Question: This is one question. Please fill in all light blue boxes. I have included the options available to choose for the Allocation Basis column (gray

This is one question. Please fill in all light blue boxes. I have included the options available to choose for the "Allocation Basis" column (gray box).

THANK YOU!!!

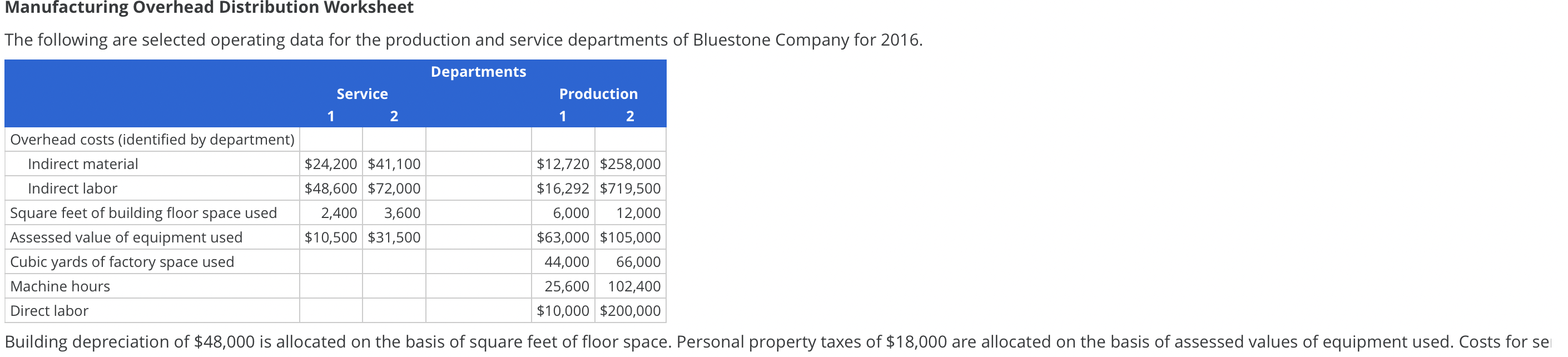

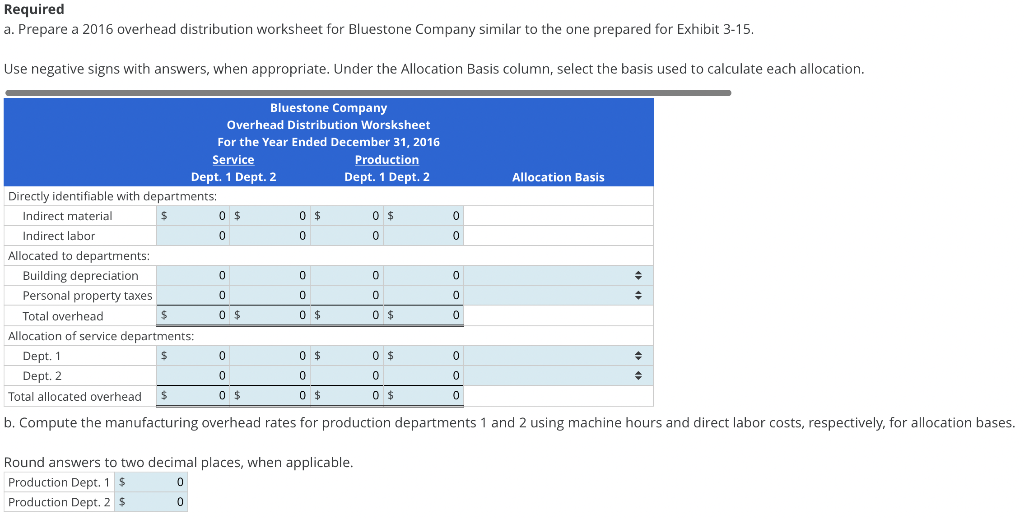

Manufacturing Overhead Distribution Worksheet The following are selected operating data for the production and service departments of Bluestone Company for 2016. Required a. Prepare a 2016 overhead distribution worksheet for Bluestone Company similar to the one prepared for Exhibit 3-15. Use negative signs with answers, when appropriate. Under the Allocation Basis column, select the basis used to calculate each allocation. b. Compute the manufacturing overhead rates for production departments 1 and 2 using machine hours and direct labor costs, respectively, for allocation bases. Round answers to two decimal places, when applicable. Production Dept. 2 Assessed value of equipment Cubic yards of factory space Floor space Machine hours used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts