Question: This is only the question you have to answer , you have to prepare journal entry for this both the quation.The both questions are complete

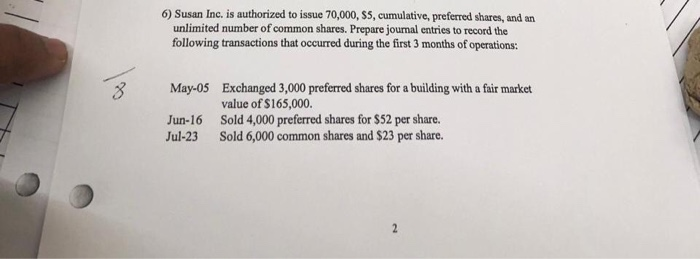

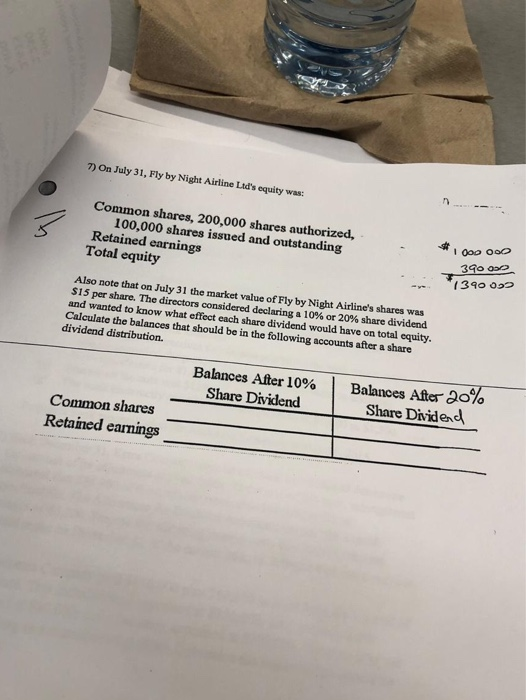

6) Susan Inc. is authorized to issue 70,000, S5, cumulative, preferred shares, and an unlimited number of common shares. Prepare journal entries to record the following transactions that occurred during the first 3 months of operations: May-05 Exchanged 3,000 preferred shares for a building with a fair market value of $165,000. Jun-16 Sold 4,000 preferred shares for $52 per share. Jul-23 Sold 6,000 common shares and $23 per share. 7) On July 31, Fly by Night Airline Lid's equity was: - 000 000 Common shares, 200,000 shares authorized, 100,000 shares issued and outstanding Retained earnings Total equity 39000 - 1340 099 Also note that on July 31 the market value of Fly by Night Airline's shares was $15 per share. The directors considered declaring a 10% or 20% share dividend and wanted to know what effect each share dividend would have on total equity. Calculate the balances that should be in the following accounts after a share dividend distribution. Balances After 10% Share Dividend 1 Balances After 20% Share Dividend Common shares Retained earnings

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts