Question: this is one problem thankyou so much for you're help 1 QS 9-5 Recording employee payroll taxes LO P2 20 points On January 15, the

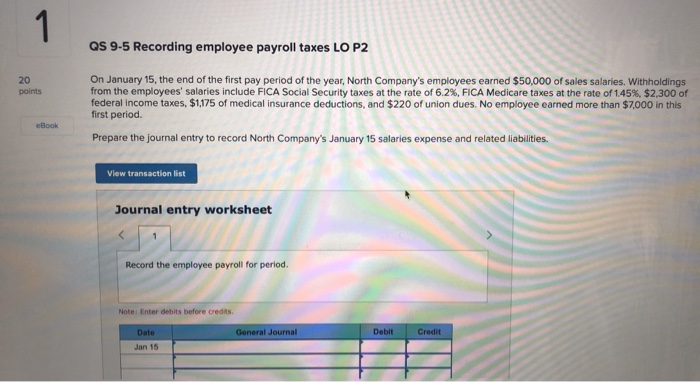

1 QS 9-5 Recording employee payroll taxes LO P2 20 points On January 15, the end of the first pay period of the year, North Company's employees earned $50,000 of sales salaries. Withholdings from the employees' salaries include FICA Social Security taxes at the rate of 6.2%, FICA Medicare taxes at the rate of 1.45%, $2,300 of federal income taxes, $1,175 of medical insurance deductions, and $220 of union dues. No employee earned more than $7,000 in this first period. Prepare the journal entry to record North Company's January 15 salaries expense and related liabilities. eBook View transaction list Journal entry worksheet Record the employee payroll for period. Note: Enter debits before credits Date General Journal Debit Credit Jan 16 Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts