Question: This is one question and multiple tables . Please answer all in tables as soon as possible. Journal entry worksheet Record the adjusting entry for

This is one question and multiple tables . Please answer all in tables as soon as possible.

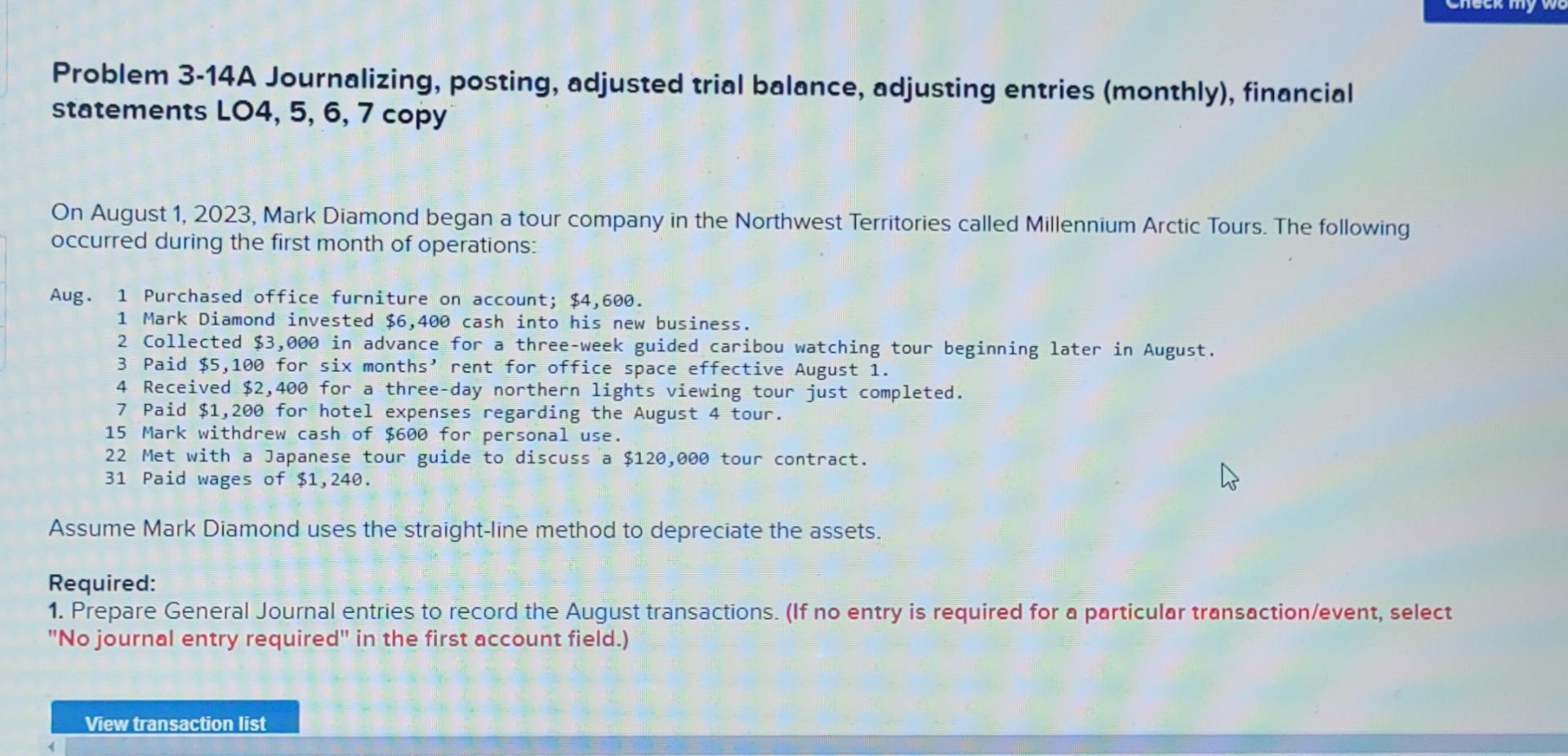

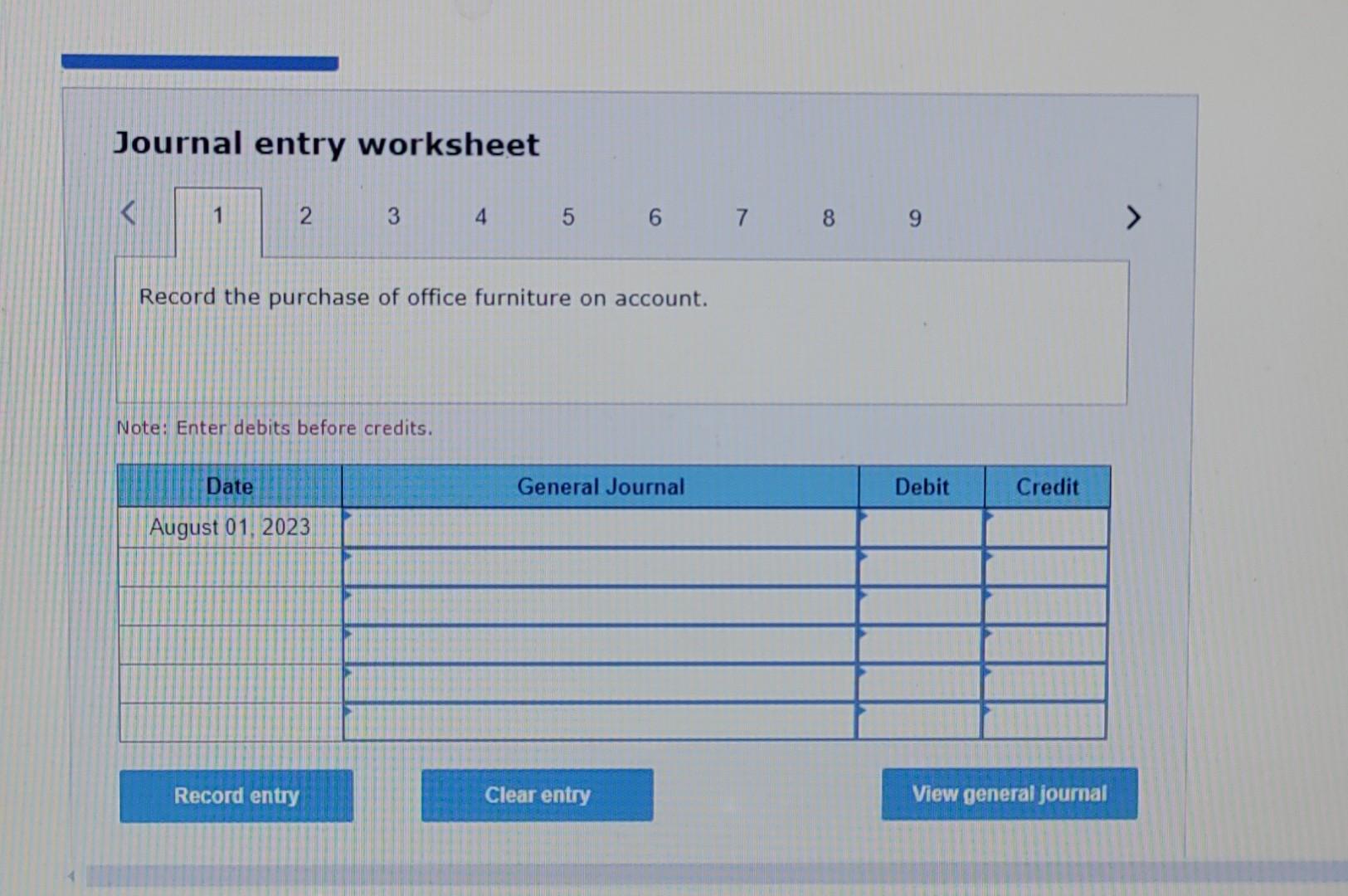

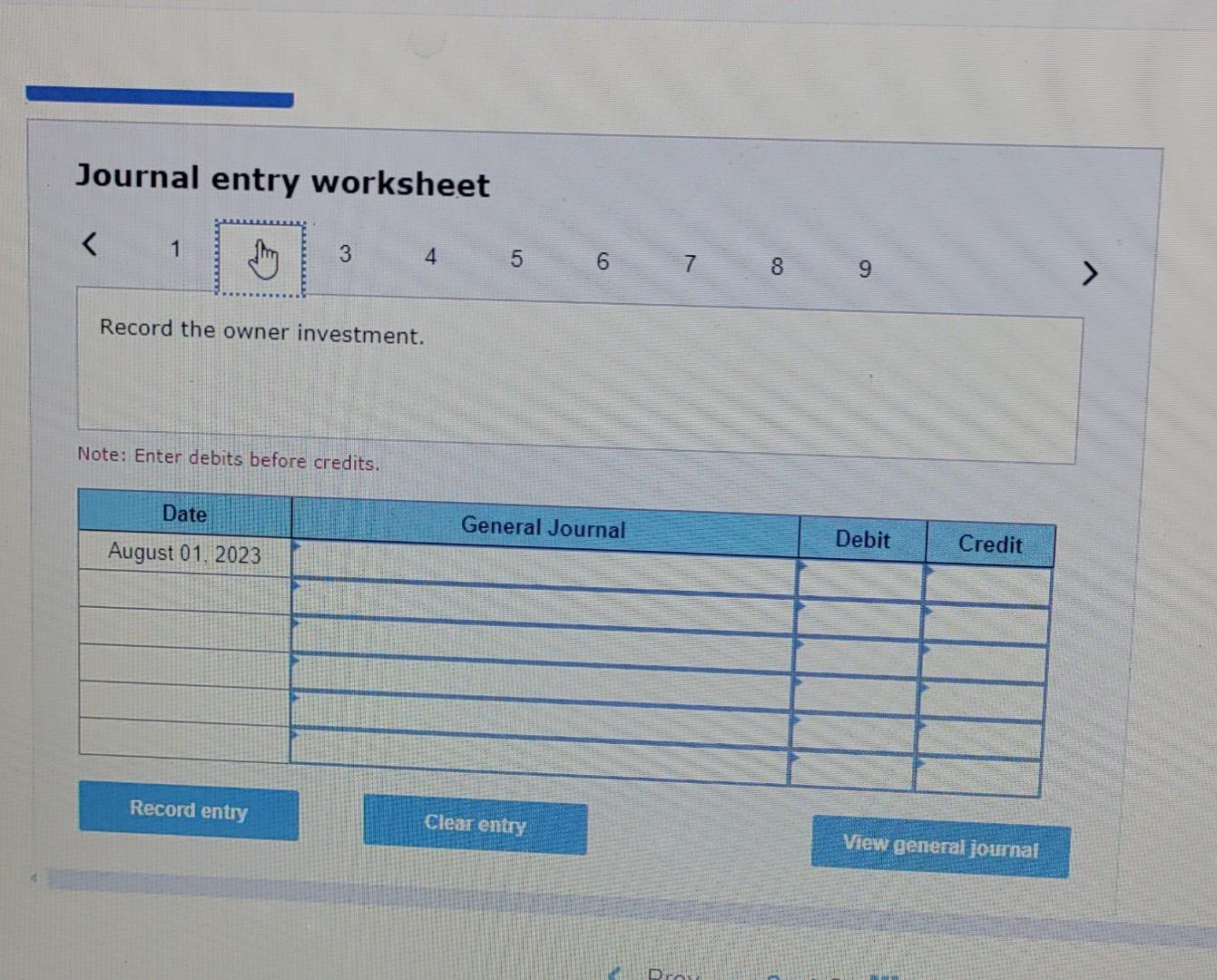

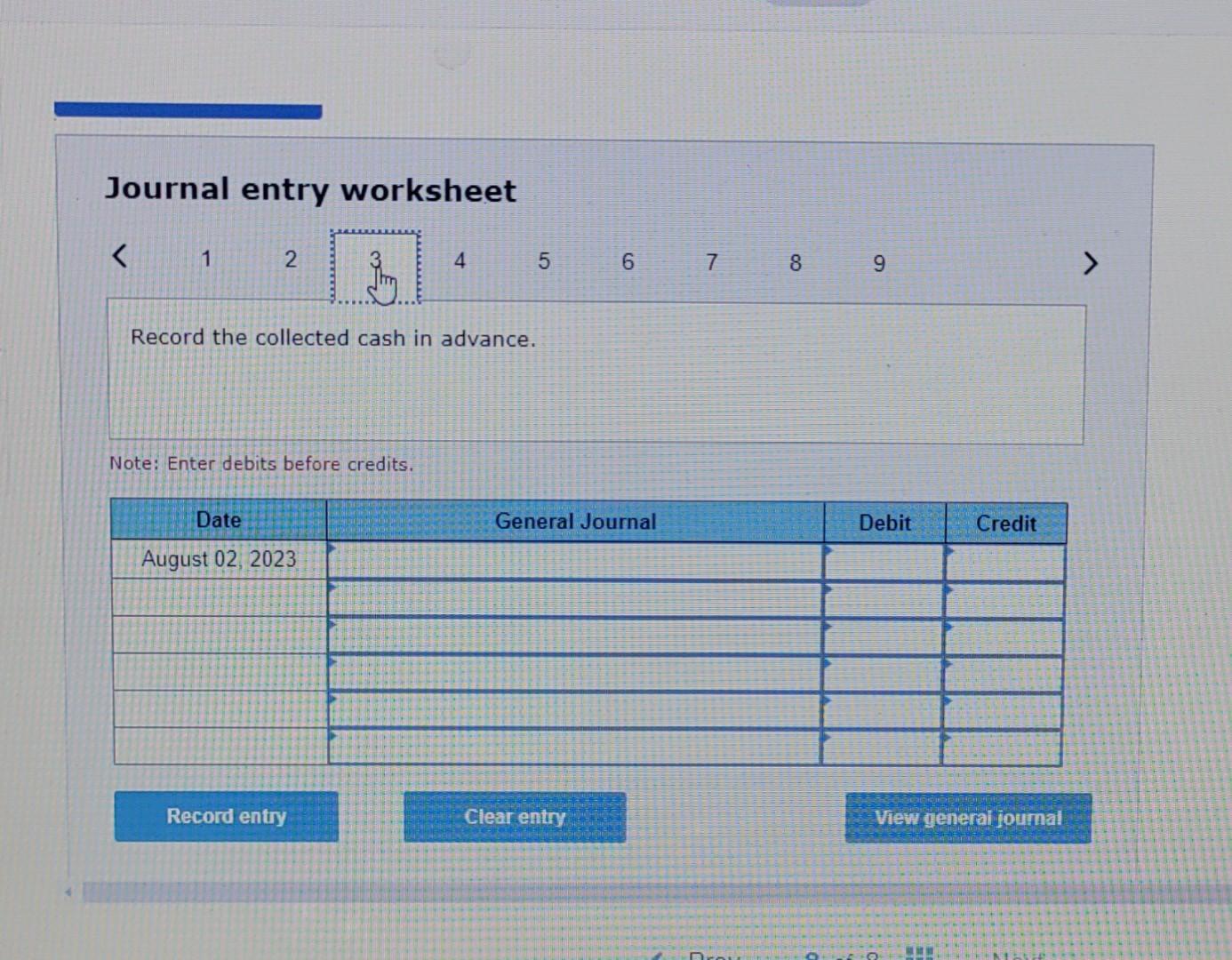

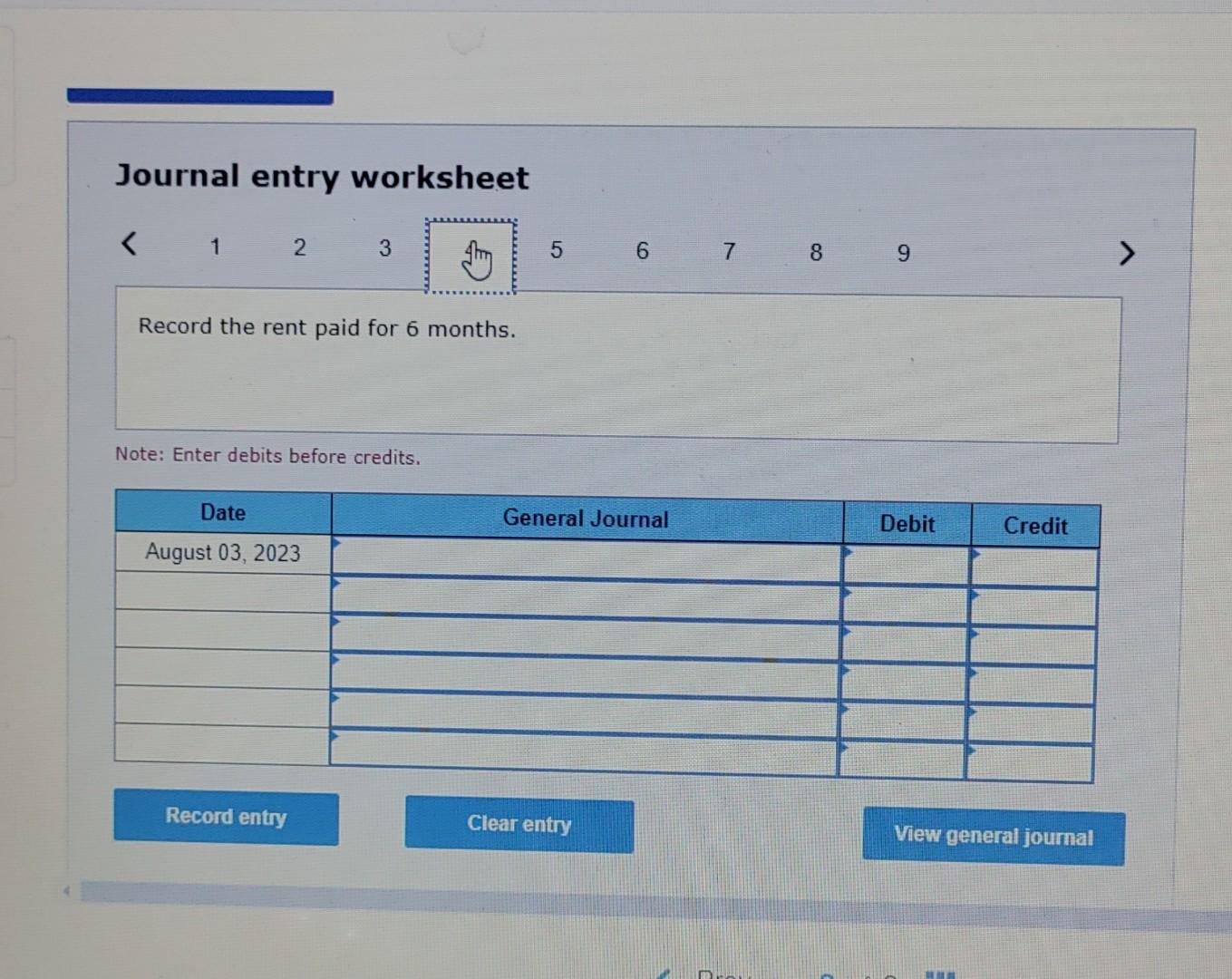

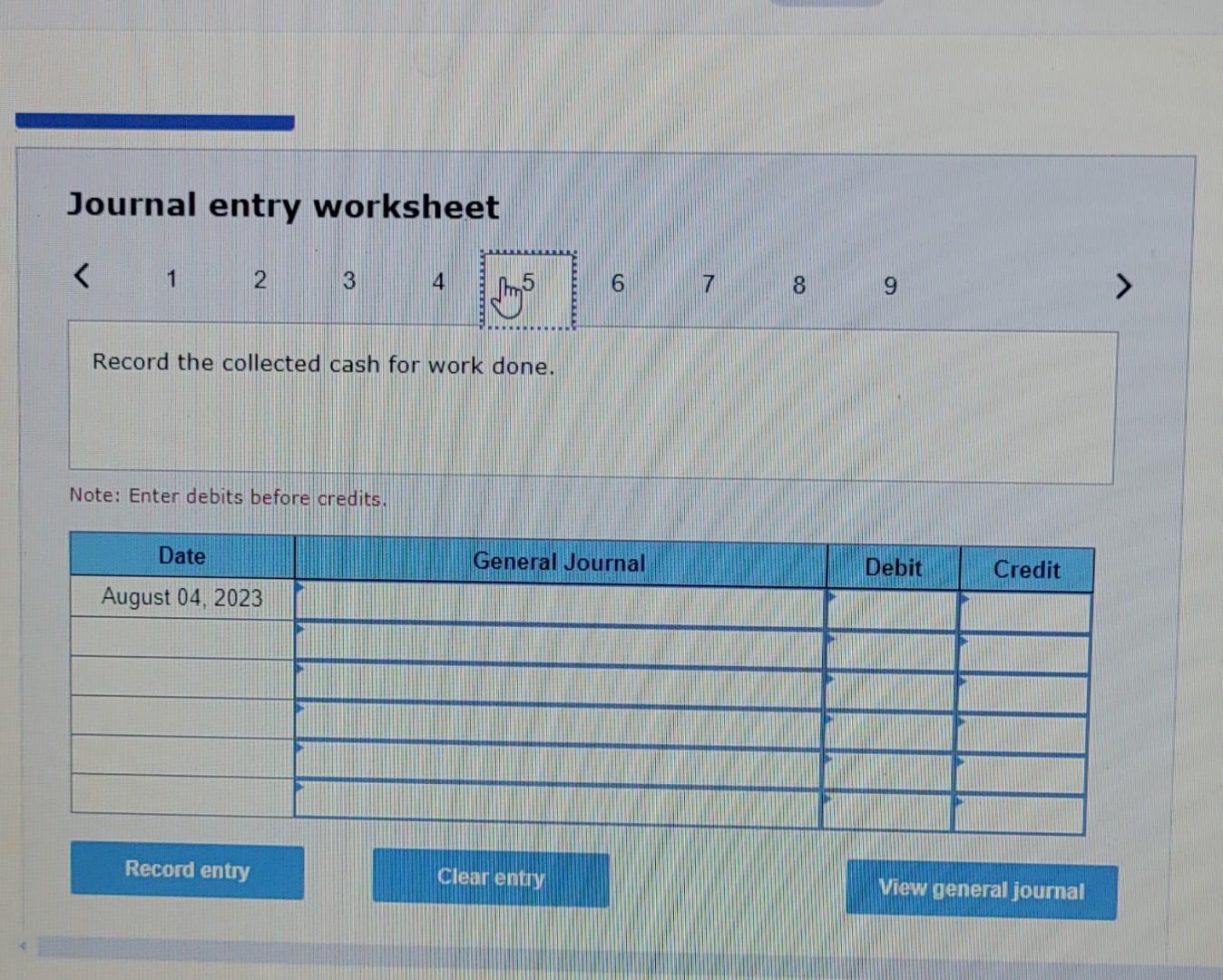

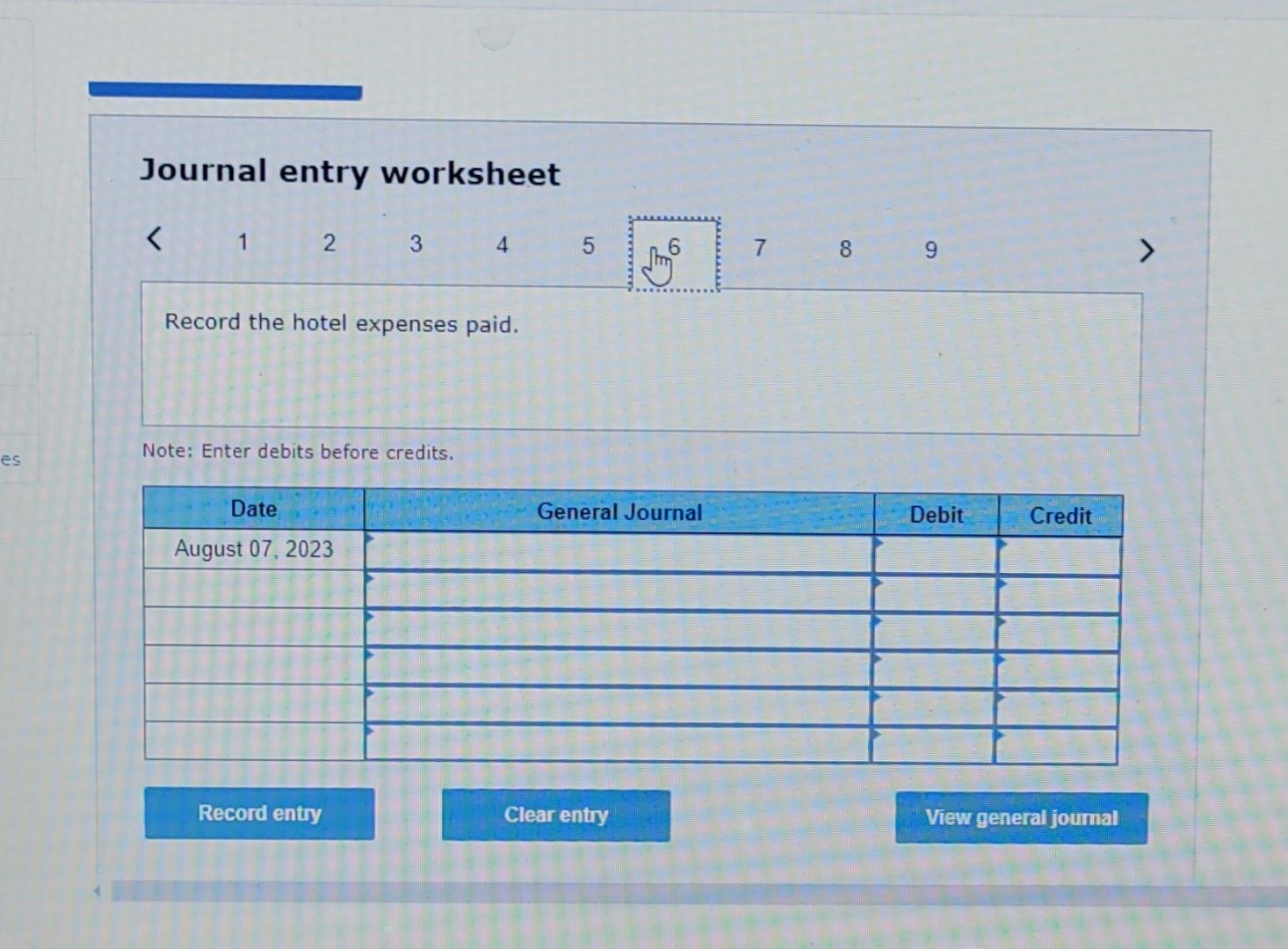

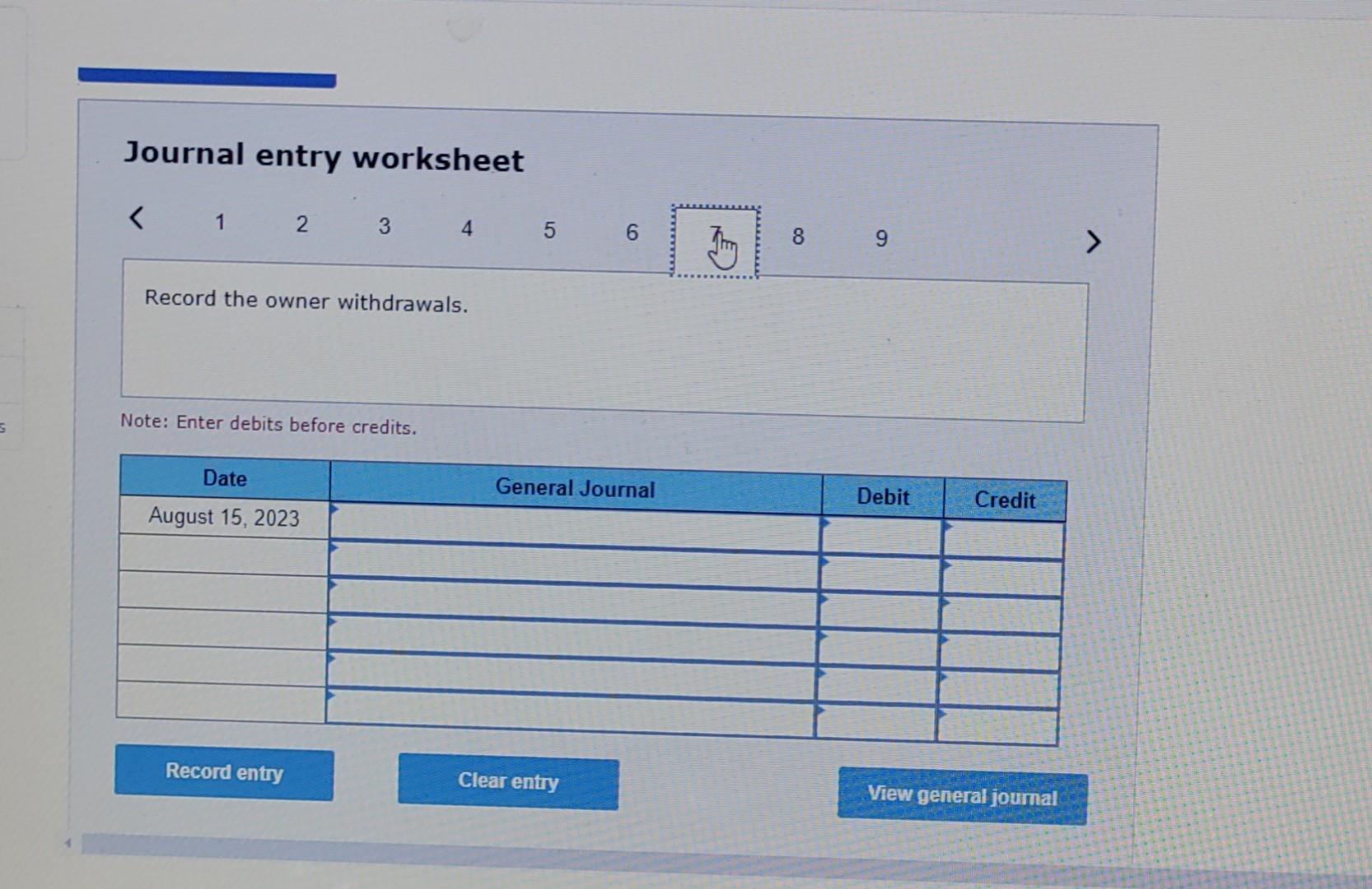

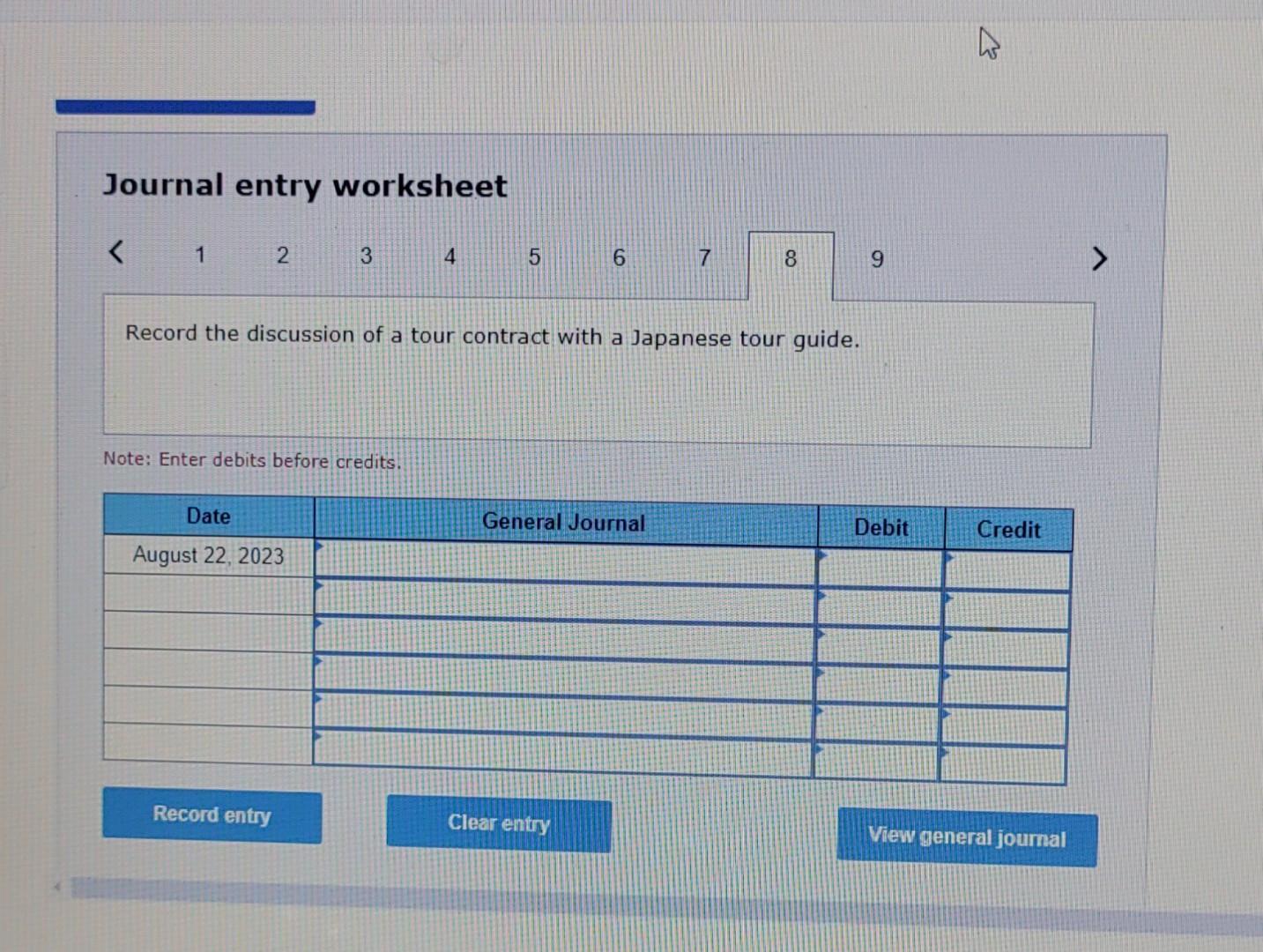

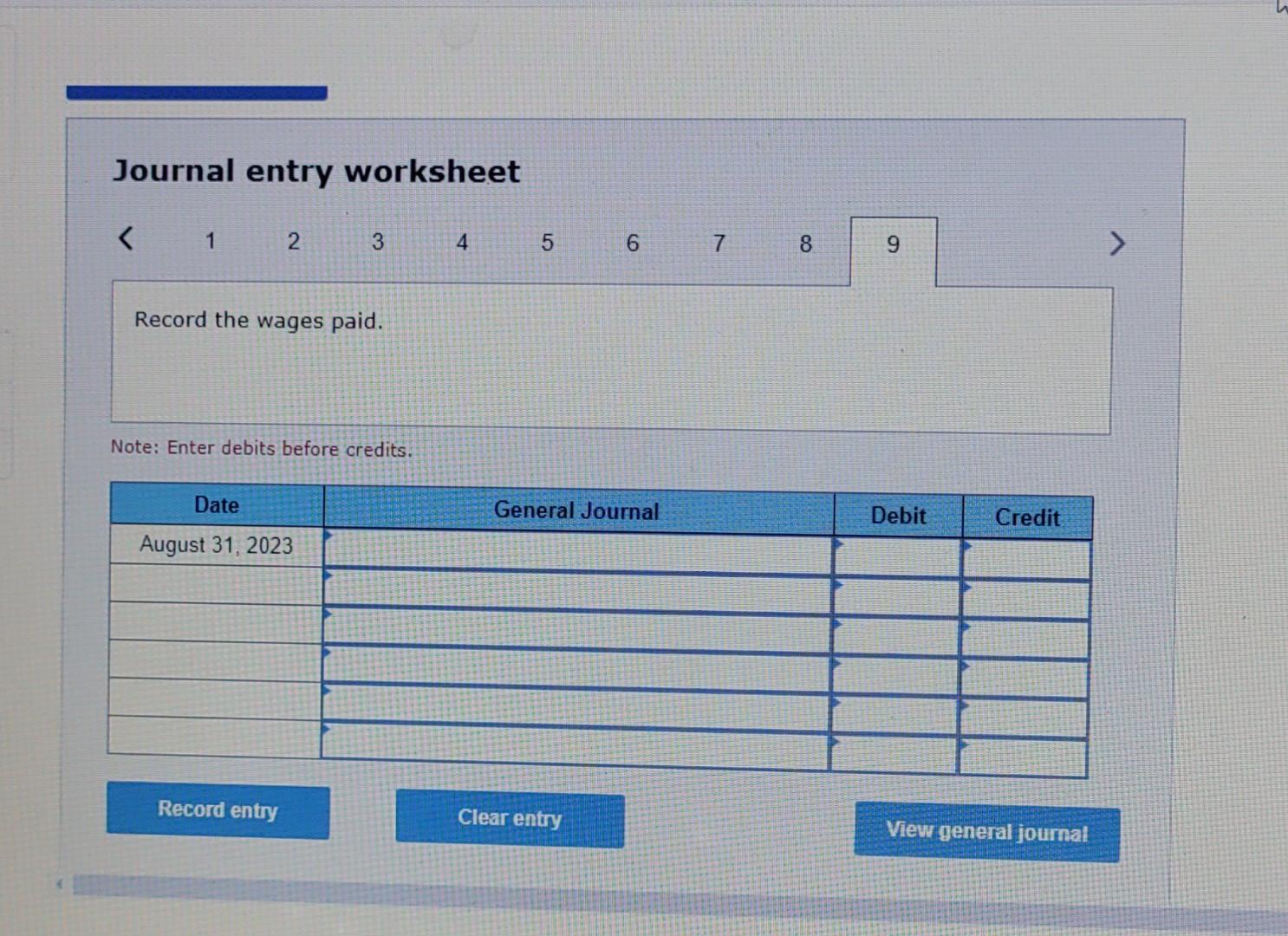

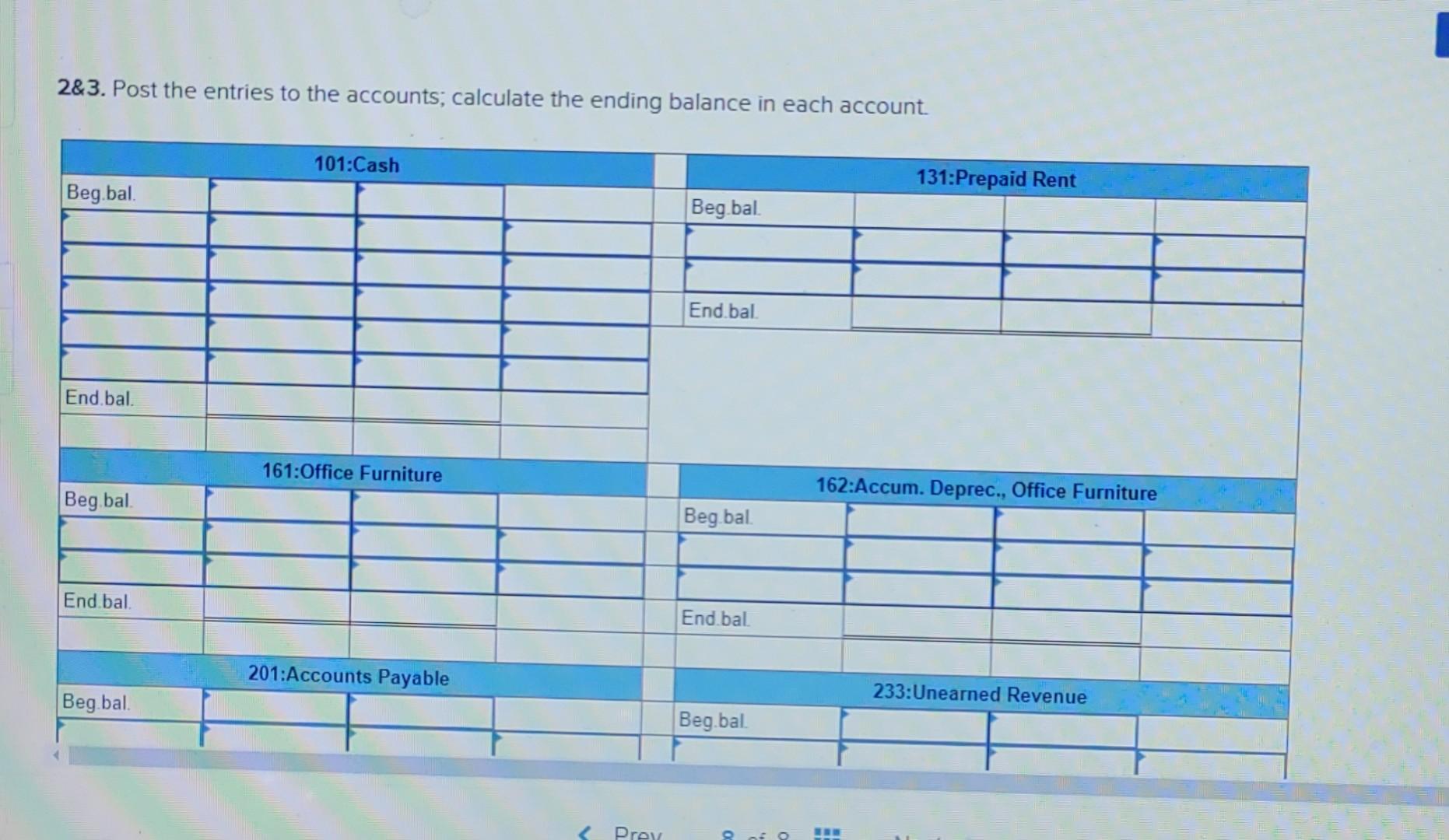

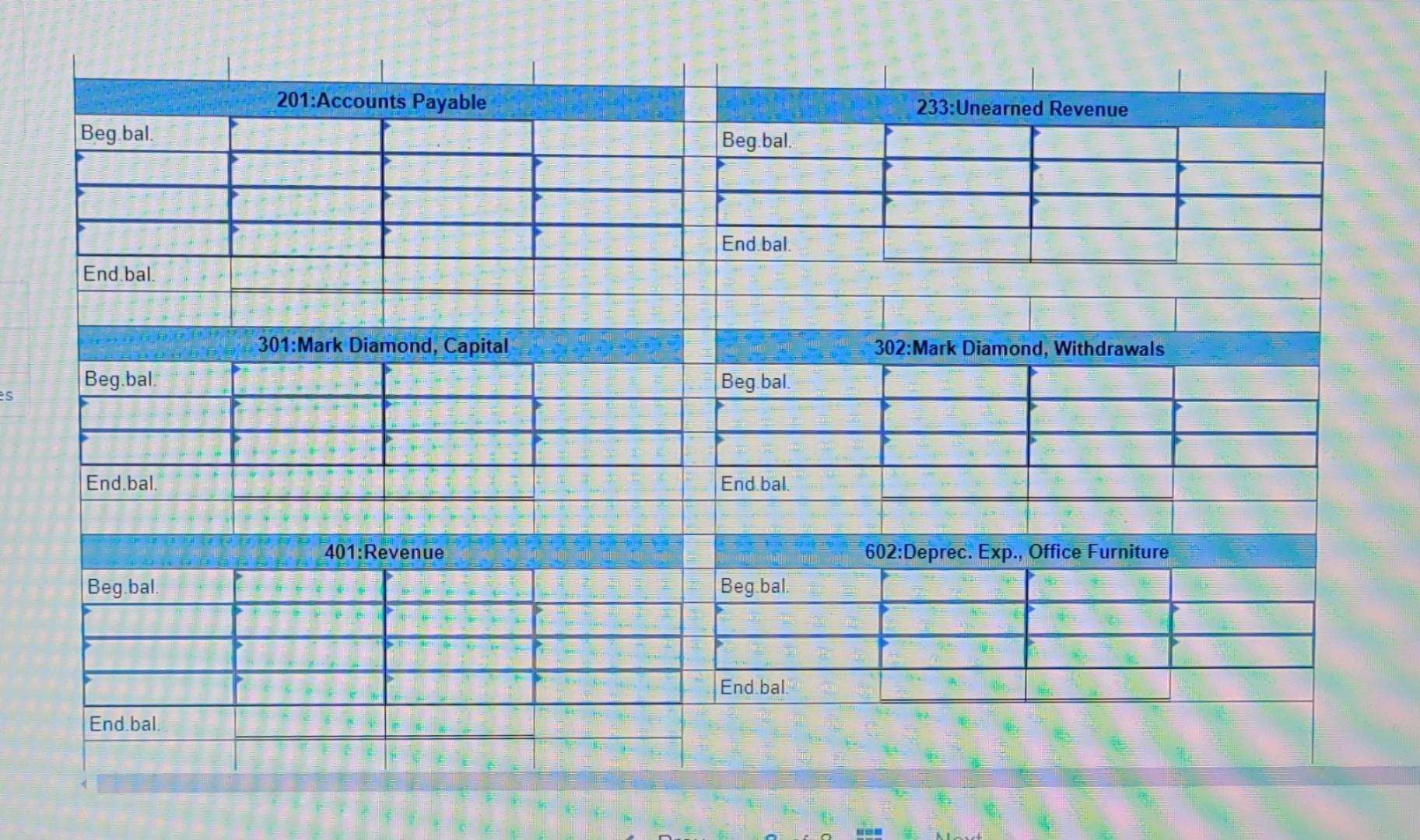

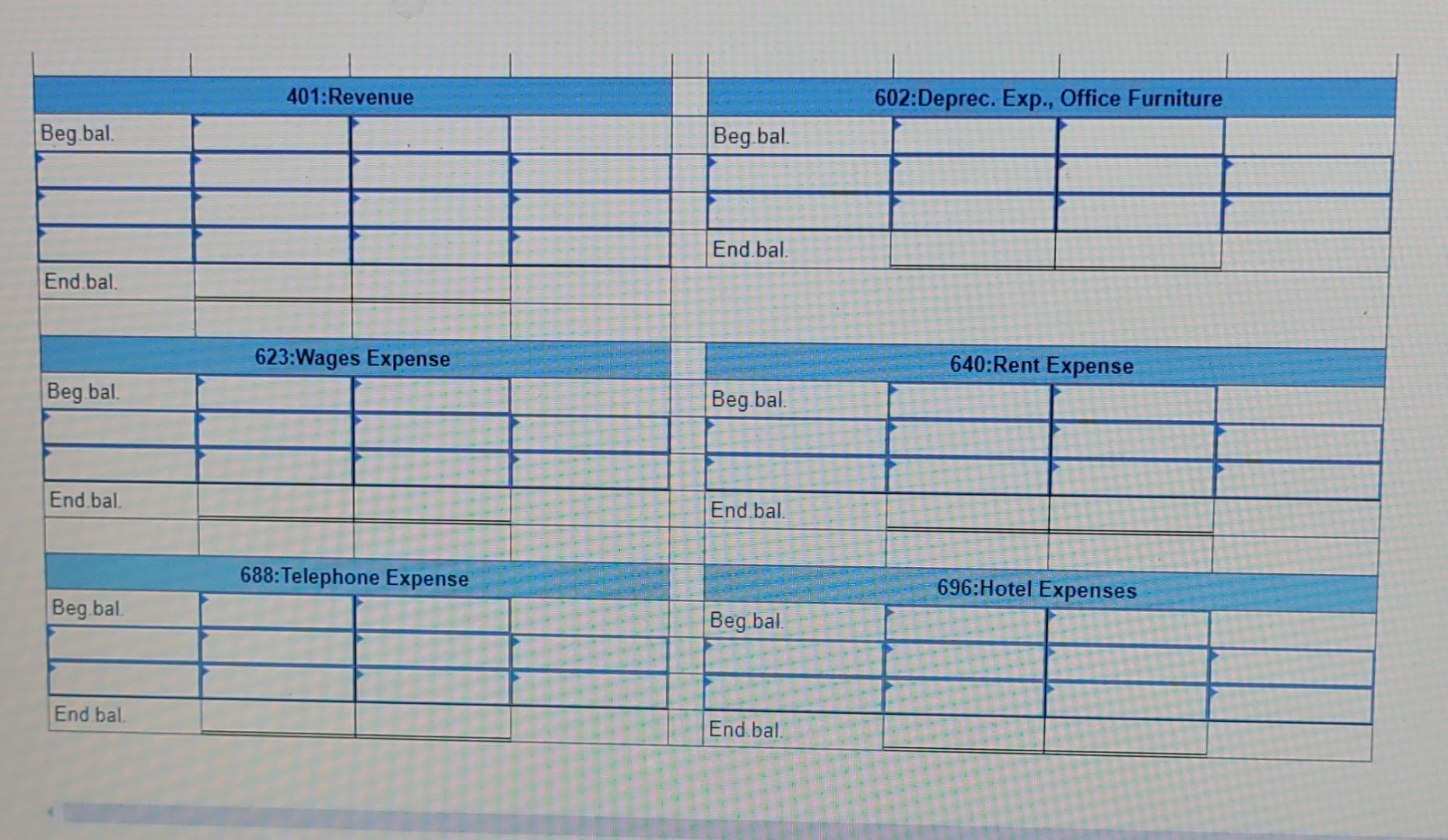

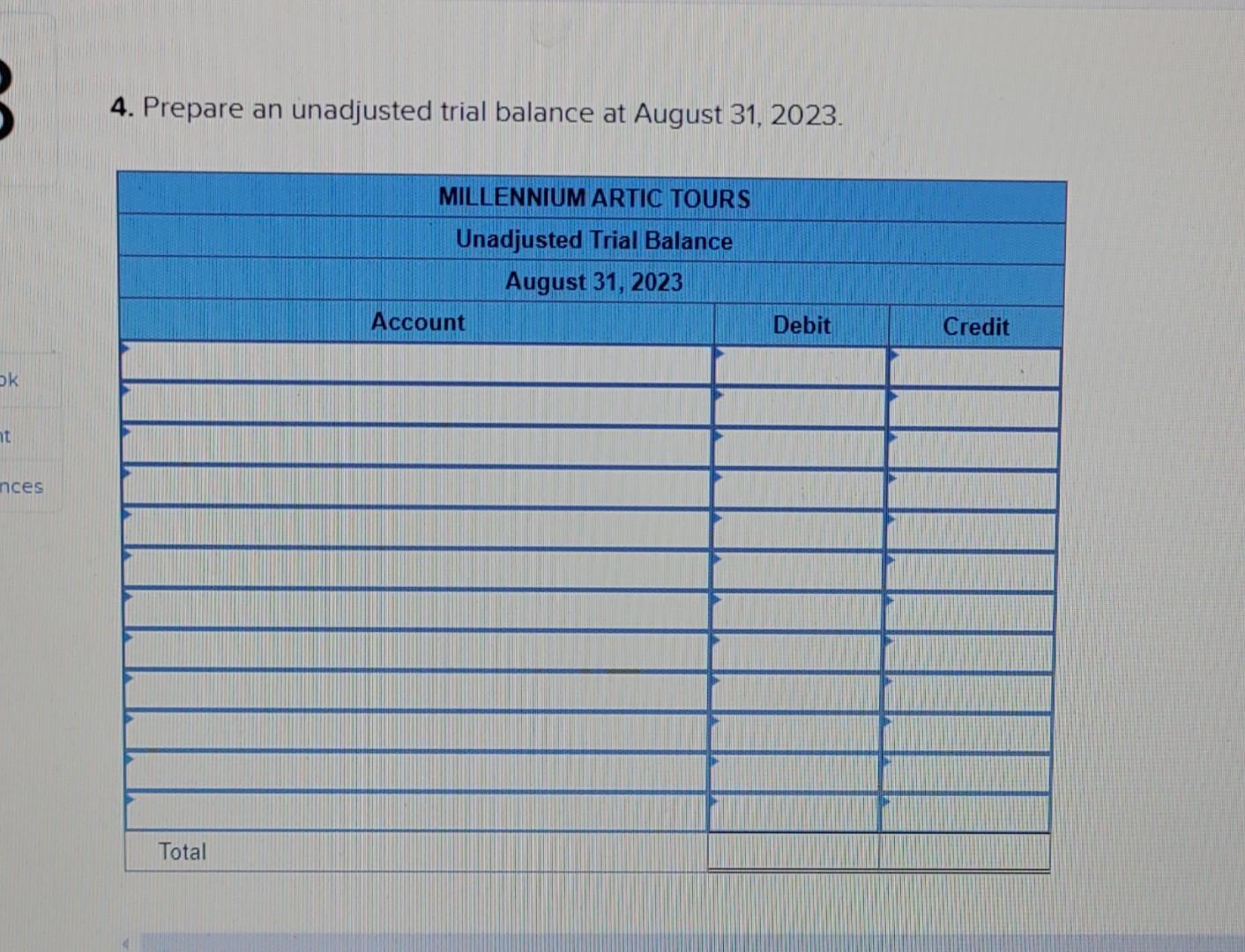

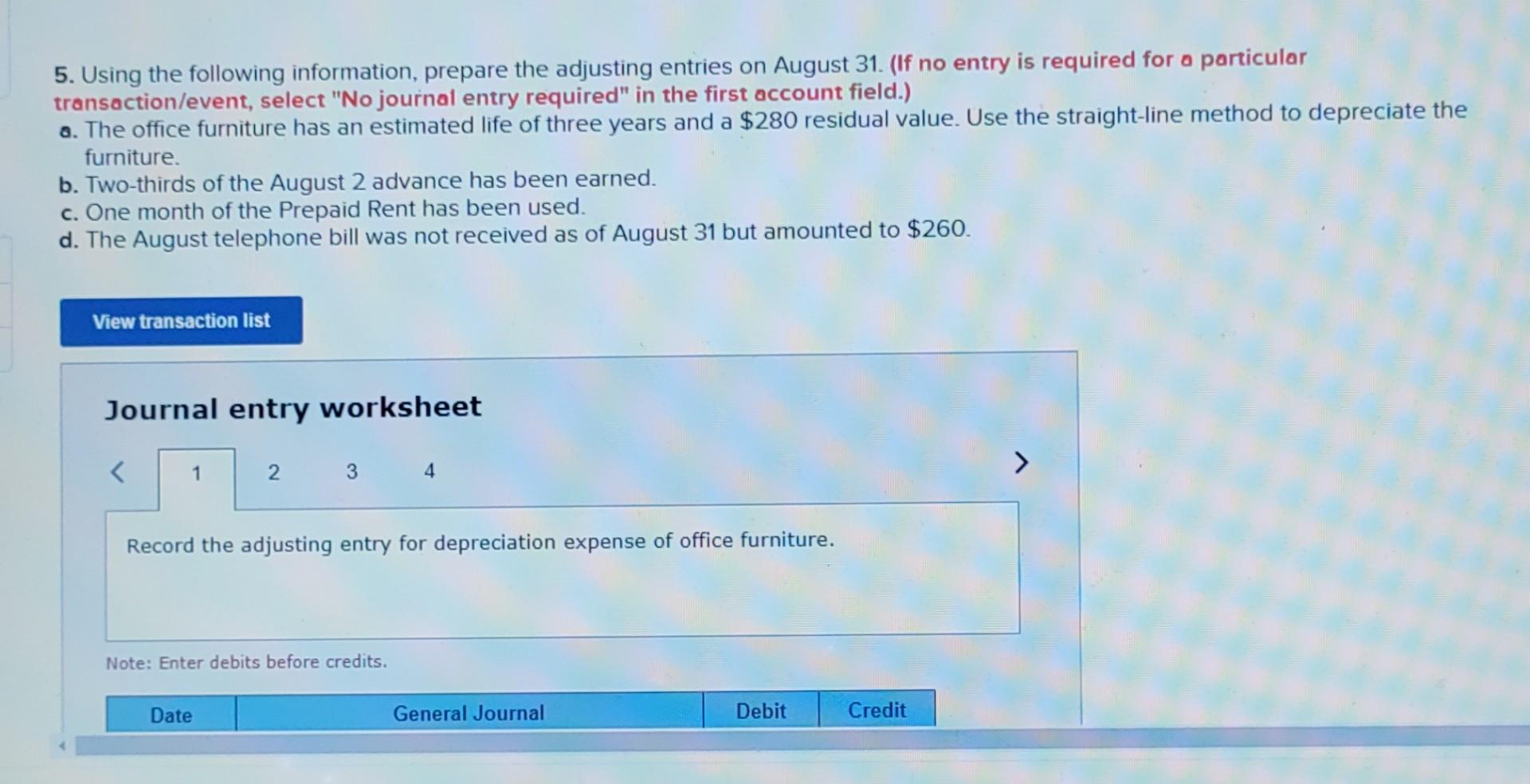

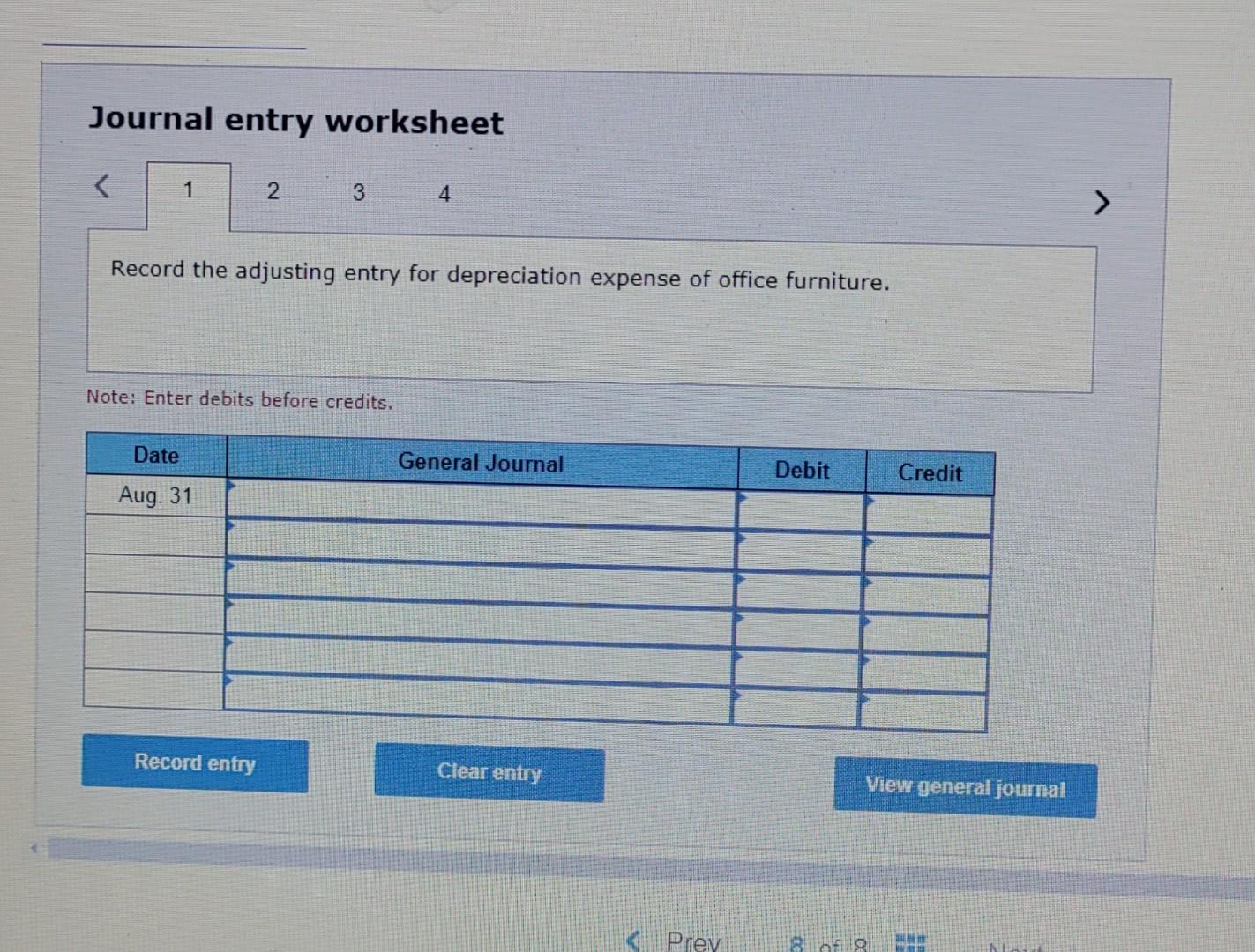

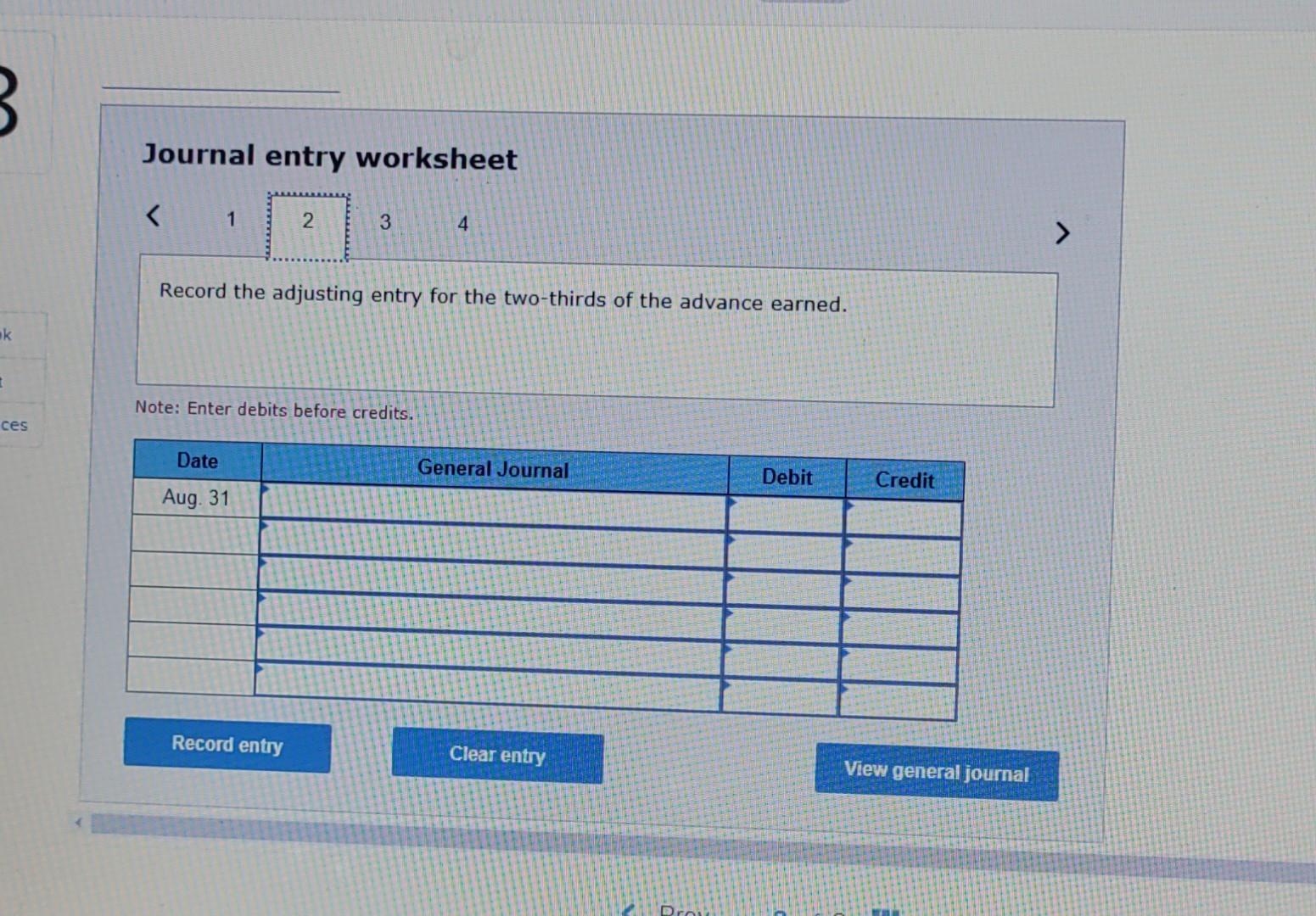

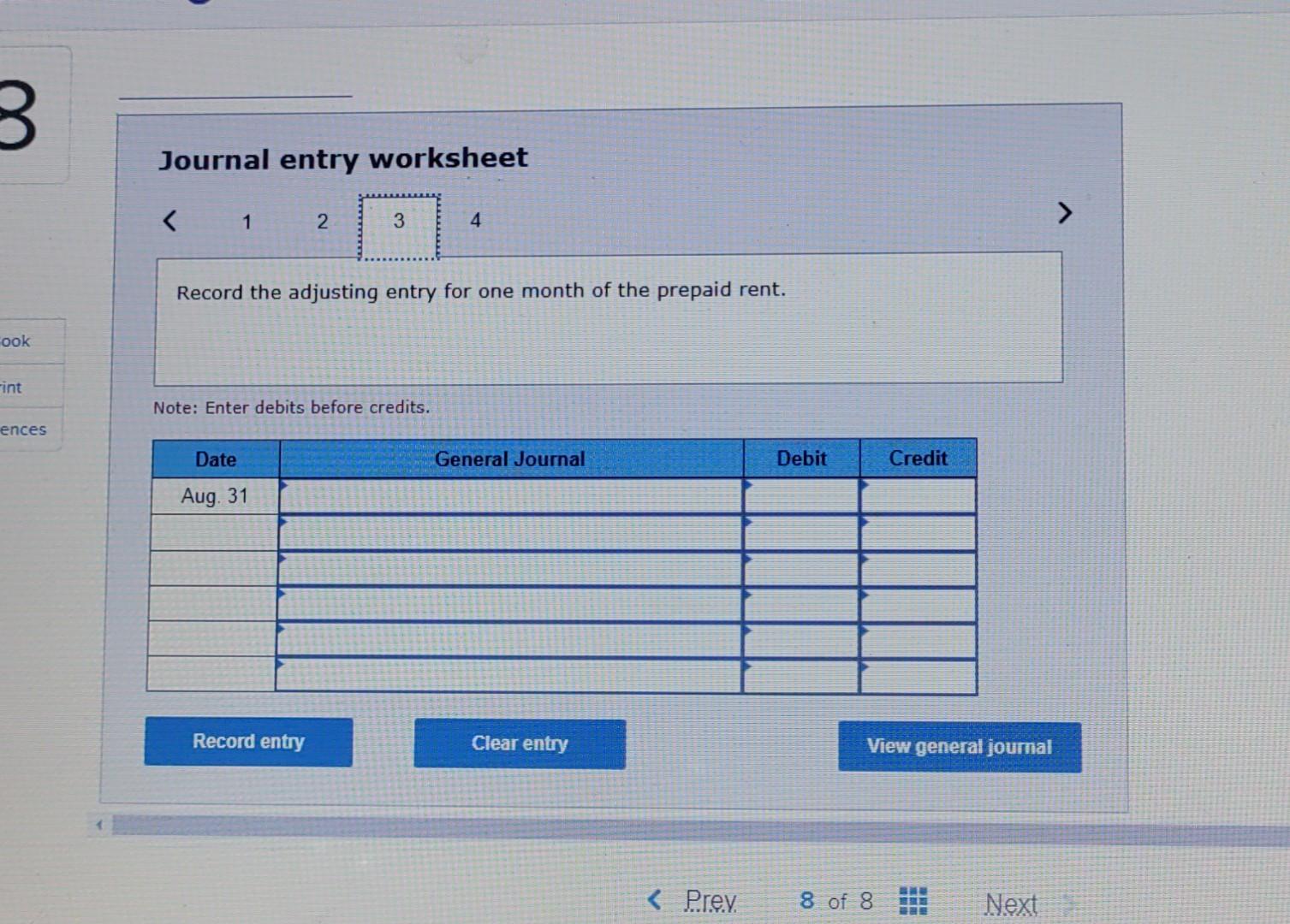

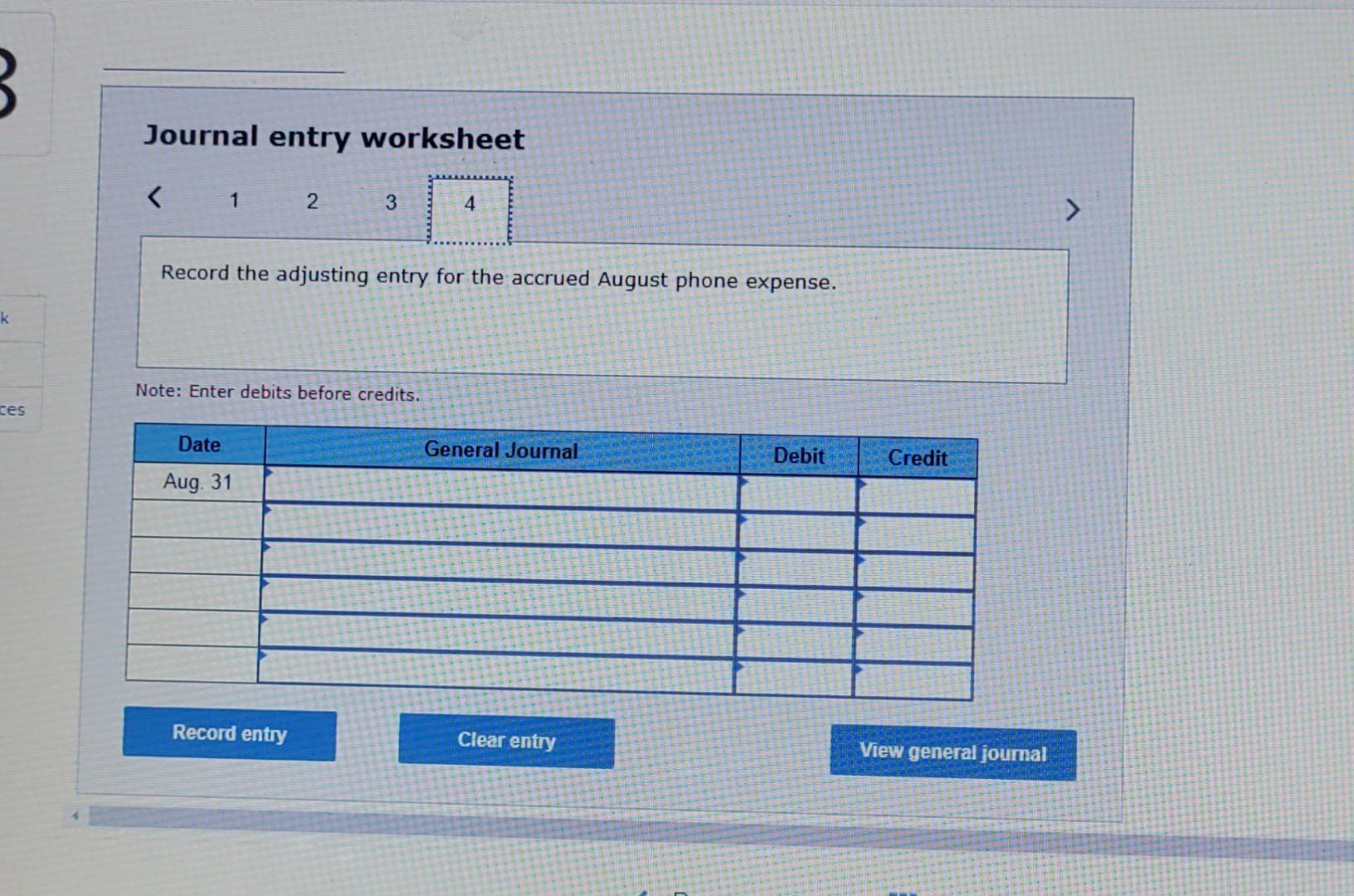

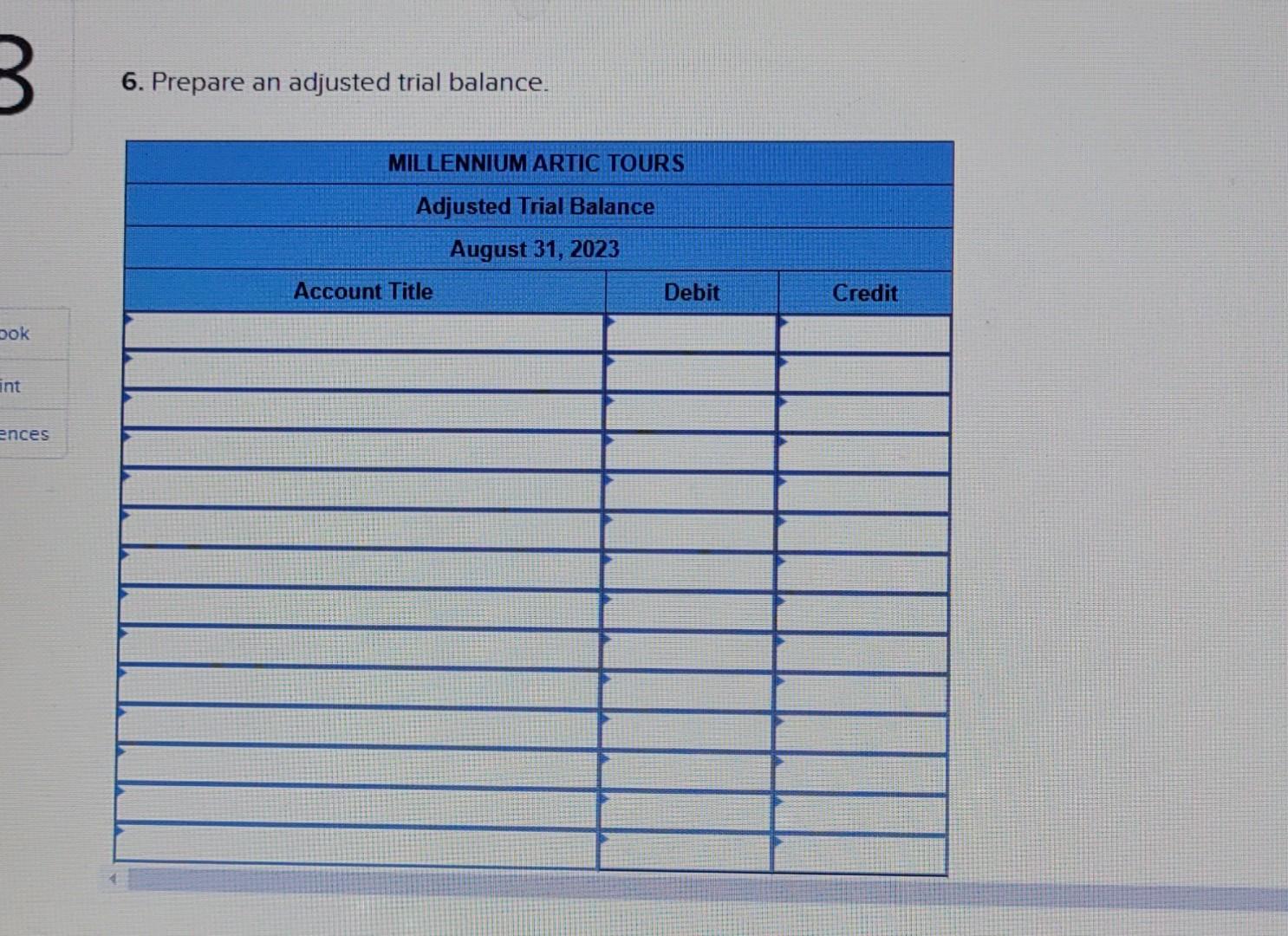

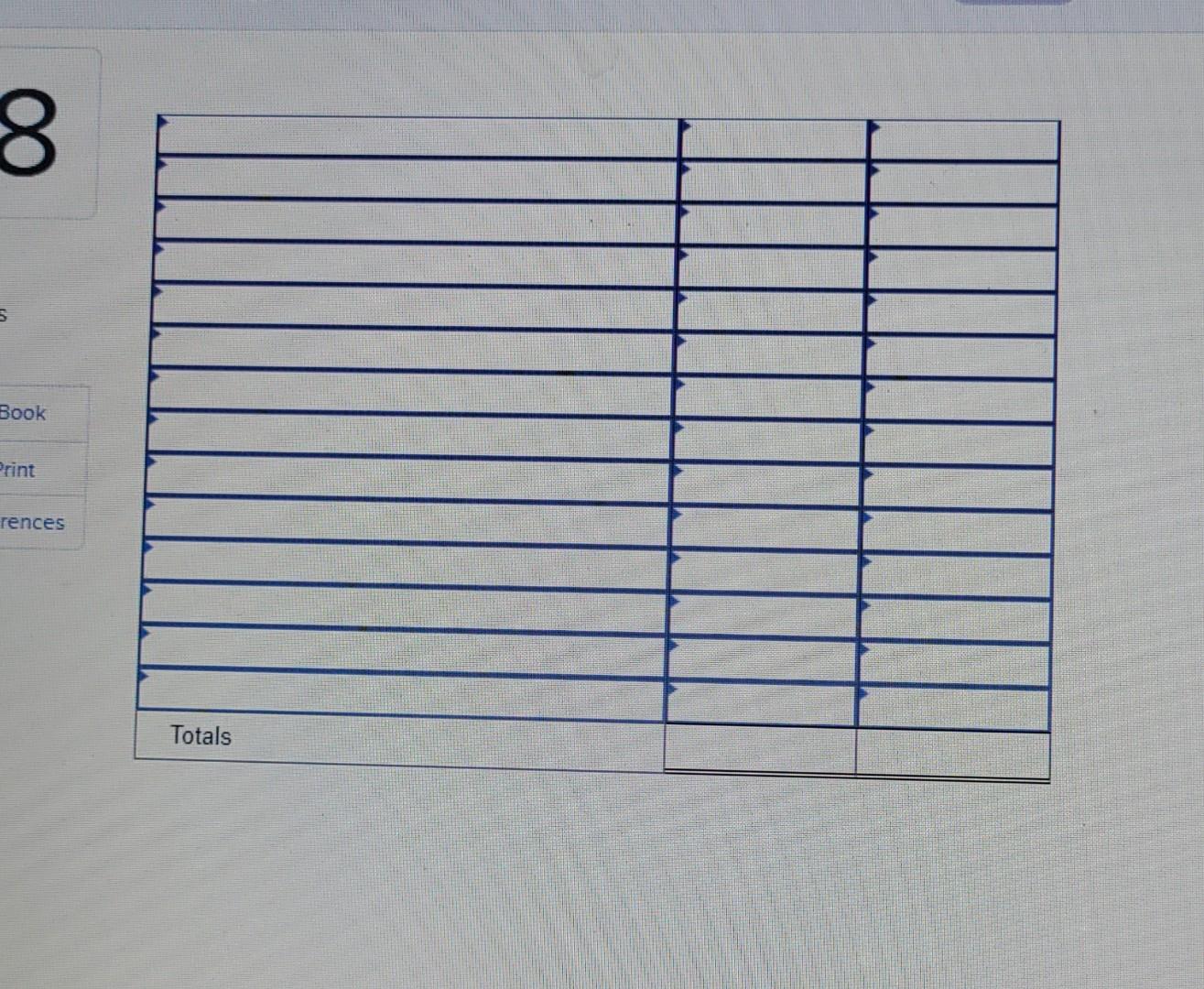

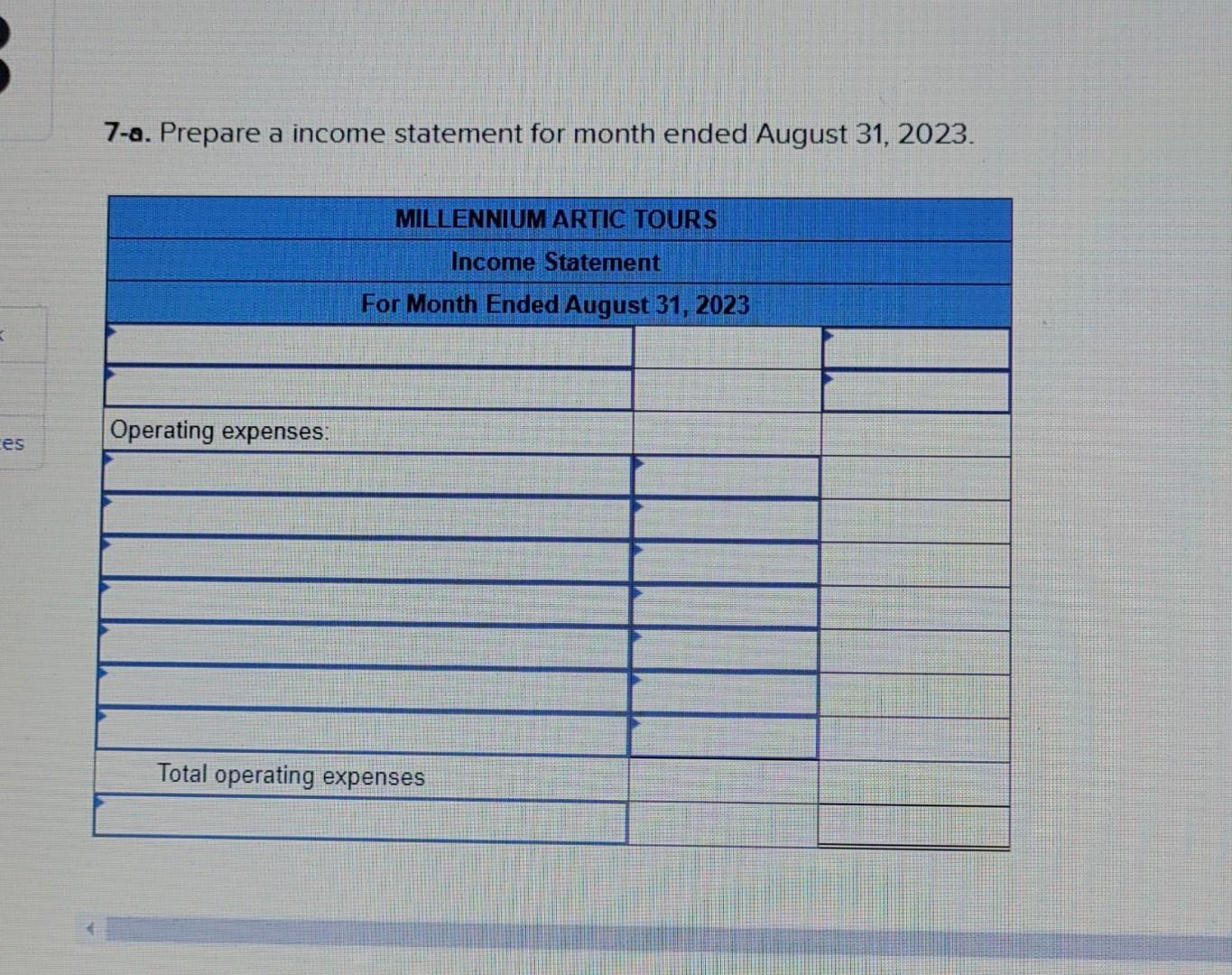

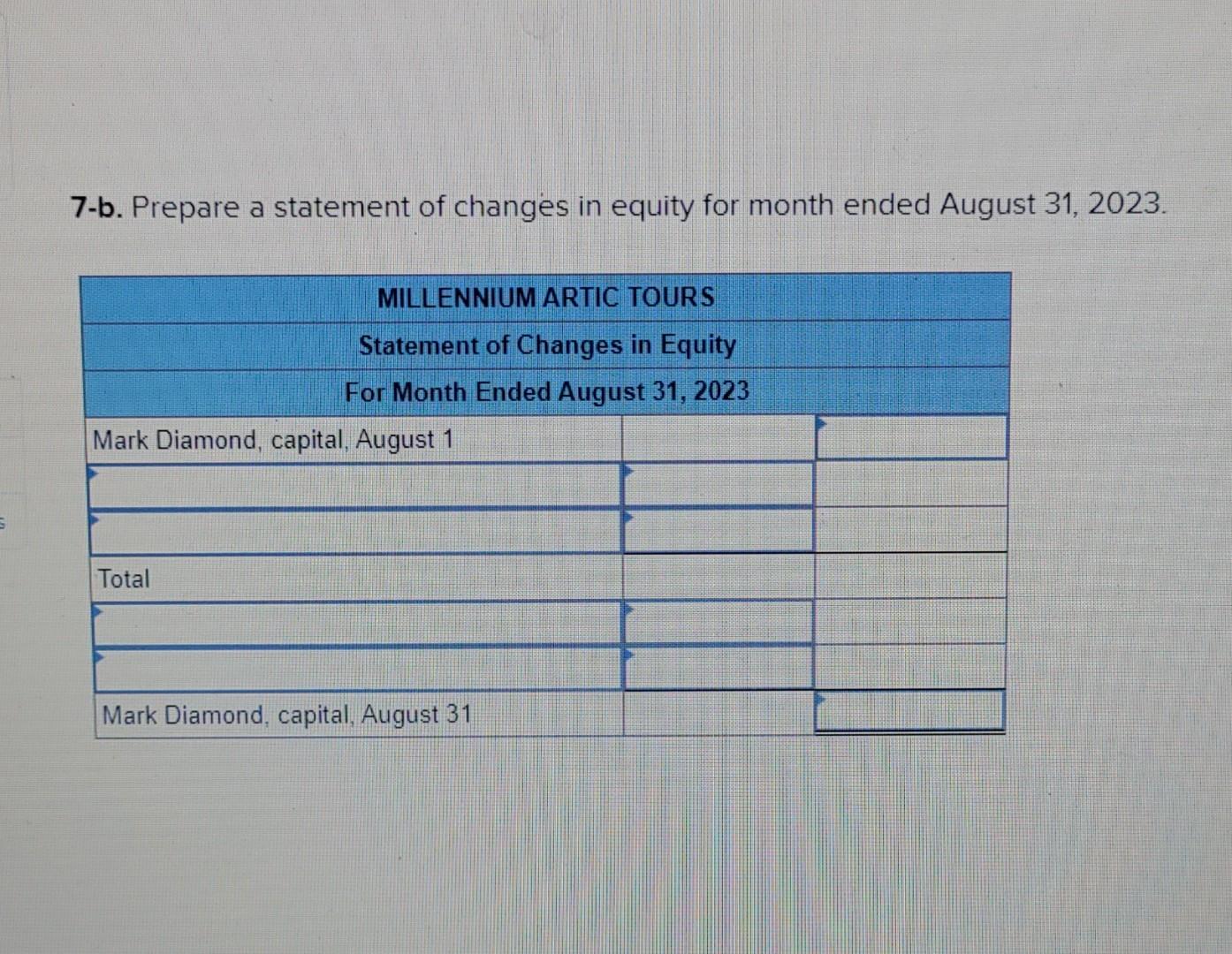

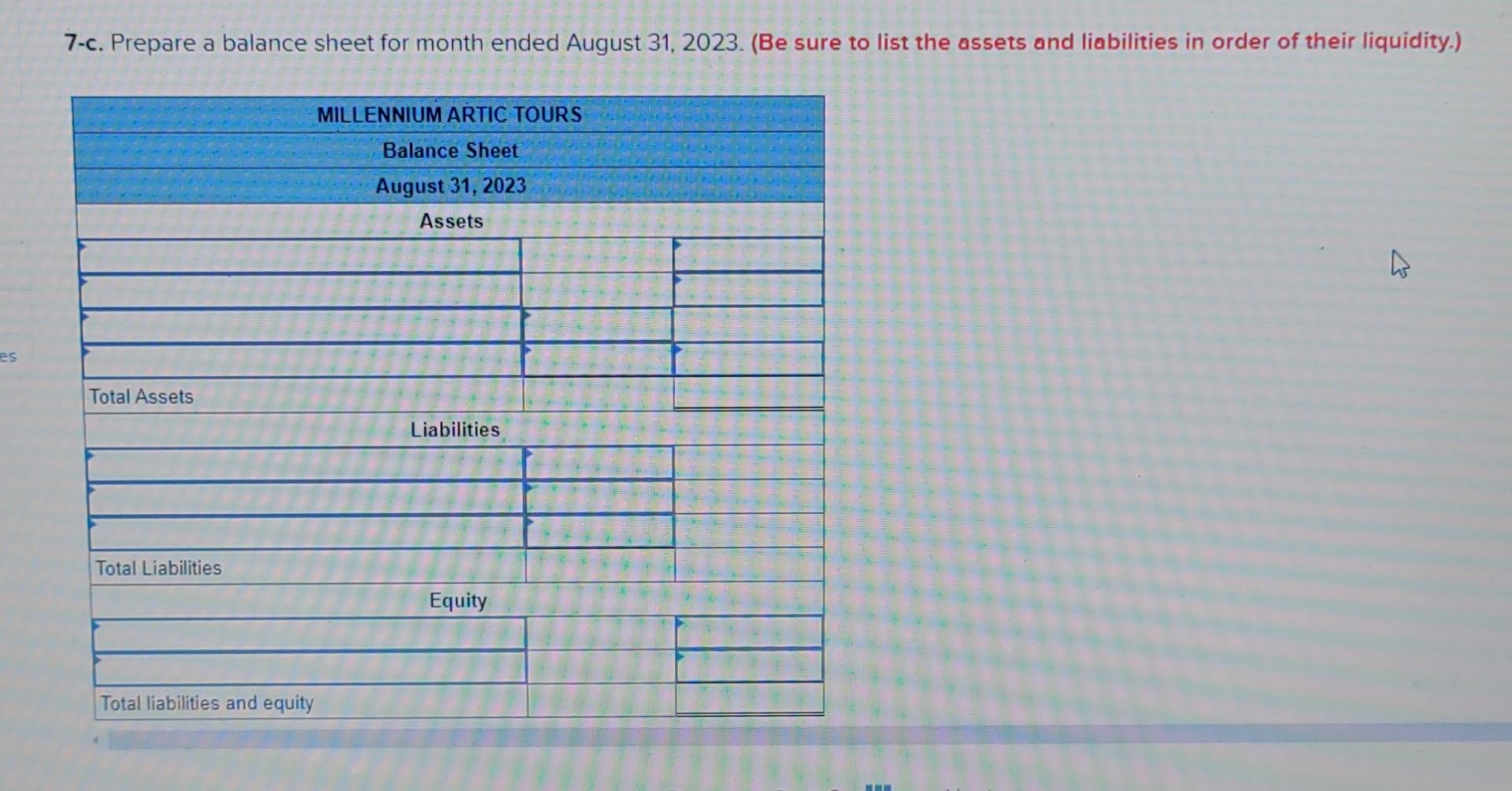

Journal entry worksheet Record the adjusting entry for the two-thirds of the advance earned. Note: Enter debits before credits. 2\&3. Post the entries to the accounts; calculate the ending balance in each account. 7-c. Prepare a balance sheet for month ended August 31, 2023. (Be sure to list the assets and liabilities in order of their liquidity.) Journal entry worksheet 123 Record the discussion of a tour contract with a Japanese tour guide. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Journal entry worksheet Note: Enter debits before credits. 7-b. Prepare a statement of changes in equity for month ended August 31, 2023. Journal entry worksheet Note: Enter debits before credits. Journal entry worksheet Journal entry worksheet Record the adjusting entry for one month of the prepaid rent. Note: Enter debits before credits. 7-a. Prepare a income statement for month ended August 31, 2023. Journal entry worksheet 456 Record the purchase of office furniture on account. Note: Enter debits before credits. Journal entry worksheet Note: Enter debits before credits. \begin{tabular}{|c|c|c|c|} \hline Date & General Journal & Debit & Credit \\ \hline August 31,2023 & P & & \\ \hline & F & & \\ \hline & 5 & & \\ \hline & & & \\ \hline & & & \\ \hline & 7 & & \\ \hline \end{tabular} Record entry Clear entry View general journal Journal entry worksheet 6. Prepare an adjusted trial balance. Journal entry worksheet Record the adjusting entry for the accrued August phone expense. Note: Enter debits before credits. 4. Prepare an unadjusted trial balance at August 31, 2023. Journal entry worksheet 4 Record the adjusting entry for depreciation expense of office furniture. Note: Enter debits before credits. statements LO4, 5, 6, 7 copy On August 1, 2023, Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first month of operations: Aug. 1 Purchased office furniture on account; $4,600. 1 Mark Diamond invested $6,400 cash into his new business. 2 Collected $3,000 in advance for a three-week guided caribou watching tour beginning later in August. 3 Paid $5,100 for six months' rent for office space effective August 1 . 4 Received $2,400 for a three-day northern lights viewing tour just completed. 7 Paid $1,200 for hotel expenses regarding the August 4 tour. 15 Mark withdrew cash of $600 for personal use. 22 Met with a Japanese tour guide to discuss a $120,000 tour contract. 31 Paid wages of $1,240. Assume Mark Diamond uses the straight-line method to depreciate the assets. Required: 1. Prepare General Journal entries to record the August transactions. (If no entry is required for a particular transaction/event, select "No journal entry required" in the first account field.) 5. Using the following information, prepare the adjusting entries on August 31. (If no entry is required for a particular transoction/event, select "No journal entry required" in the first account field.) a. The office furniture has an estimated life of three years and a $280 residual value. Use the straight-line method to depreciate the furniture. b. Two-thirds of the August 2 advance has been earned. c. One month of the Prepaid Rent has been used. d. The August telephone bill was not received as of August 31 but amounted to $260

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts