Question: This is part 2 of a 4 - part question, so you should save your answer. A property had NOI of $ 1 , 6

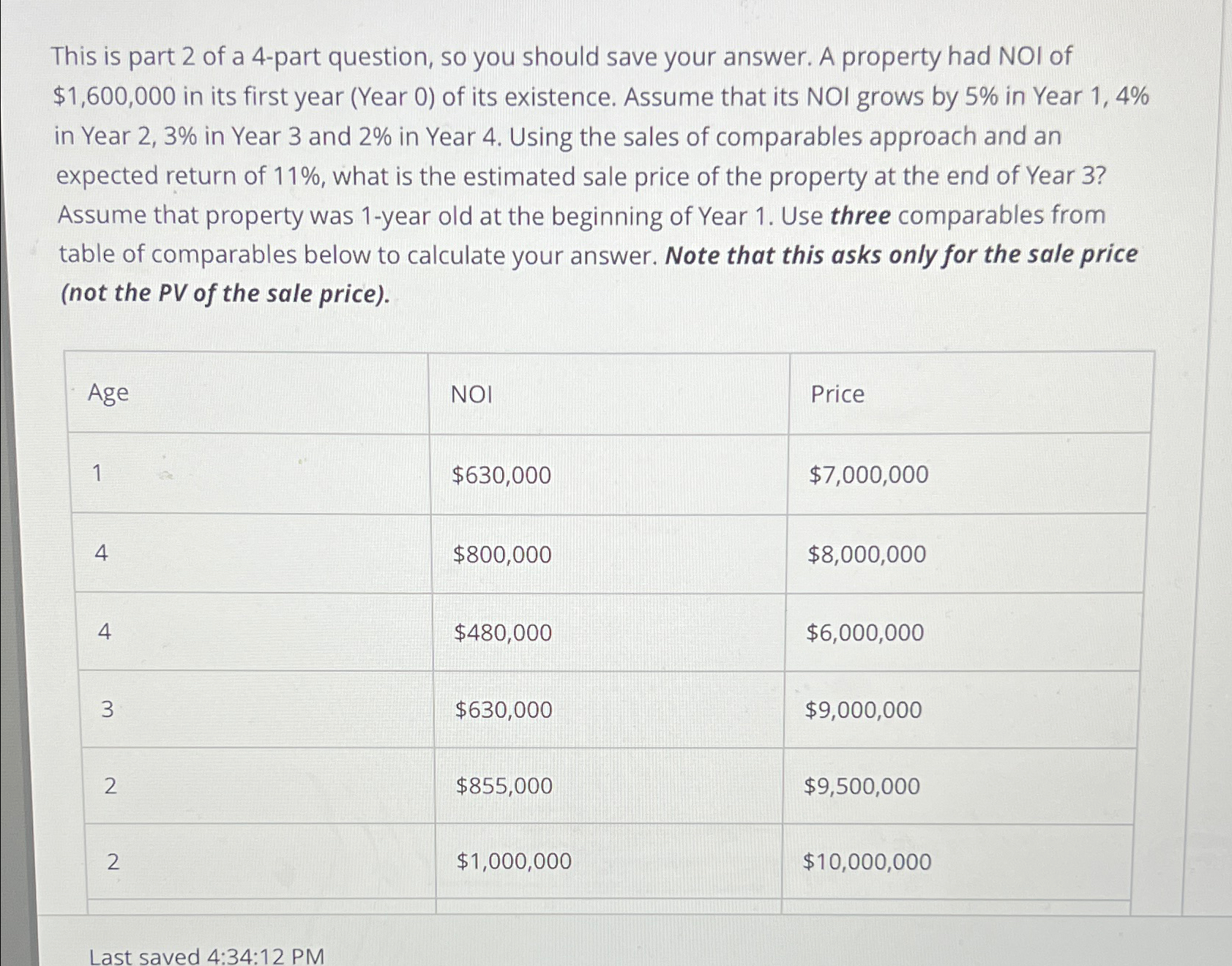

This is part of a part question, so you should save your answer. A property had NOI of $ in its first year Year of its existence. Assume that its NOI grows by in Year in Year in Year and in Year Using the sales of comparables approach and an expected return of what is the estimated sale price of the property at the end of Year Assume that property was year old at the beginning of Year Use three comparables from table of comparables below to calculate your answer. Note that this asks only for the sale price not the PV of the sale price

tableAgeNOI,Price$$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock