Question: THIS IS ONE QUESTION WITH MULTIPLE PARTS (3A, 3B, and 4). PLEASE SHOW ALL WORK AND CALCULATIONS. (NO EXCEL) WILL LEAVE THUMBS UP Two assets

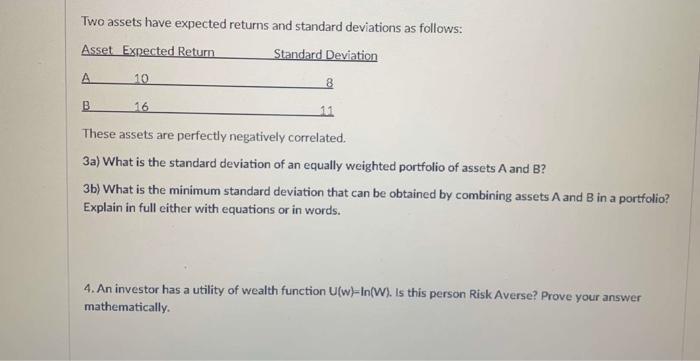

Two assets have expected returns and standard deviations as follows: Asset Expected Return Standard Deviation A 10 8 B 116 These assets are perfectly negatively correlated. 3a) What is the standard deviation of an equally weighted portfolio of assets A and B? 3b) What is the minimum standard deviation that can be obtained by combining assets A and B in a portfolio? Explain in full either with equations or in words. 4. An investor has a utility of wealth function (w)-In/W). Is this person Risk Averse? Prove your answer mathematically

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts