Question: this is once question and everything wrote in the required section under number 1 is required to be found ANSWER BOTH COMPULSORY 35 MARK QUESTIONS

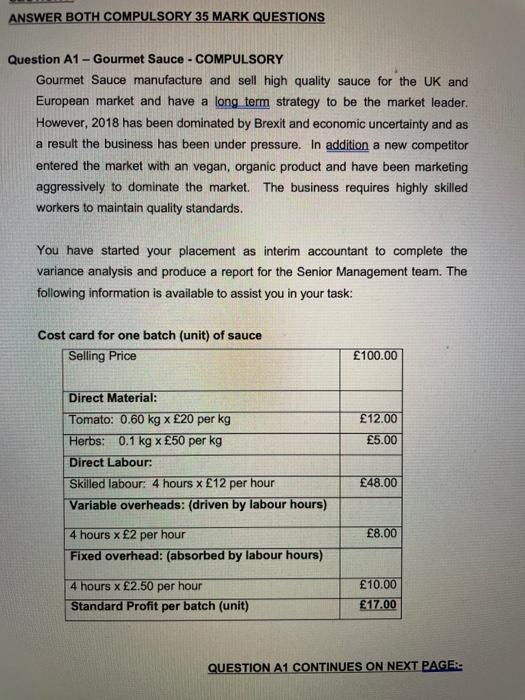

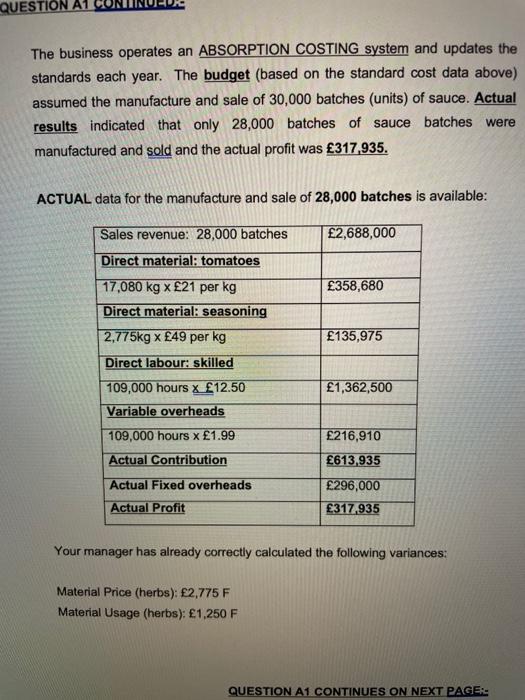

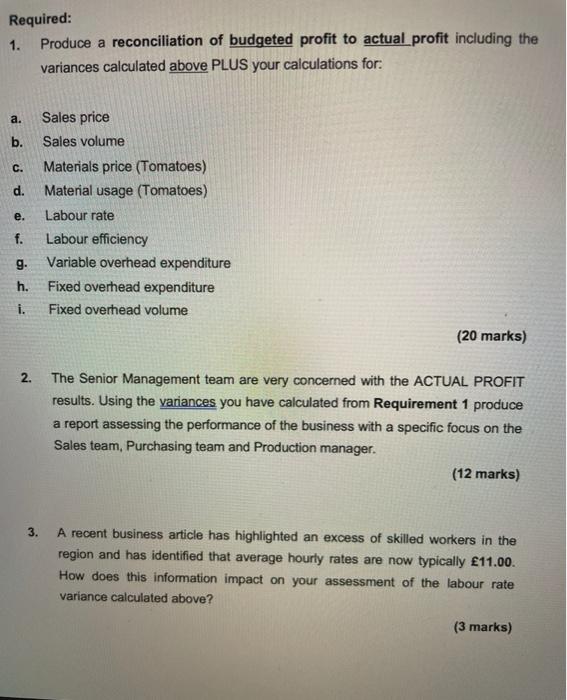

ANSWER BOTH COMPULSORY 35 MARK QUESTIONS Question A1 - Gourmet Sauce - COMPULSORY Gourmet Sauce manufacture and sell high quality sauce for the UK and European market and have a long term strategy to be the market leader. However, 2018 has been dominated by Brexit and economic uncertainty and as a result the business has been under pressure. In addition a new competitor entered the market with an vegan, organic product and have been marketing aggressively to dominate the market. The business requires highly skilled workers to maintain quality standards. You have started your placement as interim accountant to complete the variance analysis and produce a report for the Senior Management team. The following information is available to assist you in your task: Cost card for one batch (unit) of sauce Selling Price 100.00 12.00 5.00 Direct Material: Tomato: 0.60 kg x 20 per kg Herbs: 0.1 kg x 50 per kg Direct Labour: Skilled labour: 4 hours x 12 per hour Variable overheads: (driven by labour hours) 48.00 8.00 4 hours x 2 per hour Fixed overhead: (absorbed by labour hours) 4 hours x 2.50 per hour Standard Profit per batch (unit) 10.00 17.00 QUESTION A1 CONTINUES ON NEXT PAGER QUESTION ALI The business operates an ABSORPTION COSTING system and updates the standards each year. The budget (based on the standard cost data above) assumed the manufacture and sale of 30,000 batches (units) of sauce. Actual results indicated that only 28,000 batches of sauce batches were manufactured and sold and the actual profit was 317,935. ACTUAL data for the manufacture and sale of 28,000 batches is available: Sales revenue: 28,000 batches 2,688,000 358,680 Direct material: tomatoes 17,080 kg x 21 per kg Direct material: seasoning 2,775kg x 49 per kg Direct labour: skilled 109,000 hours x 12.50 Variable overheads 135,975 1,362,500 109,000 hours x 1.99 Actual Contribution Actual Fixed overheads 216,910 613,935 296,000 317,935 Actual Profit Your manager has already correctly calculated the following variances: Material Price (herbs): 2,775 F Material Usage (herbs): 1,250 F QUESTION A1 CONTINUES ON NEXT PAGE Required: 1. Produce a reconciliation of budgeted profit to actual profit including the variances calculated above PLUS your calculations for a. b. C. d. e. Sales price Sales volume Materials price (Tomatoes) Material usage (Tomatoes) Labour rate Labour efficiency Variable overhead expenditure Fixed overhead expenditure Fixed overhead volume f. g. h. i. (20 marks) 2. The Senior Management team are very concerned with the ACTUAL PROFIT results. Using the variances you have calculated from Requirement 1 produce a report assessing the performance of the business with a specific focus on the Sales team, Purchasing team and Production manager. (12 marks) 3. A recent business article has highlighted an excess of skilled workers in the region and has identified that average hourly rates are now typically 11.00. How does this information impact on your assessment of the labour rate variance calculated above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts