Question: This is one assignment and I need help with all of them please. Drop down option is regular tax system OR AMT system You bought

This is one assignment and I need help with all of them please.

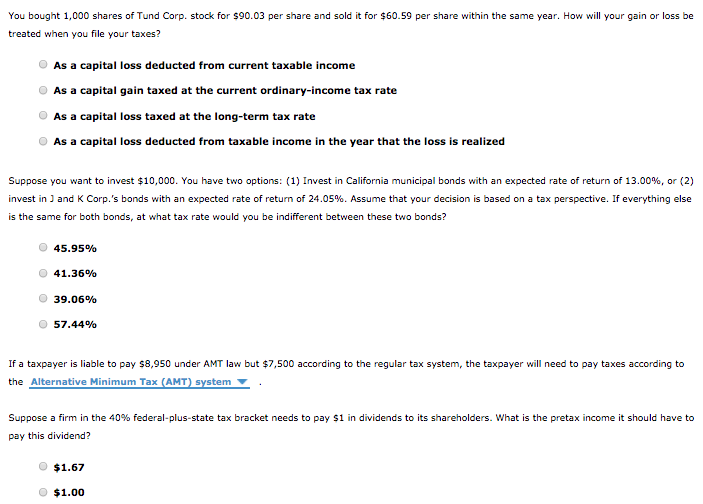

Drop down option is regular tax system OR AMT system

You bought 1,000 shares of Tund Corp. stock for $90.03 per share and sold it for $60.59 per share within the same year. How will your gain or loss be treated when you file your taxes? As a capital loss deducted from current taxable income As a capital gain taxed at the current ordinary-income tax rate As a capital loss taxed at the long-term tax rate As a capital loss deducted from taxable income in the year that the loss is realized Suppose you want to invest $10,000. You have two options: (1) Invest in California municipal bonds with an expected rate of return of 13.00%, or (2) invest in ) and K Corp.'s bonds with an expected rate of return of 24.05%. Assume that your decision is based on a tax perspective. If everything else is the same for both bonds, at what tax rate would you be indifferent between these two bonds? 45.95% 41.36% 39.06% 57.44% If a taxpayer is liable to pay $8,950 under AMT law but $7,500 according to the regular tax system, the taxpayer will need to pay taxes according to the Alternative Minimum Tax (AMT) system Suppose a firm in the 40% federal-plus-state tax bracket needs to pay $1 in dividends to its shareholders. What is the pretax income it should have to pay this dividend? $1.67 $1.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts