Question: This is only one question with 6 required steps. Pls help me answer all of the steps to the question. Already answered the first step.

![Problem 14-23 (Static) Comprehensive Problem [LO14-1, LO14-2, LO14-3, LO14-5, LO14-6] Lou Barlow,](https://s3.amazonaws.com/si.experts.images/answers/2024/05/6648b7393e6e2_5286648b738d0071.jpg)

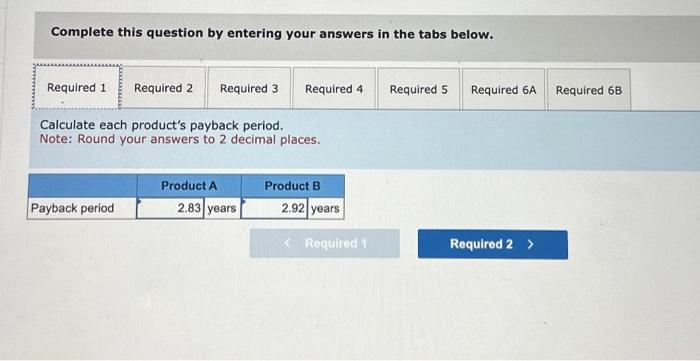

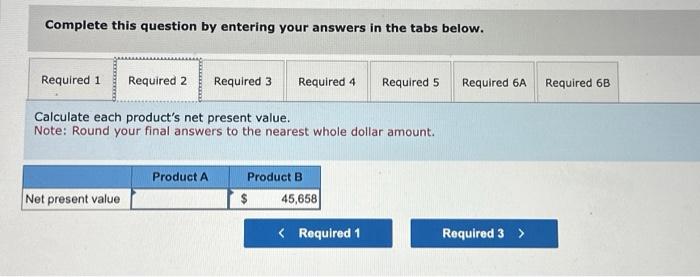

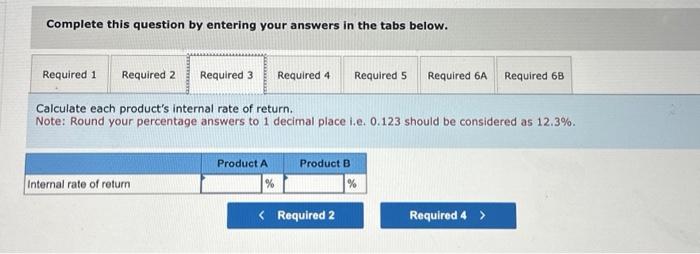

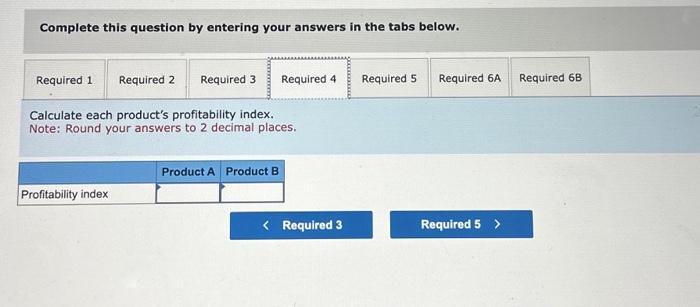

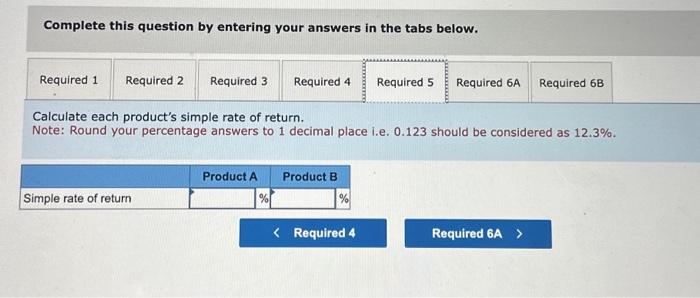

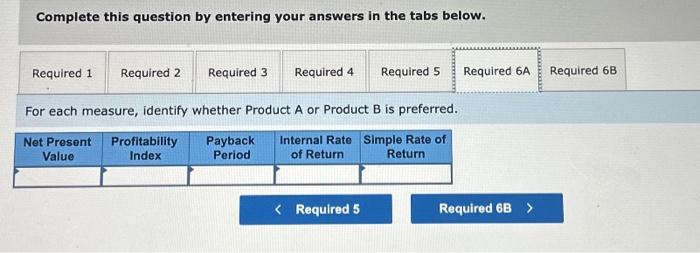

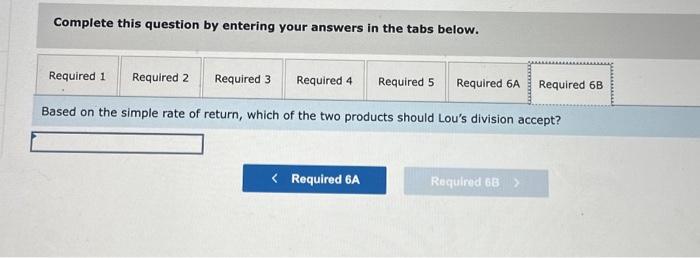

Problem 14-23 (Static) Comprehensive Problem [LO14-1, LO14-2, LO14-3, LO14-5, LO14-6] Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five- year period. His annual pay raises are determined by his division's return on investment (ROI), which has exceeded 18% each of the last three years. He computed the following cost and revenue estimates for each product: Product A Product B Initial investment: Annual revenues and costs: Sales revenues Cost of equipment (zero salvage value) $170,000 $ 250,000 Variable expenses $ 120,000 Depreciation expense $ 34,000 $ 380,000 $ 350,000 $170,000 $ 76,000 Fixed out-of-pocket operating costs $ 70,000 $ 50,000 The company's discount rate is 16%. Click here to view Exhibit 148-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using tables. Required: 1. Calculate each product's payback period. 2. Calculate each product's net present value. 3. Calculate each product's internal rate of return. 4. Calculate each product's profitability index. 5. Calculate each product's simple rate of return. 6a. For each measure, identify whether Product A or Product B is preferred. 6b. Based on the simple rate of return, which of the two products should Lou's division accept? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3. Required 4 Required 5 Required 6A Required 68

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts