Question: This is part of a case study two part question Suzanne owns a condominium unit valued at $810,000 that has a mortgage with an outstanding

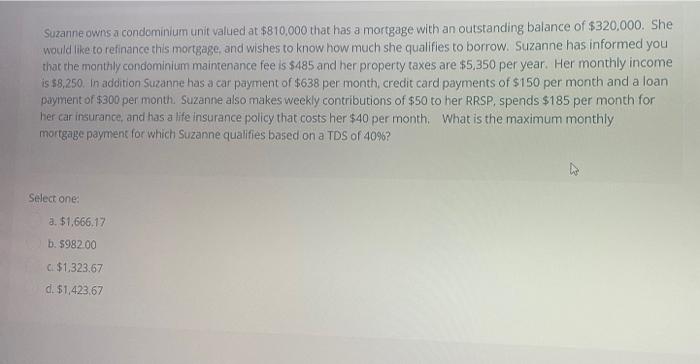

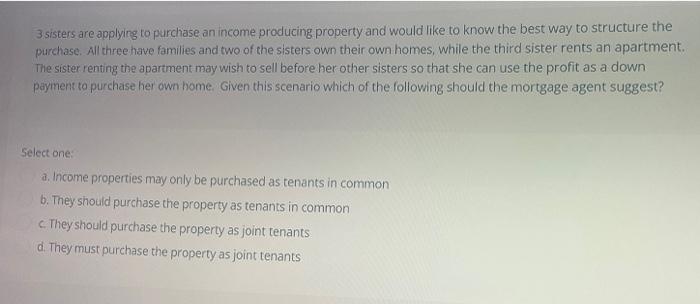

Suzanne owns a condominium unit valued at $810,000 that has a mortgage with an outstanding balance of $320,000. She would like to refinance this mortgage, and wishes to know how much she qualifies to borrow. Suzanne has informed you that the monthly condominium maintenance fee is $485 and her property taxes are $5,350 per year. Her monthly income is $8,250. In addition Suzanne has a car payment of $638 per month, credit card payments of $150 per month and a loan payment of $300 per month. Suzanne also makes weekly contributions of $50 to her RRSP. spends $185 per month for her car insurance, and has a life insurance policy that costs her $40 per month. What is the maximum monthly mortgage payment for which Suzanne qualifies based on a TDS of 40%? ho Select one: 3. $1,666.17 b. $982.00 $1.323.67 d. $1,423.67 3.sisters are applying to purchase an income producing property and would like to know the best way to structure the purchase. All three have families and two of the sisters own their own homes, while the third sister rents an apartment. The sister renting the apartment may wish to sell before her other sisters so that she can use the profit as a down payment to purchase her own home. Given this scenario which of the following should the mortgage agent suggest? Select one a. Income properties may only be purchased as tenants in common b. They should purchase the property as tenants in common c. They should purchase the property as joint tenants d. They must purchase the property as joint tenants

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts