Question: This is my work.. I got stuck where I stopped working the problem. Please help. Thank you! 7 Chocoholics Anonymous wants to modernize its production

This is my work.. I got stuck where I stopped working the problem. Please help. Thank you!

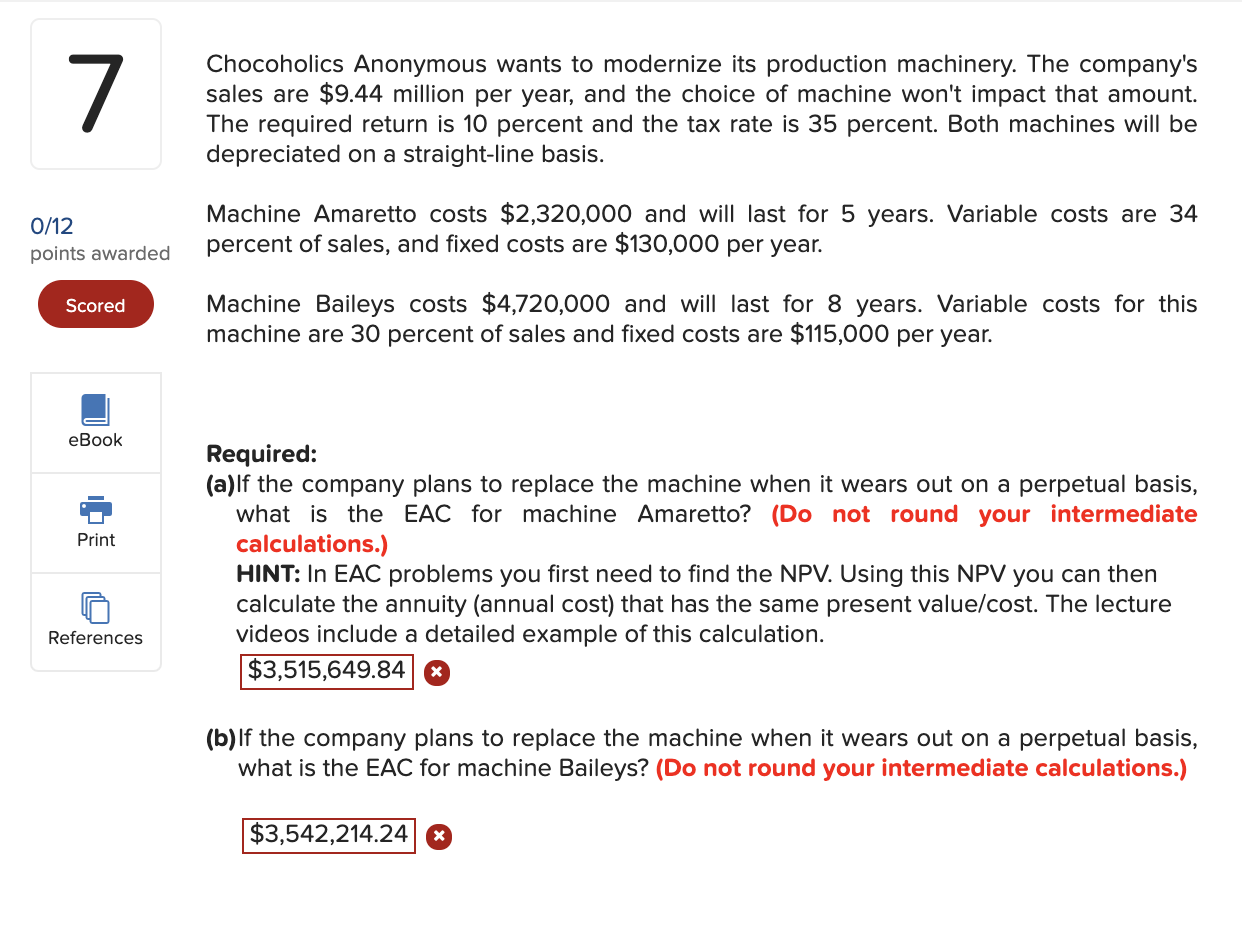

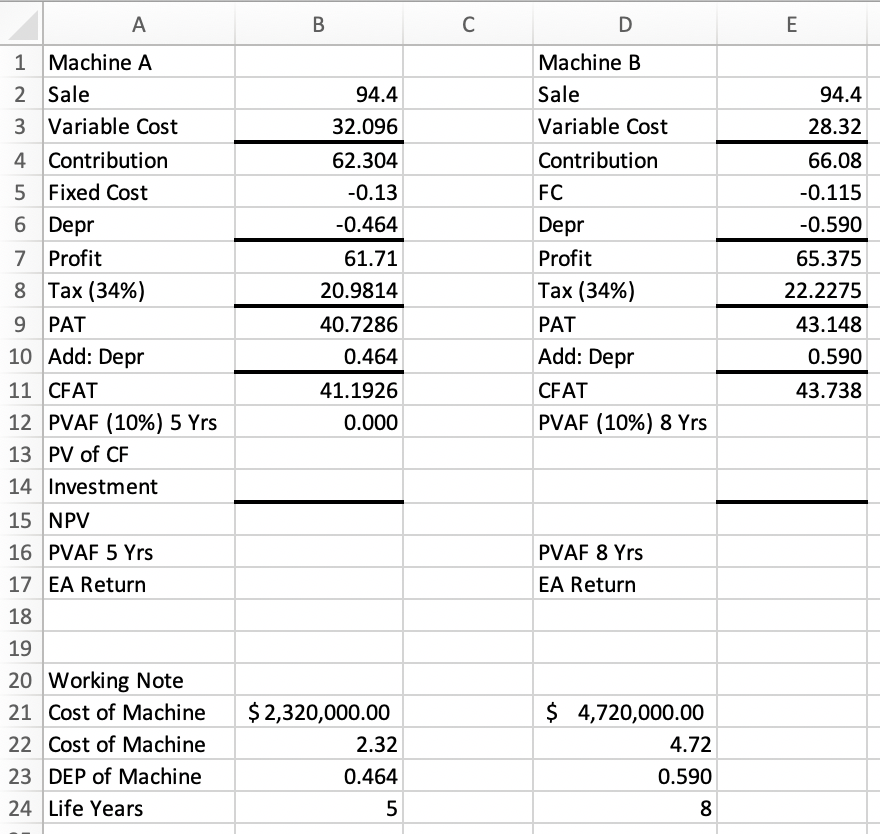

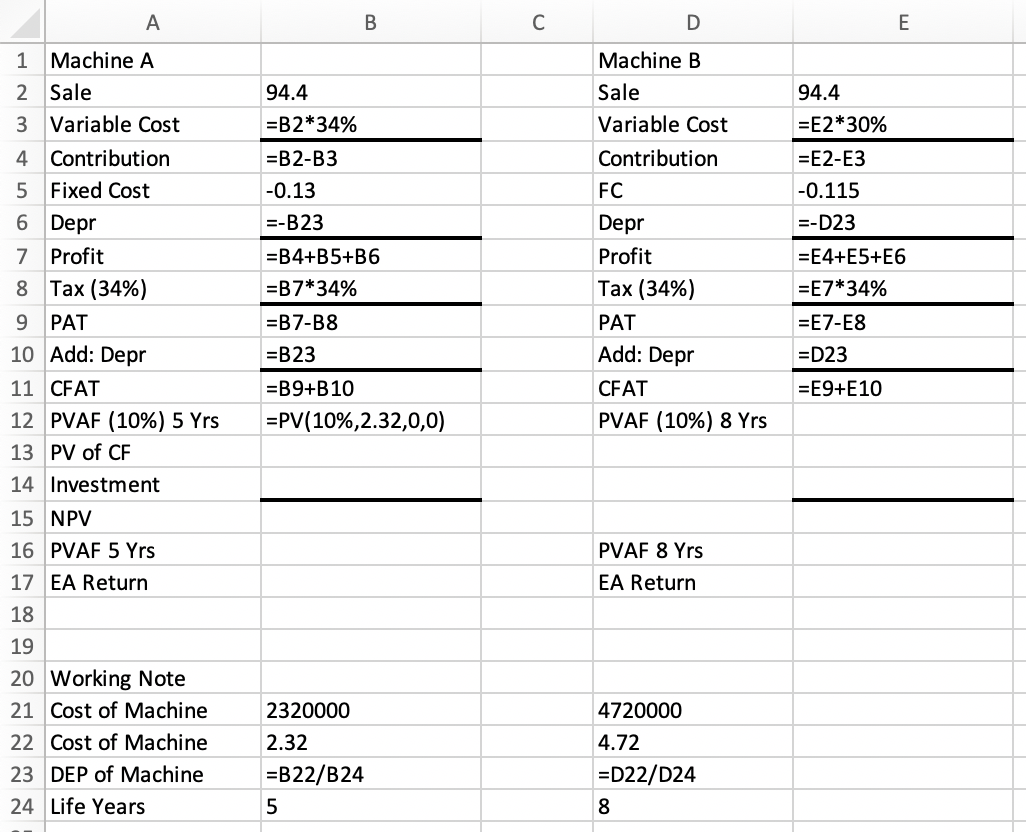

7 Chocoholics Anonymous wants to modernize its production machinery. The company's sales are $9.44 million per year, and the choice of machine won't impact that amount. The required return is 10 percent and the tax rate is 35 percent. Both machines will be depreciated on a straight-line basis. 0/12 points awarded Machine Amaretto costs $2,320,000 and will last for 5 years. Variable costs are 34 percent of sales, and fixed costs are $130,000 per year. Scored Machine Baileys costs $4,720,000 and will last for 8 years. Variable costs for this machine are 30 percent of sales and fixed costs are $115,000 per year. eBook Print Required: (a)lf the company plans to replace the machine when it wears out on a perpetual basis, what is the EAC for machine Amaretto? (Do not round your intermediate calculations.) HINT: In EAC problems you first need to find the NPV. Using this NPV you can then calculate the annuity (annual cost) that has the same present value/cost. The lecture videos include a detailed example of this calculation. $3,515,649.84& References (b) If the company plans to replace the machine when it wears out on a perpetual basis, what is the EAC for machine Baileys? (Do not round your intermediate calculations.) $3,542,214.24 * A B D E 94.4 28.32 94.4 32.096 62.304 -0.13 -0.464 61.71 20.9814 Machine B Sale Variable Cost Contribution FC Depr Profit Tax (34%) PAT Add: Depr CFAT PVAF (10%) 8 Yrs 66.08 -0.115 -0.590 65.375 22.2275 40.7286 0.464 43.148 0.590 43.738 1 Machine A 2 Sale 3 Variable Cost 4 Contribution 5 Fixed Cost 6 Depr 7 Profit 8 Tax (34%) 9 PAT 10 Add: Depr 11 CFAT 12 PVAF (10%) 5 Yrs 13 PV of CF 14 Investment 15 NPV 16 PVAF 5 Yrs 17 EA Return 18 19 20 Working Note 21 Cost of Machine 22 Cost of Machine 23 DEP of Machine 24 Life Years 41.1926 0.000 PVAF 8 Yrs EA Return $ 2,320,000.00 2.32 $ 4,720,000.00 4.72 0.590 0.464 5 8 A B D E Machine B Sale 94.4 =B2*34% Variable Cost =B2-B3 -0.13 =-B23 94.4 =E2* 30% =E2-E3 -0.115 =-D23 =E4+E5+E6 =E7*34% =E7-E8 =D23 =E9+E10 1 Machine A 2 Sale 3 Variable Cost 4 Contribution 5 Fixed Cost 6 Depr 7 Profit 8 Tax (34%) 9 PAT 10 Add: Depr 11 CFAT 12 PVAF (10%) 5 Yrs 13 PV of CF 14 Investment 15 NPV 16 PVAF 5 Yrs 17 EA Return 18 19 20 Working Note 21 Cost of Machine 22 Cost of Machine 23 DEP of Machine 24 Life Years Contribution FC Depr Profit Tax (34%) PAT Add: Depr CFAT PVAF (10%) 8 Yrs =B4+B5+B6 =B7*34% =B7-18 =B23 =B9+B10 =PV(10%,2.32,0,0) PVAF 8 Yrs EA Return 4720000 2320000 2.32 =B22/B24 5 4.72 =D22/D24 8 7 Chocoholics Anonymous wants to modernize its production machinery. The company's sales are $9.44 million per year, and the choice of machine won't impact that amount. The required return is 10 percent and the tax rate is 35 percent. Both machines will be depreciated on a straight-line basis. 0/12 points awarded Machine Amaretto costs $2,320,000 and will last for 5 years. Variable costs are 34 percent of sales, and fixed costs are $130,000 per year. Scored Machine Baileys costs $4,720,000 and will last for 8 years. Variable costs for this machine are 30 percent of sales and fixed costs are $115,000 per year. eBook Print Required: (a)lf the company plans to replace the machine when it wears out on a perpetual basis, what is the EAC for machine Amaretto? (Do not round your intermediate calculations.) HINT: In EAC problems you first need to find the NPV. Using this NPV you can then calculate the annuity (annual cost) that has the same present value/cost. The lecture videos include a detailed example of this calculation. $3,515,649.84& References (b) If the company plans to replace the machine when it wears out on a perpetual basis, what is the EAC for machine Baileys? (Do not round your intermediate calculations.) $3,542,214.24 * A B D E 94.4 28.32 94.4 32.096 62.304 -0.13 -0.464 61.71 20.9814 Machine B Sale Variable Cost Contribution FC Depr Profit Tax (34%) PAT Add: Depr CFAT PVAF (10%) 8 Yrs 66.08 -0.115 -0.590 65.375 22.2275 40.7286 0.464 43.148 0.590 43.738 1 Machine A 2 Sale 3 Variable Cost 4 Contribution 5 Fixed Cost 6 Depr 7 Profit 8 Tax (34%) 9 PAT 10 Add: Depr 11 CFAT 12 PVAF (10%) 5 Yrs 13 PV of CF 14 Investment 15 NPV 16 PVAF 5 Yrs 17 EA Return 18 19 20 Working Note 21 Cost of Machine 22 Cost of Machine 23 DEP of Machine 24 Life Years 41.1926 0.000 PVAF 8 Yrs EA Return $ 2,320,000.00 2.32 $ 4,720,000.00 4.72 0.590 0.464 5 8 A B D E Machine B Sale 94.4 =B2*34% Variable Cost =B2-B3 -0.13 =-B23 94.4 =E2* 30% =E2-E3 -0.115 =-D23 =E4+E5+E6 =E7*34% =E7-E8 =D23 =E9+E10 1 Machine A 2 Sale 3 Variable Cost 4 Contribution 5 Fixed Cost 6 Depr 7 Profit 8 Tax (34%) 9 PAT 10 Add: Depr 11 CFAT 12 PVAF (10%) 5 Yrs 13 PV of CF 14 Investment 15 NPV 16 PVAF 5 Yrs 17 EA Return 18 19 20 Working Note 21 Cost of Machine 22 Cost of Machine 23 DEP of Machine 24 Life Years Contribution FC Depr Profit Tax (34%) PAT Add: Depr CFAT PVAF (10%) 8 Yrs =B4+B5+B6 =B7*34% =B7-18 =B23 =B9+B10 =PV(10%,2.32,0,0) PVAF 8 Yrs EA Return 4720000 2320000 2.32 =B22/B24 5 4.72 =D22/D24 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts