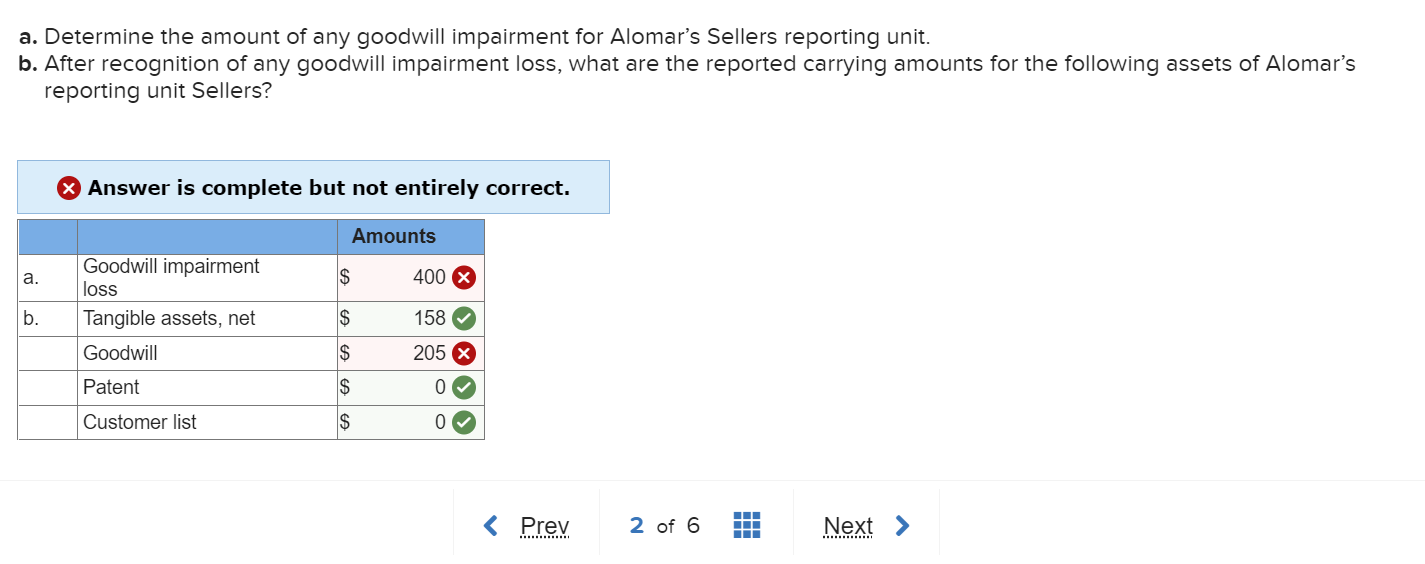

Alomar Co., a consolidated enterprise, conducted an impairment review for each of its reporting units. In its qualitative assessment, one particular reporting unit, Sellers, emerged as a candidate for possible goodwill impairment. Sellers had recognized net assets with carrying amounts totaling $985, including goodwill of $605. Seller's reporting unit fair value is assessed at $920 and includes two internally developed unrecognized intangible assets (a patent and a customer list with fair values of $115 and $107, respectively). The following table summarizes current financial information for the Sellers reporting unit: a. Determine the amount of any goodwill impairment for Alomar's Sellers reporting unit. b. After recognition of any goodwill impairment loss, what are the reported carrying amounts for the following assets of Alomar's reporting unit Sellers? a. Determine the amount of any goodwill impairment for Alomar's Sellers reporting unit. b. After recognition of any goodwill impairment loss, what are the reported carrying amounts for the following assets of Alomar's reporting unit Sellers? Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts