Question: this is one question with mutiple steps please help thank you [The following information applies to the questions displayed below.) The stockholders' equity section of

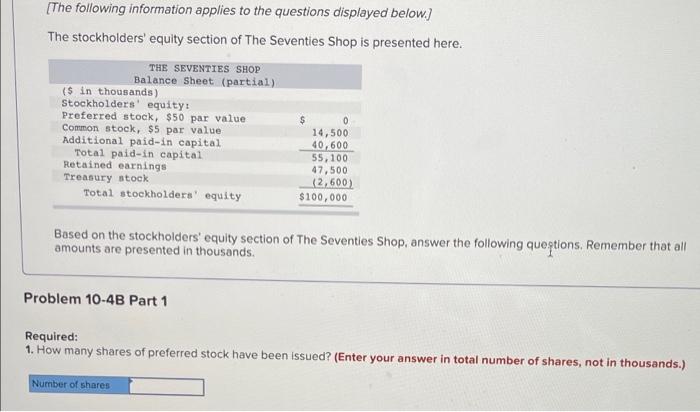

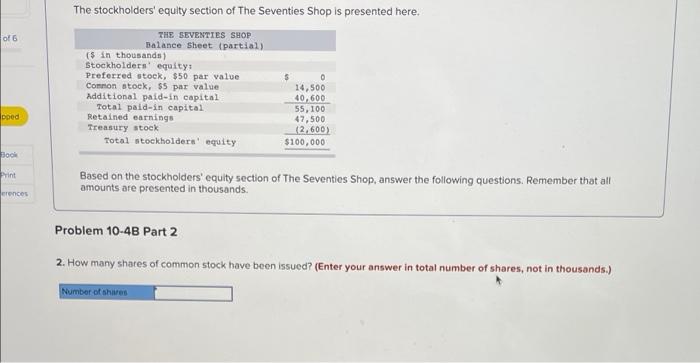

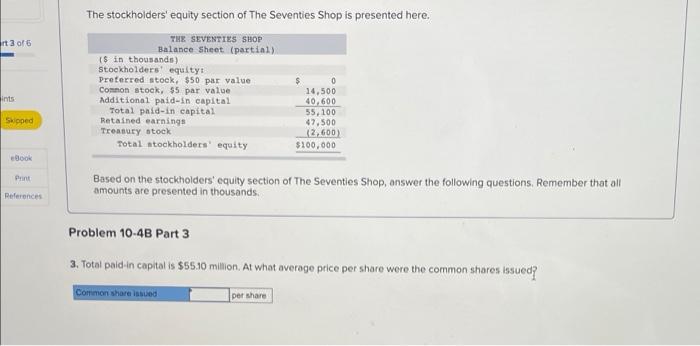

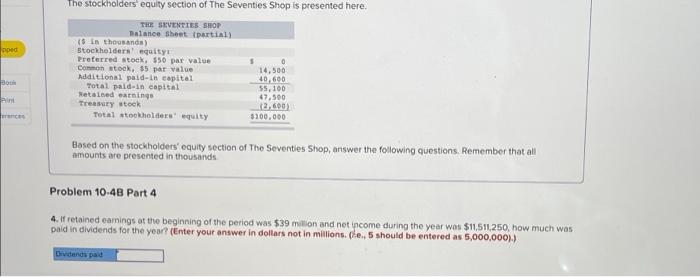

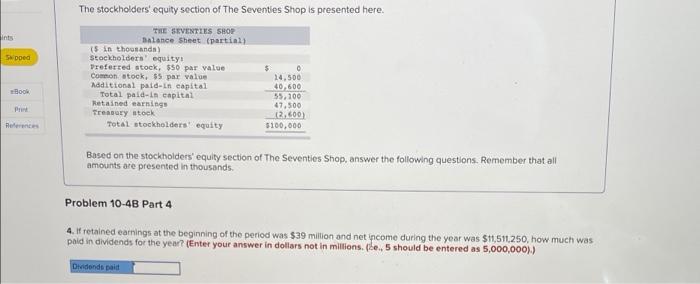

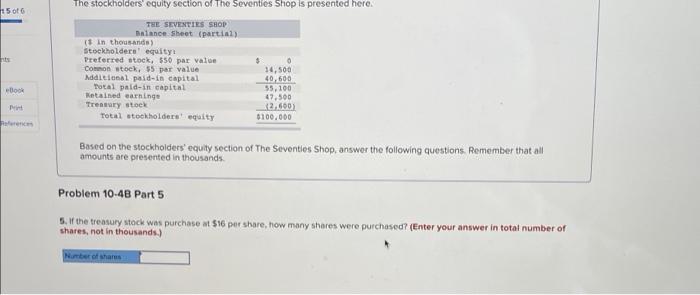

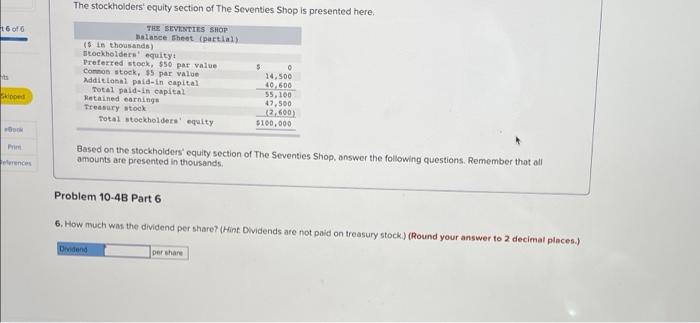

[The following information applies to the questions displayed below.) The stockholders' equity section of The Seventies Shop is presented here. THE SEVENTIES SHOP Balance Sheet (partial) ($ in thousands) Stockholders' equity: Preferred stock, $50 par value Common stock, $5 par value 14,500 Additional paid-in capital 40.600 Total paid-in capital 55,100 Retained earnings 47,500 Treasury stock (2,600) Total stockholders' equity $100,000 Based on the stockholders' equity section of The Seventies Shop, answer the following questions. Remember that all amounts are presented in thousands Problem 10-4B Part 1 Required: 1. How many shares of preferred stock have been issued? (Enter your answer in total number of shares, not in thousands.) Number of shares of 6 The stockholders' equity section of The Seventies Shop is presented here. THE SEVENTIES SHOP Balance sheet (partial) ($ in thousands Stockholders' equity! Preferred stock, $50 par value $ 0 Common stock, $5 par value 14,500 Additional paid-in capital 40.600 Total paid-in capital 55,100 Retained earnings 47,500 Treasury stock (2.600) Total stockholders' equity $100,000 poed Book Print Based on the stockholders' equity section of The Seventies Shop, answer the following questions. Remember that all amounts are presented in thousands erences Problem 10-48 Part 2 2. How many shares of common stock have been issued? (Enter your answer in total number of shares, not in thousands.) Number of shares The stockholders' equity section of The Seventies Shop is presented here. rt 3 of 6 THE SEVENTIES SHOP Balance Sheet (partial) ($ in thousands) Stockholders' equity! Preferred stock, $50 par value Common stock, 55 par value Additional paid-in capital Total paid-in capital Retained earnings Treasury stock Total stockholders' equity ints $ 14,500 40,600 55,100 47,500 2.600) $100,000 Skipped B00K Print Based on the stockholders' equity section of The Seventies Shop, answer the following questions. Remember that all amounts are presented in thousands References Problem 10-4B Part 3 3. Total paid in capital is $55.10 million. At what average price per share were the common shares issued? Common share issued per share The stockholders' equity section of The Seventies Shop is presented here. pped THE SEVENTIES SHOP Dalance sheet partial) (5 in thousands) Stockholders' equity Preferred stock, 550 par value Common stock. $5 par value Additional paid capital Total pald.in capital Retained earnings Treasury steek Total stockholders' equity Pour O 14,500 40,600 55,100 47,500 2.600 5200,000 Print Based on the stockholders' equity section of The Seventies Shop, answer the following questions. Remember that all amounts are presented in thousands Problem 10-48 Part 4 4. If retained earnings at the beginning of the period was $39 million and not income during the year was $11,511,250, how much was paid in dividends for the year? (Enter your answer in dollars not in millions. e., 5 should be entered as 5,000,000).) Dividends paid The stockholders' equity section of The Seventies Shop is presented here. ints spoed THE SEVENTIES SHOP Dalance Sheet (partin) (5 in thousands Stockholders' equity Preferred atock, $50 par value Common stock, 65 par value Additional paid in capital Total paid.in capital Retained earnings Treasury stock Total stockholders equity BOOK 5 o 24,500 40,600 55,100 47,500 12.600) $100,000 Based on the stockholders' equity section of The Seventies Shop, answer the following questions. Remember that all amounts are presented in thousands Problem 10-48 Part 4 4. If retained earnings at the beginning of the period was $39 million and net income during the year was $11,511.250, how much was paid in dividends for the year? (Enter your answer in dollars not in millions, the 5 should be entered as 5,000,000).) Dividends paid The stockholders' equity section of The Seventies Shop is presented here. 15 of THE SEVENTIES SHOP Balance Sheet partial) ( in thousands Stockholders' equity Preferred stock. $50 par value Comon stock, 55 par valve Additional paid in capital total paid in capital Katained earning Tressary stock Total stockholdere quity 000 . 14,500 40,600 53,100 47.500 2.660) $100.000 Based on the stockholders' equity section of The Seventies Shop, answer the following questions. Remember that all amounts are presented in thousands Problem 10-48 Part 5 5. If the treasury stock was purchase at $16 per share, how many shares were purchased? (Enter your answer in total number of shares, not in thousands.) Number of shares to of The stockholders' equity section of The Seventies Shop is presented here. THE SEVENTIES SHOP Balance sheet (partial) (5 in thousands) stockholders' equity Preferred stock, $50 par value $ 0 Connon stock, $5 par value 14,500 Additional paid-in capital 40.600 Total paid-in capital 55,100 retained earnings 47,500 Treasury stock 12,600) Total stockholders' equity $100,000 its Food Based on the stockholders' equity section of The Seventies Shop, answer the following questions. Remember that all amounts are presented in thousands res Problem 10-48 Part 6 6. How much was the dividend per share? (Hint Dividends are not paid on treasury stock) (Round your answer to 2 decimal places.) Dividend per share

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts