Question: this is one ques with sub parts. like will be given Vauxall Holdings showed the following information regarding its notes receivable: Note Date Days of

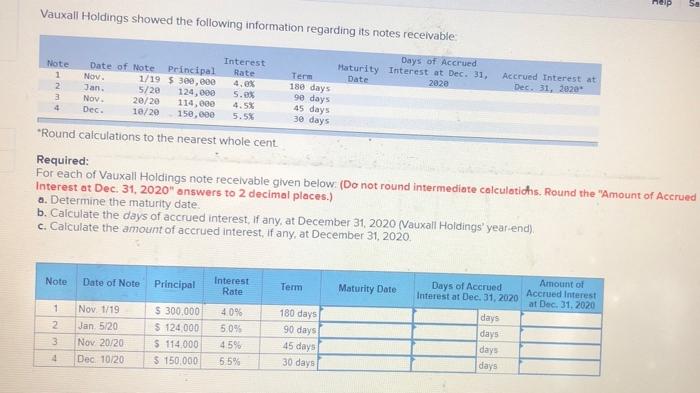

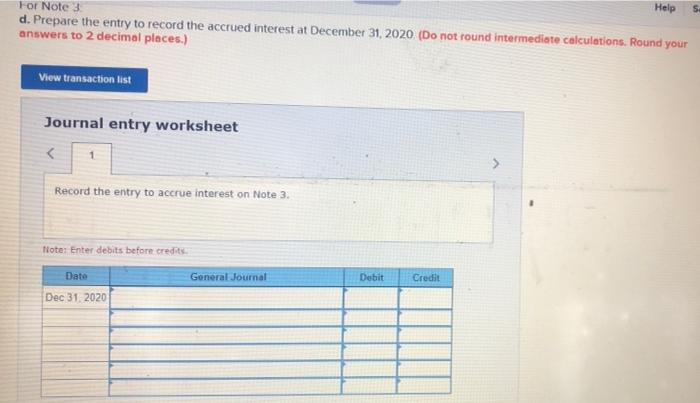

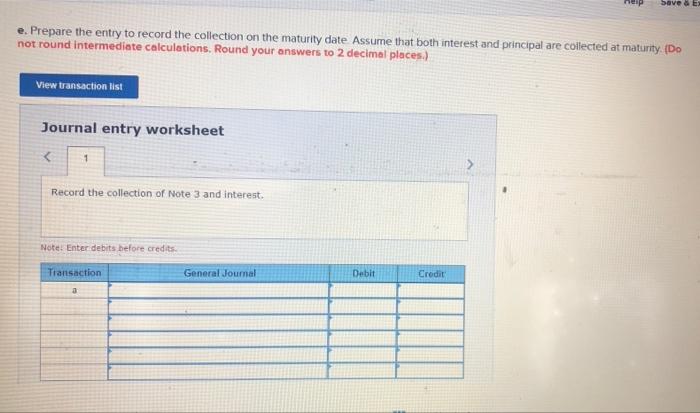

Vauxall Holdings showed the following information regarding its notes receivable: Note Date Days of Accrued Interest Maturity Interest at Dec. 31, Accrued Interest at Date of Note Principal Rate Term 2020 Dec 31, 2020 1 Nov. 1/19 $ 300,000 180 days 2 Jan. 5/2e 124,800 5.2% 90 days a Nov 20/20 114,000 4.5% 45 days 4 Dec. 10/20 150,000 5.5% 30 days *Round calculations to the nearest whole cent Required: For each of Vauxall Holdings note receivable given below. (Do not round intermediate calculatichs. Round the "Amount of Accrued Interest at Dec 31, 2020"answers to 2 decimal places.) a. Determine the maturity date. b. Calculate the days of accrued interest, if any, at December 31, 2020 (Vauxall Holdings' year end), c. Calculate the amount of accrued interest, if any, at December 31, 2020, Note Date of Note Principal Interest Rate Term Maturity Date Amount of Accrued Interest at Dec. 31. 2020 1 2 Nov 1/19 Jan 5/20 Nov 20/20 Dec. 10/20 $ 300,000 $ 124 000 $ 114.000 $ 150.000 40% 50% 45% 55% 180 days 90 days 45 days 30 days Days of Accrued Interest at Dec 31, 2020 days days days days 3 4 Help For Note 3 d. Prepare the entry to record the accrued interest at December 31, 2020 (Do not round intermediate calculations. Round your answers to 2 decimal places.) View transaction list Journal entry worksheet Record the entry to accrue interest on Note 3. Note: Enter debits before credits Date General Journal Debit Credit Dec 31, 2020 bove & E e. Prepare the entry to record the collection on the maturity date Assume that both interest and principal are collected at maturity. (Do not round intermediate calculations, Round your answers to 2 decimal places.) View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts