Question: This is one question please answer all parts and I will make sure to like :) In this question we are going to address whether

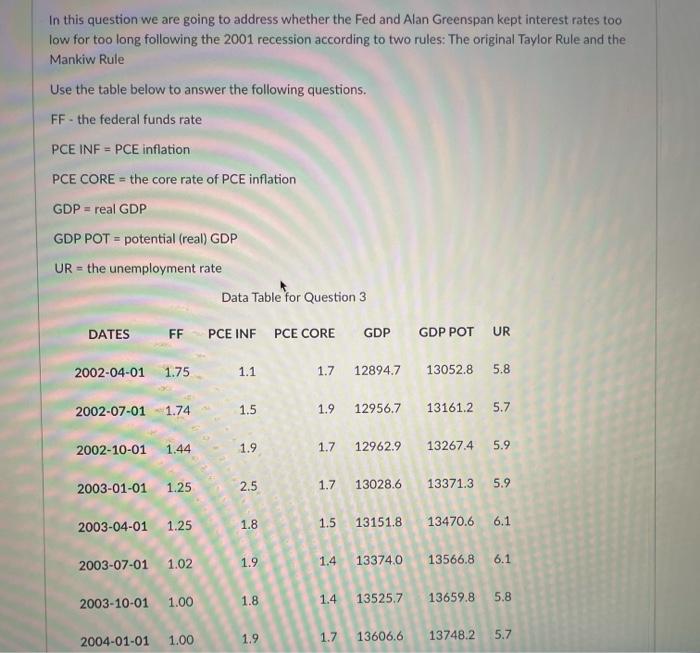

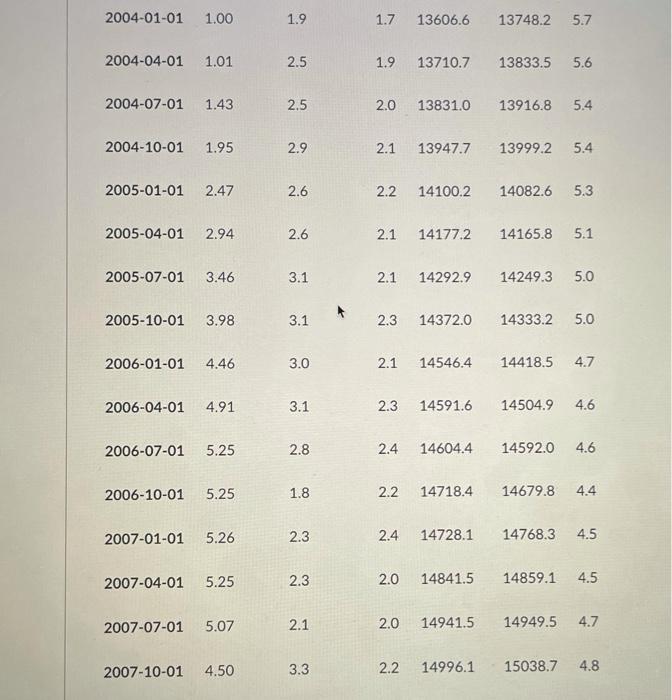

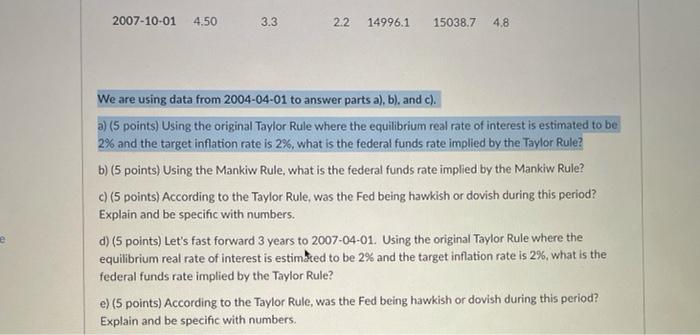

In this question we are going to address whether the Fed and Alan Greenspan kept interest rates too low for too long following the 2001 recession according to two rules: The original Taylor Rule and the Mankiw Rule Use the table below to answer the following questions. FF - the federal funds rate PCE INF = PCE inflation PCE CORE = the core rate of PCE inflation GDP = real GDP GDP POT = potential (real) GDP UR = the unemployment rate Data Table for Question 3 DATES FF PCE INF PCE CORE GDP GDP POT UR 2002-04-01 1.75 1.1 1.7 128947 13052.8 5.8 2002-07-01 1.74 1.5 1.9 12956.7 13161.2 5.7 2002-10-01 1.44 1.9 1.7 12962.9 13267.4 5.9 2003-01-01 1.25 2.5 1.7 13028.6 5.9 13371.3 2003-04-01 1.25 1.8 1.5 13151.8 6.1 13470.6 1.9 2003-07-01 1.02 1.4 13374.0 13566.8 6.1 1.8 2003-10-01 1.00 1.4 13525.7 13659.8 5.8 5 1.9 2004-01-01 1.00 1.7 13606.6 13748.2 5.7 2004-01-01 1.00 1.9 1.7 13606.6 13748.2 57 2004-04-01 1.01 2.5 1.9 13710.7 13833.5 5.6 2004-07-01 1.43 2.5 2.0 13831.0 13916.8 5.4 2004-10-01 1.95 2.9 2.1 13947.7 13999.2 5.4 2005-01-01 2.47 2.6 2.2 14100.2 14082.6 5.3 2005-04-01 2.94 2.6 2.1 14177.2 14165.8 5.1 2005-07-01 3.46 3.1 2.1 14292.9 14249.3 5.0 + 2005-10-01 3.98 3.1 2.3 14372.0 14333.2 5.0 2006-01-01 4.46 3.0 2.1 14546.4 14418.5 4.7 2006-04-01 4.91 3.1 2.3 14591.6 14504.9 4.6 2006-07-01 5.25 2.8 2.4 14604.4 14592.0 4.6 2006-10-01 5.25 1.8 2.2 14718.4 14679.8 4.4 2007-01-01 5.26 2.3 2.4 14728.1 14768.3 4.5 2007-04-01 5.25 2.3 2.0 14841.5 14859.1 4.5 2007-07-01 5.07 2.1 2.0 14941.5 14949.5 4.7 2007-10-01 4.50 3.3 2.2 14996.1 15038.7 4.8 2007-10-01 4.50 3.3 2.2. 14996.1 15038.7 4.8 We are using data from 2004-04-01 to answer parts a), b), and c). a) (5 points) Using the original Taylor Rule where the equilibrium real rate of interest is estimated to be 2% and the target inflation rate is 2%, what is the federal funds rate implied by the Taylor Rule? b) (5 points) Using the Mankiw Rule, what is the federal funds rate implied by the Mankiw Rule? c) (5 points) According to the Taylor Rule, was the Fed being hawkish or dovish during this period? Explain and be specific with numbers. d) (5 points) Let's fast forward 3 years to 2007-04-01. Using the original Taylor Rule where the equilibrium real rate of interest is estimated to be 2% and the target inflation rate is 2%, what is the federal funds rate implied by the Taylor Rule? e) (5 points) According to the Taylor Rule, was the Fed being hawkish or dovish during this period? Explain and be specific with numbers, e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts